Muhammad Ibrahim should send a postcard thanking The Wall Street Journal for exposing an initial decision by Najib administration, allegedly to appoint bootlicker Irwan Serigar Abdullah as the next Bank Negara (Central Bank) Governor. Muhammad, presently the Deputy Governor of Bank Negara Malaysia will take over from Zeti Akhtar Aziz effective from May 1, for 5 years.

It’s absolutely hilarious seeing Prime Minister Najib Razak, red-faced, make a major U-turn just to prove the WSJ was wrong. Perhaps Najib’s overpaid band of bloggers should challenge the WSJ to produce documents showing Irwan Serigar’s supposedly “done-deal” appointment. In retaliation, the WSJ might publish the “proof” so that Najib could be humiliated – again.

Only time will tell if Harvard-graduate Muhammad Ibrahim is too weak to stand against interference and instruction from Putrajaya and becomes Najib Razak’s new pet. For now, this guy is relatively better than Irwan Serigar, who sits on the board of 1MDB as an advisor and various other important boards, acting as the prime minister’s eyes and ears.

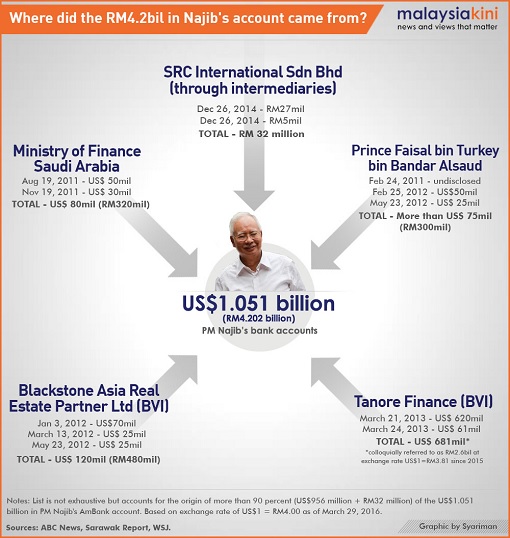

All eyes are on the new Governor Muhammad Ibrahim if he would clear PM Najib Razak of all wrongdoings in the 1MDB scandal, the same way newly appointed Attorney General Mohamed Apandi Ali and Public Accounts Committee Hasan Ariffin had done. If he’s a man of integrity and honour, the new governor can do real damage with his powerful post to Najib.

While Najib Razak is trying very hard to walk, act and look cool, the Malaysian prime minister is actually under tremendous pressure from not only domestic demands but also international authorities on his 1MDB scandal. We had written about a possible snap election to be called this year, and we believe the probability has just increased that Najib would proceed with it this year.

What’s keeping him from calling it yesterday is the Sarawak state election, which is now in full swing. Najib’s Barisan Nasional (BN) government is expected to win big in Sarawak, thanks to internal fighting between DAP and PKR, two of three opposition parties forming Pakatan Harapan (Coalition of Hope), which doesn’t really seem to promise any hope at the moment.

Still, Najib needs to know – officially – what the people of Sarawak think about his administration. Here’s the puzzle: can Chief Minister Adenan’s popularity offset 1MDB scandal and GST issue? More importantly, they need to know the number of parliamentary seats that can be won after the redelineation of parliamentary and state constituencies in the state.

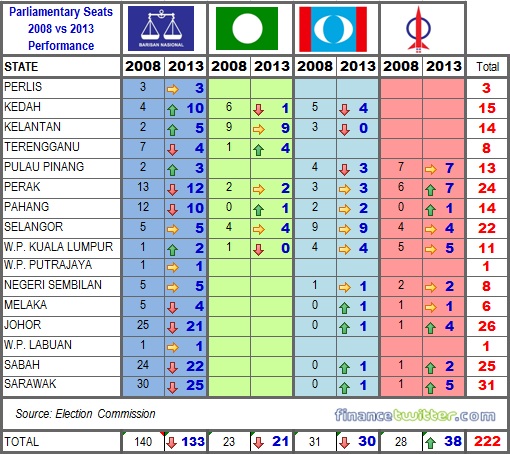

And the results from the state election can provide the answer whether BN could maintain, or increase their parliamentary seats won in 2013. Out of 31 parliamentary seats allocated for the state of Sarawak, BN won 25 in 2013 as compared to 30 in 2008 national election. The latest redelineation was unfairly drawn to help BN recapture the 5 seats lost.

But why’s the rush for a snap election now when the 1MDB refuses to die a natural death? That’s precisely why Najib needs to call for a new mandate. The 1MDB is now a full-blown crisis so serious that it’s not about a village boy fights between Najib Razak and Mahathir Mohamad anymore. The fight has escalated and is now between Najib and the World.

While US$50 million is not a huge amount, the fact that Najib chose to default on the interest payment has made it a huge issue. Essentially, bond holders are facing at least US$4.5 billion (RM17.6 billion) in potential liabilities. Soon, sovereign credit rating agencies such as Moody’s and S&P may be forced to downgrade Malaysia’s rating.

In a nutshell, Najib needs truckloads of money to fix his 1MDB debt problems before Moody’s and S&P swing into action. What about the RM2.3 billion cash sitting in bank as claimed by 1MDB President Arul Kanda? Well, if you believe him that 1MDB is really debt-free, then you should believe Tooth Fairy is your neighbour and Donald Trump is still a virgin (*grin*).

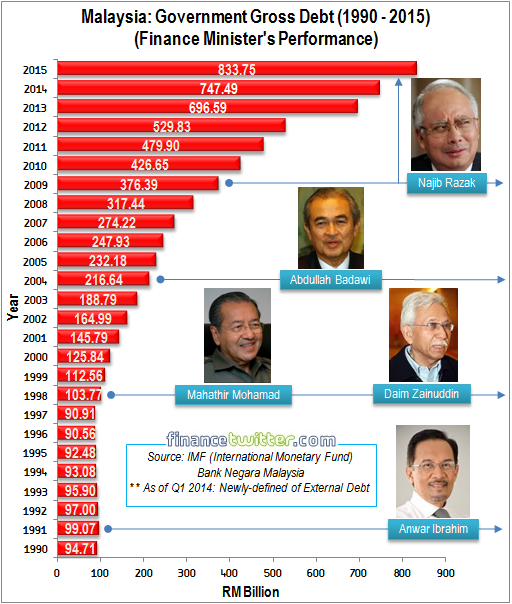

Therefore, the only place to get money is through taxes unless the prime minister plans to jump start Malaysia into a regional drug-trafficking hub. One has to remember under Najib, the country’s total gross external debt has climaxed in excess of RM830 billion. That means tons of money would disappear into thin air annually just on interest payment alone.

The only place to raise taxes is none other than the existing 6% GST cash cow. Actually this is not really a secret anymore. If you’re a business owner, especially in the trading and services sector, chances are your suppliers would have tipped you that Najib Razak is planning to increase the GST rate to 8%, a 2% jump, effective 1 April 2017 (next year).

Since its introduction on 1 April, 2015 until end of January 2016, the government happily collected RM51 billion. That’s roughly RM5.67 billion in monthly collections for a period of 9 months, translating into RM67.92 billion for 12 months. A simple calculation shows an additional 2% increase in GST to 8% would bring in a staggering RM22.64 billion every year.

In other words, Najib Razak will be flushed with an “extra RM1.88 billion” – every month – when the GST is increased from 6% to 8%. That’s freaking lots of money to pay whatever outstanding debts from his screwed up 1MDB project. On paper, 2% doesn’t look awfully huge but 2% from 6% is actually a 33.33% or one-third increase.

The amazing part is this. When raised eventually, the additional 2% GST tax will be permanent, not temporarily, even after 1MDB scandal and debt are solved. What this means is Najib will be laughing all the way to the bank with RM90.56 billion of 8% GST, screwed from 30 million Malaysians’ hard-earned money – every fucking year.

Now, some speculate that the quantum of increase would be much higher, from 6% to 10%. But we think that would be overkill and could trigger a serious “people uprising”, a risk Najib isn’t willing to take. Furthermore, if GST is indeed increased from 6% to 10%, the pricing of goods and produce could be jacked up by as much as 50% by suppliers and traders, thanks to zero government enforcement.

Regardless whether the new rate to be introduced is 8% or 10%, everyone in the business community agrees on this – the GST is set to increase next year. Not only is the extra RM22.64 billion annual income critical to the lavish-spender Najib regime, it’s also necessary to satisfy sovereign credit rating agencies such as Moody’s and S&P not to downgrade Malaysia’s rating.

Because a period of 12-month is too close for comfort, Najib cannot risk increase GST in 2017 and dissolve Parliament for national election due in 2018. Of course, he can always call for a snap election next year and push up the GST rate in 2018 after he win the election. But his 1MDB scandal could take a turn for the worse between now and 2017.

Other Articles That May Interest You …

- Sarawak Election – Why DAP & PKR Should Be Punished Before 2018

- Here’s Why Making His Son A PM Isn’t The Reason Mahathir Attacks Najib

- Here’re 2 Methods To Skin Najib, But Election Is Not One Of Them

- Apandi Cleared Najib “Legally”, Serigar About To Clear Najib “Financially”

- Budget 2016 Revision – What Najib Razak Doesn’t Want You To Know

- Uh-oh, Najib In Trouble – Get Ready For A Snap Election Next Year 2016

- Can GST Finally Breaks UMNO’s Malay VoteBank?

- Great Minds Think Alike – Both Obama & Najib Are Great Debt Accumulators

- Budget 2014: Sugar & GST – Newly Found Cash Cows

|

|

April 28th, 2016 by financetwitter

|

|

|

|

|

|

|

Comments

Excerpt: ” the country’s total gross external debt has climaxed in excess RM 830 billion” …I supposed this figure excludes EPF RM 300-400 billion , LTAT, KWAP, TH and others , so are we looking at a national debt of exceeding RM trillionn ?

@dan: it’s not so simple. The 47% is Sarawakians etc who barely have water and no electricity. They don’t have Internet to know about these issues. They just care about who gives them extra RM50 and go on about living their life.

Developed status achieved in case of at least of public debt well before 2020.

Also No.2 in corruption index and no more in the world’s best 100 Universities.

i hope gst is raised to 10% as i will be pretty damn glad that this is the only way that the 47% assholes who voted and continues to vote for the current regime will get fucked every single day. no other way….sweet revenge. too bad for the other majority but then this is a really unfair world.