Sales figures are a key measure of a company’s strength – the figure which will tell you to investigate more or simply ignore a particular stock altogether. This piece of financial information reflects growth, a yardstick of how efficient a management is running the company.

Companies basically have two ways to increase earnings – either increase sales or reduce expenses (better still both). Though controlling expenses can increase earnings but you can only do so much without jeorpardizing productivity and the moral of the workers. Hence the main engine of growth is still healthy sales.

When you search for the best stocks, you want a company to have strong sales growth to support its earnings growth. When a company recorded increasing sales every quarter, it’s telling you its business is gaining larger demand from customers and capable of boosting its stock price with increase earnings.

Increased demand could be due to :

-

increased in number of new customers

-

increased in purchase volume from existing customers

-

expansion into new markets territory

-

introduction of new products

-

improvement to existing products

-

special limited promotions via bundling programs

Top-performing companies normally show consistent double or triple-digit sales growth, in fact such companies perform so well that the expectation from investors are so high that if they miss a single quarter earning estimate, their stock price might subject to severe punishment.

However pay attention to companies which have great sales growth but :

-

depends heavily on certain number of customers only

-

depends heavily on overseas market (bad economies & political factor)

-

high exposure in foreign-exchange rates (1997 Asian crisis is a good example)

-

recorded sales which have not actually taken place

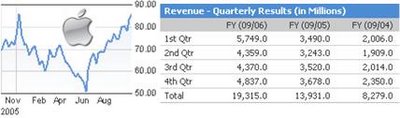

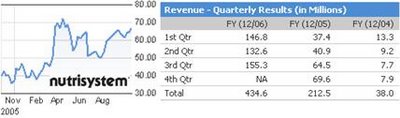

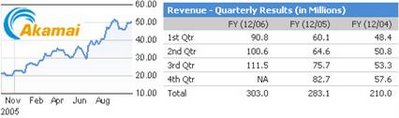

Example of companies with good sales growth :

-

Apple (Nasdaq : AAPL)

-

Nutrisystem Inc. (Nasdaq : NTRI)

-

Akamai Technologies (Nasdaq : AKAM)

-

Google (Nasdaq : GOOG)

Other Articles That May Interest You …

|

|

November 22nd, 2006 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply