JPMorgan Chase has just revealed its first-quarter profit, and it’s not good. The American bank, ranked by S&P Global as the largest bank in the United States and the sixth largest bank in the world by total assets, only earned 78 cents per share – compared to US$1.84 expected from analysts. Its profit of US$2.87 billion was a jaw-dropping 69% drop from a year earlier.

Wells Fargo, another American bank that was once Warren Buffet’s “Big Four” investments, reported a profit of just 1 cent per share – against analyst expectations of 33 cents per share. All American banks are affected, one way or another, due to the Coronavirus pandemic. Banks like JPMorgan and Wells Fargo are bracing for a severe recession.

Giant banks are setting aside truckloads of money for credit losses. Besides closing hundreds of branches, JPMorgan has set additional credit reserves of US$6.8 billion as provision for loan loss, pushing the total credit costs to US$8.3 billion, as its customers are struggling to pay their debts. Even then, CFO (Chief Financial Officer) Jennifer Piepszak warned it may not be enough.

To get an idea of how critical the situation has become, JPMorgan’s profit from its consumer unit plunged 95% to just US$191 million due to loan loss provision in credit cards. Coming from the nation’s biggest bank, it says a lot about the coming recession and the potential impact as the Covid-19 literally affects every single sector of the U.S. economy.

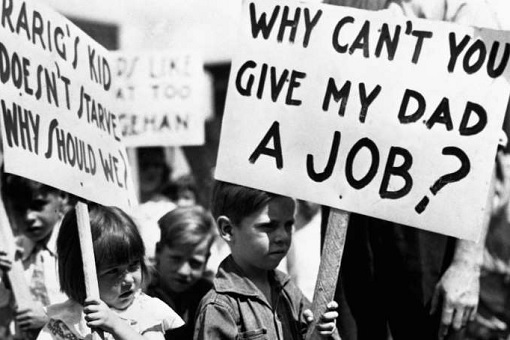

On the same day JPMorgan posted its disappointing first-quarter profit, IMF (International Monetary Fund) dropped a bombshell – the global economy will suffer the worst financial crisis since the 1929 Great Depression. The world could only watch powerlessly as the Coronavirus leaves its trail of destruction in 210 countries and territories.

It was only in January that the IMF had forecast a global GDP ((gross domestic product) expansion of 3.3% for this year and a growth rate of 3.4% in 2021. Back then, it was cautious about the state of the global economy primarily due to concerns about new trade tensions between the U.S. and the EU, as well as the fragile “Phase One” trade deal between the U.S. and China.

But today, those trade wars or tensions look like child’s play. From a global economic expansion of 3.3%, the IMF now expects a contraction by at least 3% instead in 2020. In essence, it means a loss of 6.3% in the worldwide economy. The huge slash in growth was derived as more institutions warn that the “Great Lockdown” due to the Coronavirus pandemic is bringing massive damage to the economy.

Gita Gopinath, the IMF’s chief economist, said – “It is very likely that this year the global economy will experience its worst recession since the Great Depression, surpassing that seen during the global financial crisis a decade ago.” That means the coming recession meltdown will be worse than the 2008-09 Financial Crisis, also known as the Great Recession.

Last week, the World Trade Organization (WTO) said the global trade will contract by between 13% and 32% this year due to the Covid-19 pandemic. It further said that nearly all regions will suffer “double-digit” declines in trade volumes, with exports from North America and Asia to be hit the most. The lockdown measures implemented by most of the countries have stalled business activities.

The IMF also reveals a disturbing data – more than 90 of the organization’s 189 members have already asked for financial assistance. The rich economies of the West will shrink by 6.1% on average. In the Europe, Italy and Spain, two most infected countries in the region, will suffer the worst economic punishment where their GDP is predicted to contract by 9.1% and 8% respectively.

The GDP of UK will drop by 6.5% this year – the deepest plunge for a century, according to the IMF. But according to the British official independent fiscal watchdog the Office for Budget Responsibility (OBR), the country’s economy could shrink by a record 35% with unemployment skyrockets to 3.4 million by June – based on a 3-month lockdown followed by 3 months of partial restrictions.

Overall, the OBR estimated the UK economy will contract by 12.8% for the year. While the European Union is expected to tumble by 7.5%, the U.S. is not spared. The IMF predicts that the American economy will contract by 5.9% this year. The exception will be India and China, the country where the Coronavirus reportedly first started, but has since won the war against the pathogen.

Even though the Chinese economy will also fall, according to the IMF, its economy will still grow by 1.2% in 2020 (from 6.1% last year). India, on the other hand, will see its economy growing by 1.9%, down from 4.2%. Still, while the impact of the pandemic has been more serious in developed countries, the rich nations were better equipped to cope, says the IMF.

For example, the U.S. can always print more money to pay its citizens as in the case of the recent historic US$2 trillion stimulus package. The IMF predicts that a partial recovery could only happen in 2021. The global contraction of 3% was nevertheless the best case scenario. In the worst case, the global economy would shrink by around 11% rather than 3%.

Other Articles That May Interest You …

- 3 Coronavirus Variants Discovered – Surprisingly, “Type-A” Found In Americans, Wuhan’s Type-B And Type-C In Europe

- USA vs Europe – The War For Face Masks Get Ugly As The U.S. Accused Of Piracy & Paying 3 Times Cash

- Trump Admits Coronavirus Could Kill 240,000 Americans – But Document Shows The U.S. Army Had Warned Him 2 Months Ago

- The World Is Working On 20 Coronavirus Vaccines – But It Could Take Up To 18 Months

- China Appears To Be Winning The Coronavirus War, And Other Countries Are Studying How The Chinese Did It

- Get Ready For A Brutal Recession – Trump’s Speech Fails To Inspire As 150 Million Americans Could Get Infected

- Get Ready For $20 Oil – All Eyes On “Russia vs Saudi” After 30% Oil Crash Sparked By Price War

- Trump Tells Americans Not To Panic – But Coronavirus May Have Spread Undetected For 6 Weeks In The U.S.

- Financial Meltdown – In Only 6 Days, Stock Markets Lost $6 Trillion & Plunge Into Correction Territory

- Arabs Conspiracy Theories – Coronavirus Is The U.S. & Israel Biological Warfare To Cripple China’s Economy & Reputation

|

|

April 15th, 2020 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply