Four years ago, the Reuters / Ipsos gave Hillary Clinton a 90% chance of defeating Donald Trump. According to the numbers, Clinton was on track to win 303 Electoral College votes out of the 270 needed, to Trump’s 235. Even bookmaker Betfair reported US$140 million worth of bets were placed – with Clinton has 83% of winning, higher than Obama’s 76% chance in 2012.

In fact, Clinton was so confident of winning that her campaign had arranged to celebrate the victory with a 2-minute long fireworks display over the Hudson River in New York. But on the election night, her campaign suddenly contacted the U. to “cancel” the fireworks show. No explanation was given. The rest, as they say, is history. Clinton lost stunningly.

Rumours spread that Clinton had a violent temper tantrum upon learning she had lost. “ towards her staffs, including her campaign chairman John Podesta. Sore loser Clinton blamed FBI Director James Comey, the Russian, the White Americans, the women and practically everyone and everything except herself.

Donald Trump, often mocked and ridiculed by the liberal mainstream media, unexpectedly won the 2016 Presidential Election. paid the price for ignoring the super huge crowd that Trump managed to attract to his talks. Clinton was dumbfounded and speechless because the polls had shown that she would win.

Forget the polls as it could easily be manipulated. But if poll numbers cannot be trusted, is there any way to predict who will win the White House. Too bad Paul the Octopus is dead. While very few people saw Trump’s victory, the stock market had correctly predicted the winner. But even if Clinton was told about it, chances are she would not have believed it.

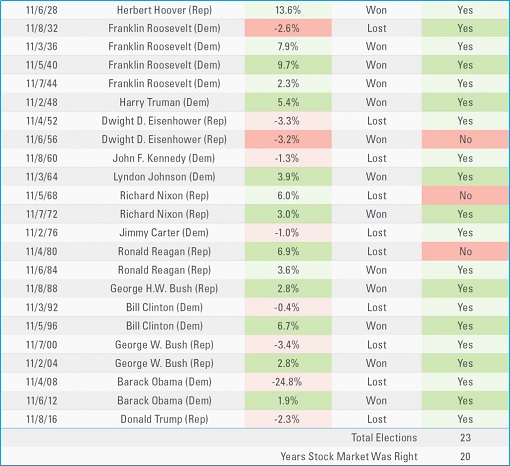

So if you want to make some pocket money betting which horse – Donald Trump or Joe Biden – will emerge victorious, it pays to monitor the stock market. Since 1928, investors have been able to use one simple stock market trick – S&P 500 – to correctly predict the winner of the U.S. presidential election – with an accuracy of 87%. And since 1984, this method is 100% accurate.

Here’s how it works: when the S&P 500 is trending higher over the three months before the election, the incumbent party candidate almost always wins. Likewise, when the stock index is down over that same consecutive three-month, the incumbent party candidate almost always loses. Hence, by following the price movements of the market in the 3 months leading up to the election, a winner can be predicted.

But if the trick or theory is 100% accurate, as revealed by Ryan Detrick, a senior market strategist at LPL Financial, President Donald Trump could be in trouble. Since June 8, where the S&P 500 breached above 3,200 points after an extraordinary rally from March’s plunge due to Coronavirus, the stock index has been on the down-trend. It is now trading at 3,073 points.

However, it’s still too early to place your bet since there is a little more than 4 months to go until Election Day. One can start monitoring the S&P 500 index between July 31 and October 31, 2020 to accurately predict the next President of the United States. Still, there have been 3 elections since 1928 where the stock market missed its own predictions, hence the 87% accuracy:

- In 1956, incumbent, Dwight D. Eisenhower was reelected despite the S&P 500 falling 3.2% in the three months leading to the election. But in that year, Britain and France joined Israel in attacking Egypt over the Suez Canal.

- In 1968, incumbent Lyndon Johnson lost to Richard Nixon, despite the S&P 500 rising 6% in the three months leading to the election. Incumbent President Johnson withdrew from the race after narrowly winning the New Hampshire primary. It was a chaotic year that saw the assassinations of Martin Luther King Jr. and Robert F. Kennedy, not to mention racial riots and protests against the Vietnam War.

- In 1980, incumbent Jimmy Carter lost to Ronald Reagan, despite the S&P 500 rising 6.9% in the three months leading to the election. Jimmy Carter was then very unpopular and was blamed for the Iran hostage crisis where 8 servicemen were killed.

Now, do you understand why Trump has to throw everything, including the kitchen sink, to make sure a bullish stock market leading up to November? But even if the sitting president manages to see a positive S&P 500 performance this year, the result could be very unreliable simply because the year 2020 is incredibly havoc, similar to that of 1968.

As a start, the global pandemic Covid-19 is unprecedented. The last time a pandemic as deadly as the Coronavirus happened was the Spanish Flu in 1918 – 100 years ago. And as a result, the Federal Reserve has been printing money and pumping an unlimited amount of money to support the financial markets, including the Wall Street, hence the artificial bullish stock market.

Like the 1968, where incumbent Lyndon Johnson lost to Richard Nixon, despite the S&P 500 rising 6%, this election year is definitely tumultuous. While there hasn’t been any assassination attempt, peaceful protesters have turned violent across major cities in America after the death of George Floyd, a 46-year-old African American who died in Minneapolis police custody.

George Floyd was killed on 25 May, after a 44-year-old white police officer – Derek Chauvin – knelt on his neck for nearly nine minutes, despite Floyd pleading that he could not breathe. Floyd was arrested after he was suspected of trying to purchase cigarettes with a US$20 counterfeit bill. Mr Chauvin has since been charged with murder and manslaughter.

In a country with history where a single death can spark a revolution, as in the assassination of Martin Luther King Jr. in 1968, the death of George Floyd couldn’t come at a worse time for President Trump. It was already bad that the black man had lost his job as a security guard because of layoffs in the Covid-19 pandemic, which was due largely to Trump’s arrogance and incompetency.

As Trump’s approval rating drops like a rock for his mishandling of Covid-19 and mismanagement of police brutality protests and riots, the way Floyd died could be the last straw that broke the camel’s back. Therefore, it’s absolutely possible that Donald Trump could join the list of incumbent president who lost despite a positive rally in the stock market.

Other Articles That May Interest You …

- U.S. Rollbacks Business Reopening But China’s Economy Recovers – First Monthly Profit Of $82 Billion In 6 Months

- Trump Faces Huge Problem Getting People Back To Work – They Earn More Free Cash Staying At Home

- It’s Payback Time – China Trolls Trump To Stop “Hiding”, Mocks “Beautiful Sight” Of Looting & Burning In America

- From Terminating Trade Deal To Cancelling $1.1 Trillion Debt Owed To China – Here’re Some Of Trump’s Crazy & Dirty Ideas

- Lawsuits For Trillions Of Dollars Against China Over Spread Of Coronavirus – Here’s Why It’s A Waste Of Time

- IMF – The “Great Lockdown” Is Set To Triggers The World’s Worst Recession Since The 1929 Great Depression

- 3 Coronavirus Variants Discovered – Surprisingly, “Type-A” Found In Americans, Wuhan’s Type-B And Type-C In Europe

- Trump Admits Coronavirus Could Kill 240,000 Americans – But Document Shows The U.S. Army Had Warned Him 2 Months Ago

- Arabs Conspiracy Theories – Coronavirus Is The U.S. & Israel Biological Warfare To Cripple China’s Economy & Reputation

- Like Hillary Clinton, Najib Razak Is Blaming Everyone & Everthing – Except Himself & Witch Wife

- Get Ready For The Biggest Surprise – Hillary Clinton Is Losing!!

|

|

July 1st, 2020 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply