Have you notice food prices have already been increased since early of the year? If your normal basic “Wantan Mee” was RM5.00 last year, it’s RM5.50 now – that’s 10% increase. A plate of “Mee Goreng” at Mamak stall is now RM4.00 when it was RM3.50 three months ago. Of course if you stay in area such as Bangsar or Damansara, the food prices are even higher. When GST comes into picture next year, the pricing would be havoc.

Like it or not, things will get worse if Malaysian currency gets weaker. Due to massive foreign debt and continuous foreign-fund outflows, Bank Negara (Central Bank) has no other choice but to raise interest rate soon. Traders will surely raise prices of goods again under the excuse of weaker local currency. They sure are creative in finding justifications to raise their profits, don’t they? Like wise, you’ve to be equally creative in reducing your monthly expenses in order to survive.

Forget about politicians’ silly suggestion about planting your own vegetables. They may ask you to mix petrol with Coke to turbo-charge your car for better mileage later. The spoiled brat born with silver spoon prime minister is clueless about managing the country’s economy. Well, since he didn’t actually finish his economics degree in UK, perhaps we can’t blame him after all. So, what can you do to save more money this year in order to fight inflation?

[ 1 ] Reduce Electricity Usage

The CEO of Tenaga Nasional Berhad (KLSE: TENAGA, stock-code 5347) is perhaps one of the easiest positions in this country. When the company is in loss, despite its monopoly in the sector, the CEO will just propose a rate hike. There’s no way citizens can fight against electricity price hike, lest you fancy prime minister telling you to use candles instead of electricity (*grin*). Like it or not you’ve to be creative in saving electricity.

Most of the time, lightings, computers or air-conds at dining area or bedrooms are on while all of your family members are in the living hall. Likewise, when it’s dinner time, lightings and TV in living area are on although nobody is there. By switching off lights, fans, computers and air-cond in areas that are not occupied, you can save considerable amount of energy and thus electricity bill. Unless you can find ways to stop or slow down your meter-reading box, it’s wise to start saving electricity usage. But if you can wash clothes yourself without washing machine, so much the better.

[ 2 ] Reduce Laundry

You may not realize this but washing machine sucks tons of money from your utility bills every month. The cost of electricity, water, detergent, softener and whatnot could be reduced if you’re creative enough. As a start, you should always wait until you have a full load of laundry before run your washing machine. Since the longer you wait the more you can save on costs, you should then prolong the time to make a full load of laundry. And how do you suppose to do that?

You should only send really, obviously, unbelievably, terribly dirty clothes to the washing machine. Reuse towels and wear clothes more than once should do the trick. Heck, do you know you can actually wear your underwear for four days before it’s qualified to be sent to the washing machine (*tongue-in-cheek*)? Front, back, flip it and wear it front and back again – that’s four days and lots of cost savings. Stop laughing because that was what PM Najib meant when he urged you to change your lifestyle not many moons ago.

[ 3 ] Reduce Car Wash Frequency

Thanks to massive unskilled foreign workers imported, the cost of sending your car for a wash is still considerable low. For as little as RM10, you can send your car for a wash and vacuum. Some send their car once a week while others once a month. There are also some who did it couple of times in a week. Those who do it once a year, on the eve of Chinese New Year or Hari Raya Aidilfitri, are the real heroes. Instead of spending RM480 per year on weekly basis, these ultimate warriors spend merely RM10 – a whopping saving of RM470 in a year.

Besides, an inch-thick dusty car helps to prevent potential car theft (*grin*). Psychologically, a dirty car would not fetch a good price, let alone the prospect of having valuables inside it. Car thieves would not go near a dirty or dusty car so you could potentially save tons of money from car theft. There’s nothing wrong in letting your car collecting dust over a year period because that’s only the outer layer. Once you send it for your annual wash, it’s back to it’s “bling-bling” condition.

[ 4 ] Stop Annual Cell Phones Upgrade

Just like a new car model, smart phone models do not actually have super-duper major improvements within four years of release. Apple and Samsung are equally smart by holding on major features release until they squeeze every drop of your juices. If you’re owning iPhone 4, you won’t miss the orgasms with iPhone 4S, iPhone 5 or iPhone 5S. Unless you’re a reckless user, chances are high your smart phone can last four years and beyond. So, stop upgrading your phone on yearly basis.

Malaysians should realize that buying a latest smart phone constitutes about 50% of their monthly pay, based on RM4,000 monthly salary. Dollar-to-dollar speaking, a 16GB iPhone 5S will cost you RM2,399 (Maxis RRP) while our American friends can have it for US649 (unlocked and contract-free). So, upgrading smart phone is a huge commitment in this country, thanks to weak local currency. Unless upgrading can win you over boyfriends or girlfriends such as Kate Upton, Justin Bieber, Kim Kardashian, you should stop burning a huge hole in your pocket.

[ 5 ] Find Free or Cheap Entertainments

Of course you can’t just hide inside your house everyday in order to save money. You still need entertainments such as movies or musics. If you’re patience, you can actually download months-old blockbuster movies for free. That’s a good way to maximise your internet usage. In fact, you can actually download any movie you like as long as it’s available on the net. Popular television series from United States, Korea or Hong Kong are made available couple of days after its official airing. Heck, you can even say good-bye to cable TVs such as Astro or Netflix.

But if you can’t wait for the download and wish to enjoy the big screen view in Cineplex, make yourself available during promotional period. For example, TGV cinemas are running a value deal whereby you pay only RM7 for a ticket (instead of normal RM16), valid for all movies before 12pm daily. That’s only RM14 for you and your partner, a good deal if you can squeeze your time before 12pm. If weekdays are your only option and you’re a Citibank credit card holder, go for Friday’s buy-one-free-one option.

[ 6 ] Use Cash-back Credit Cards, Don’t Overspend

How on earth can anybody survives without credit cards nowadays? Depending on individual, credit cards can be your best friend or could send you into bankruptcy. As of Apr 2013, Malaysians have a staggering RM32.3 billion in credit card debt. Most people get into trouble when they spend more than their earnings and could only pay the minimum amount. This is when the “loan shark” banking institutions start charging interest and laugh their way to the bank.

However, if you can pay in full your credit card bills every month without fail, you should make full use of cash-back credit cards. Terminate all your credit cards that earn you only pathetic reward-points. Those are so yesterday. It’s much more rewarding with cash-back credit cards. Ever since OCBC Titanium reduces their 5% cash-back (on dining, groceries, petrol, utilities) to a flat 1%, the best cash-back credit card now is no doubt Maybank 2 Amex cards, which not only gives you 5% cash-back on weekend spending but also 5 times treat points.

[ 7 ] Find Cheap Food

Food is a major cost but unfortunately you can’t go hunger without food. If you’re overweight, consider taking two meals only – breakfast and dinner, without lunch. While I can guarantee that you won’t die by skipping lunch, you’ll surely die consuming “Kangkung” (water spinach) everyday (*grin*). It may sound ridiculous but nowadays, a plate of proper meal costs more than fast-food. Even mixed-rice (Chap-Fun) costs a bomb on average, let alone a meal at Mamak Restaurants.

No wonder fast food restaurants such as KFC, McDonald’s, Burger King, A&W, Subway and whatnot are throwing value meals promotion all year long. However, there’re certain time limit that these value meals are valid, such as KFC’s latest Tuesday Treats (RM14.50 for 4pcs chicken, 2 buns, 6 nuggets). If you do not fancy carbonated drinks and fries, McDonald’s McSavers should be a good choice to help you save some ringgits.

[ 8 ] Compare Prices, Shop Smarter

Make full use of your smart phone – note prices of goods that you normally purchase every month for comparisons. For example, I know a pack of MamyPoko (XL 50+) diapers at RM40.90 is a good price that I should grab. Aeon Jusco, Aeon Big (previously Carrefour) and Giant will have such promotion periodically. So, buy only at such price and not anything higher. 100-Plus at RM7.48 for three 1.5liter bottles is the lowest you should get but not anything higher.

The same applies to baby milk powder. For example, I know I should buy a 1.8kg Pediasure from Chinese “Medicine cum Grocery” shop at RM131.50 than RM144 at Aeon Big (at present moment). However, sometime Giant or Aeon Big would throw at ridiculous price that those Chinese shop’s Ah Pek cry like a baby. You have to be smart to know the trend as well. For example, weeks before Chinese New Year, Pop-Pop fireworks costs RM1 for a small pack while a box (50 packs) costs about RM39.

But as the big day comes closer, you can get the whole box (50 packs) for merely RM20. And do you know a loaf of Massimo or Gardenia bread cost only RM2.10 at KK Supermarket while 7-Eleven is selling higher at list price? So, if you have KK Supermarket and 7-Eleven outlets within a couple of shops apart, do yourself a favour by choosing wisely.

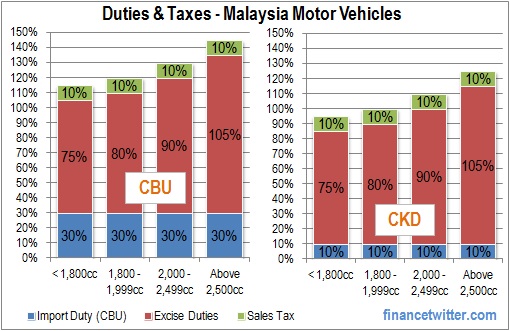

[ 9 ] Delay Car Upgrade

It’s an open fact that Malaysia is second most expensive country on planet earth to own a car, after Singapore. As of Apr 2013, total car loans in this country amounts to RM145 billion, second only to housing loans at RM316.2 billion. And how much the present federal government is collecting yearly? A cool RM7 billion annually in excise duty alone. Based on a 90% financing with an interest rate of 3% and loan tenure of 7 years for a Honda Civic 1.8 (Malaysia costs RM110,000 while United States costs RM58,000), a Malaysian pays monthly installment of RM1,426 while an American pays RM752 only.

Unless this is your first car, you should make full use of whatever you’re driving now. The joke on the street is this: while your first car can be a Proton, your subsequent car should be other models. First, get a cheapest Proton car possible and push it to some five or seven years. Then, you should be able to at least afford a Honda City or Toyota Vios. You can easily run your reliable Honda or Toyota for ten years. And hopefully the political pressure would pull down car prices when it’s time to upgrade your Honda or Toyota.

Besides political factor, Malaysians can play their part to force a reduction in car prices. By delaying car purchase in massive number, it won’t be attractive for the present regime to maintain high rate of duties simply because tax collection is small. It’s a simple supply and demand economy. It will also force car sellers not to short-change car buyers by selling featureless car at world class price. Attack where it hurt the most (money) and consumers will win the war. The present government is too arrogant and stubborn in this issue because the money (RM7 billion) is too mouth-watering to be taken off the table.

[ 10 ] Get News Online

If your main source of news is still newspaper, chances are either you’re computer illiterate or the newspaper contents are more interesting than Penthouse. Seriously, if you still read newspapers such as theStar, Utusan, New Straits Times, Malay Mail, Berita Harian, it’s time you cancel them and save yourself the trouble of being brainwashed by government propaganda, racism, advertisements and whatnot, not to mention tons of money. You can get most news online, even from their own online portal.

If you really need to check for shopping promotions, just get the weekend Saturday version. Assuming it’s RM1.20 per newspaper, you will save an extra RM380 a year to spend on something else more meaningful. Guess what, you can also boast that you help the environment by saving tons of trees.

[ 11 ] Terminate Excessive Credit Cards

If you have more than five credit cards, chances are high that you’re in debt and couldn’t pay your outstanding in full every month. Ideally, you just need a Master / Visa and an Amex (American Express) credit cards. At most, you should have three credit cards for easier management. It’s a torture carrying a bulky wallet filled with credit cards as thick as your mattress, no? But the main reason why you should reduce the number of credit cards is the annual charges.

There’re two annual charges that you should take note. First – service tax (amount varies depending on type of credit cards) imposed by banks. Second – RM50 GST or Government Service Tax, collected by banks on behalf of the government. While service tax imposed by banks could be waived, the same cannot be said about GST. To attract new customers, banks may give away “cash-back” to offset GST. But subsequently, you still need to pay GST of RM50 per card.

So, if you’ve 10 seldom-used credit cards, you need to pay an extra RM500 annually to the government. And we have not talk about sub-cards that need to pay the same amount of GST annually. Furthermore, the less cards you have, the less likely you could swipe and accumulate debt. If you currently have mountain of credit card debt, the first thing to do is to do 0% balance transfers to temporarily save on outrageous interest charges.

[ 12 ] Reduce Consumption of Alcohol and Tobacco

Malaysia Prime Minister Najib claimed sex life can be boosted by reducing sugar intake. If that’s true, definitely you can be guaranteed of multiple orgasms by cutting down on smoking and drinking. On average, a pack of 20s cigarette costs RM12. While it’s cruel to ask you to give up smoking totally, you can save a whopping RM576 annually if you can only reduce it by a pack for each week. If you can further reduce it to two packs a week, that’s RM1,152 every year.

Just like Malaysia cars are second priciest in the world, the country’s beer prices is second highest only to Norway. Price of beer varies – cheaper at “kopitiam” but definitely higher at hotel. And since there’s no health benefits of consuming alcohol, perhaps you should try to reduce its intake to save some money.

[ 13 ] No to Authorized Service Center, Goto Chow Ah Beng Workshop

Unless your car warranty forces you to visit the authorized service centre, you should start scouting for workshops normally operated by those Chow Ah Bengs. Your car’s official authorised service centre normally charge you skyrocket prices for parts and labour. It’s still okay to visit those tyre shops for engine oil and filter replacements but definitely not for major engine or gearbox repair. Tyre shops do best in, well, tyres and not engines so why go to dentist when you’re having fever.

When scouting for workshops, your primary concern is the labour charges. There’re tons of spare parts shop around so you can buy parts yourself. Tell the foreman your problem and ask him what parts need to be replaced and you buy the parts. But if you’re too lazy to buy parts yourself and don’t mind workshops’ jack-up prices of parts, you can always ask the foreman for the total amount to fix the damages and pay accordingly. Beware – some workshop mechanics are no better than loan sharks though.

[ 14 ] Give Up or Reduce Betting on 4D, 5D or Lottery

The odds of winning the Sports Toto 6/58, 6/55 and 6/52 jackpots are 1 in 43.6 million, 1 in 29.9 million and 1 in 21.1 million respectively. Even in 4D game, the probability of winning is only 0.01% since there’re 10,000 possible combinations. In other words, the odds of winning 4D is 1 in 10,000. When was the last time you heard your family members or close friends hit jackpot or 4D? Sure, there’re winners but strangely it’s always someone else unknown to you. If you can’t even strike 4D, what more with those jackpots?

Even if you’ve relatives who hit 4D, how much was the winning prize and how much has he invested all these years betting his numbers? If it’s for the fun of trying your luck, restrict yourself to weekend betting (example) with negligible amount of money. Do not get yourself addicted to this gambling. Betting opens on Wed, Sat and Sun every week at all three gaming centers, not to mention special draws on certain days. If you bet merely RM5 per ticket, you’re gambling away RM5 x 3-centers x 3-times-per-week – that’s RM2,160 in a year.

[ 15 ] Don’t Pay Summons Until …

This may sound absurd but it’s not worthwhile to pay your summons early especially your DBKL (Dewan Bandaraya Kuala Lumpur) summons. Those bravehearts may not think twice about throwing away DBKL summon tickets. It may not affect them, for now, because DBKL system is not connected to JPJ system but it’s a matter of time before they do so considering the country’s gigantic debt (government’s hunger for money). You cannot run away from JPJ’s summons though since it’ll affect your annual road-tax’s renewal.

Now, if you’re an obedient citizen, you should pay your DBKL summons. However you shouldn’t pay them early as it doesn’t entitles you to any discount. It’s almost an annual event that DBKL will announce special “discount promotion” in conjunction with Federal Territory Day where traffic compound summon is reduced to a flat RM30 per ticket. This year’s discount is effective from Feb 1 to Mar 8. The normal rate for the same compound without discount is RM100 (normal traffic offence), regardless whether you pay it within 24 hours or 14 days. So, you get to save RM70 per ticket if you drag your feet.

There you have it – 15 exciting and crazy tips to save more money especially during tough time. Obviously there’re more ways in saving money out there. So, do share with us how creative you are in saving money by paying less.

Other Articles That May Interest You …

- Psst !!! Remember Your Bread And Butter Issues?

- 15 Fast Food Restaurants You Wish Would Come Here

- Fuel Prices Hike – Can You Blame PM Najib Alone?

- Crazy Services For The Rich That You May Not Know

- BN Moneyfesto – Do You Know The Hidden Messages?

- Unbelievable Markup Products That You May Not Know

- Budget 2013 – What the Govt Doesn’t Want You to Know

- Here’re Reasons Why You Shouldn’t Buy A New Car Now

|

|

February 21st, 2014 by financetwitter

|

|

|

|

|

|

|

I think better to do a UKRAINE on UMNO-BN or Migrate to Sabah-Sarawak en MASS…remove UMNO-BN from Sabah-Sarawak and Sack Malaya….. that is a Generational savings..Guranteed!!