I had my breakfast at my favourite Mamak restaurant today. A piece of Roti Kosong, Nasi Lemak bungkus and Teh Tarik kurang manis totalled RM3.70, the same price as before the 2014 Budget last Friday. It’s my favourite Mamak hangout because this is perhaps the last place on earth that will increase its prices after any sugar, petrol and whatnot increases. However, “Aneh” said they’re still adopting “wait-and-see” approach whether to increase their prices or not after the RM0.34 per kilogram increase in sugar price.

Yes, the biggest surprise from the 2014 Budget was indeed the total abolition of sugar subsidies announced by PM Najib Razak. The main reason for the increase was to reward Syed Mokhtar al-Bukhary, the tycoon who monopolize the sugar business in the country, and the same person who sponsored Barisan Nasional (BN) heavily during this year General Election. Actually that was not something that upset the people the most. What really anger the people was the way Najib administration justify the subsidy abolishment.

Sugar is not the only reason that leads to diabetes problem. Hence by slashing sugar subsidy does not guarantee a total elimination of diabetes issue. If this is the case, then zero-sugar-subsidy countries worldwide would have zero problem with diabetes, wouldn’t they? All carbohydrates can cause a rise in blood sugar as well because 90% are broken into glucose. And this includes food such as rice, potato, corn, bread, pasta, fruit, milk, honey and whatnot.

PM Najib may thought this is the best time to insult peoples’ intelligence by justifying slashing sugar subsidy would solve diabetes problem, not to mention helping peoples’ sex life. But he definitely underestimates the chain reaction and multiplier effect in the prices of other food due to sugar price increase. But why should he care when the abolishment could help his UMNO-led government saves (or rather gains) a whopping RM567 million annually?

On the other hand, it’s a blessing in disguise to the “Kampong Folks” who voted the present government because they’ve been demanding for decades for higher price in “Air Sirap, Kuih, Kopi, Cakes, Cookies, Carbonated drinks, Bread” and whatnot (*grin*). The next item that’s still screaming headlines is non other than the proposed GST (Goods and Services Tax) effective April 1, 2015 starting at 6%. This is not surprising at all since every Tom and Jerry knows it will be revealed upon BN winning the general election.

It’s true that GST is the easiest way for a lazy government to collect more money. It’s mind-boggling that many economists applaud GST announced by PM Najib. GST on its own is not a problem. But implementing GST in Malaysia is a huge problem. GST is like a blank cheque for the present government to collect an estimated RM30.75 billion (at 6% GST with the exemption of basic necessities such as rice, flour, cooking oil, education, public healthcare, etc.) – a huge amount that most likely will lead to more leakages.

Already pride itself with about RM26 billion in annual leakages, an additional RM30.75 billion income annually to Najib administration is indeed a mouth-watering golden goose. It’s a blank cheque because the government can always increase the rate any time they like it, mind you. In time, GST could become the country’s biggest revenue generator, surpassing current piggy bank Petronas. Unlike Petronas that depends on global oil prices, GST depends on government’s need to increase its coffers (*tongue-in-cheek*).

PM Najib was grinning and having fun insulting peoples’ intelligence by justifying that since 146 countries have implemented it, then GST must be the greatest thing invented since sliced bread. Of course he didn’t dare to reveal that in developed countries, the GST is one of revenues pooled to help its citizens with free home, food, healthcare and whatnot. Fancy working for just nine months in your adult life and have the cheek to demand for a five-bedroom property upgrade despite claiming £32,000 (RM162,438) a year in benefits while having nine kids, 27-inch flatscreen, Nintendo Wii and Playstation 3?

That can only happen in United Kingdom, one of the countries that PM Najib proudly showcase his GST case studies. Hey, we didn’t say anything about UK having a lazy government, okay. It’s also a big lie that prices would come down with GST’s introduction and abolishment of existing Sales and Services Tax (SST), which is at 10% and 6% respectively. You can argue till cow comes home whether GST is a replacement tax or an additional tax. The fact is whatever the items, the price will not become any cheaper post-GST simply because in Malaysia, whatever goes up will never comes down.

If it’s true that Najib administration is so generous about a lower 6% GST tax rate instead of Sales tax at 10%, will cars price become cheaper by 4%, being the difference? The fact is people do not see and feel the existing 10% sales tax in general items but will surely see and feel the 6% GST when it is implemented. Unless there’s a period of “less 10% sales tax” whereby people can “experience” cheaper goods by 10%, and follows by a “6% GST tax” period, the slogan that GST will translate to cheaper goods is just plain lie.

Knowing the extraordinary efficiency of government enforcement, goods will become 4% more expensive post GST – as simple as that, at least to the average Joe and Jane. Sure, existing SST is not fair but at least people knows that they’ve to fork out additional 10% plus 6% in Sales and Service Tax everytime they step into KFC, McDonald, Starbucks, Little Penang Cafe, GeorgeTown White Coffee, Papa John’s Pizza, Kenny Rogers, private hospital, hotels and so on. But with GST, people does not have any option but to pay the mandatory 6% tax bracket, even if they merely want to enjoy a can of Coca-Cola from 7-Eleven.

Surely the government wouldn’t bother to implement the lower 6% GST if indeed prices of goods would become cheaper. Why collect less (6% GST) if you can collect more (10% plus 6% SST) presently? Here’s the main key that Najib administration doesn’t want to tell you – there’re more items to be taxed under GST than the existing SST. For example, you would end up paying extra 6% GST for newspaper, stationery, children school bags, shoes, private tuitions, smartphones, tablets, car’s spare parts, milk powder and the list goes on. Duty free goods would not be free after all.

Furthermore, why cry and scream till foam at mouth about cheaper goods with GST when Najib also announced a one-off payment of RM300 to BR1M (1Malaysia People’s Aid) household when the GST is implemented. Doesn’t that proves overall goods would be more expensive hence the sweetener to pacify the ignorants? There’re countries that are fit to impose GST but definitely not Malaysia under the present corrupt regime. And this is precisely the missing piece that economists who support GST are not aware (or rather refuse to acknowledge) of.

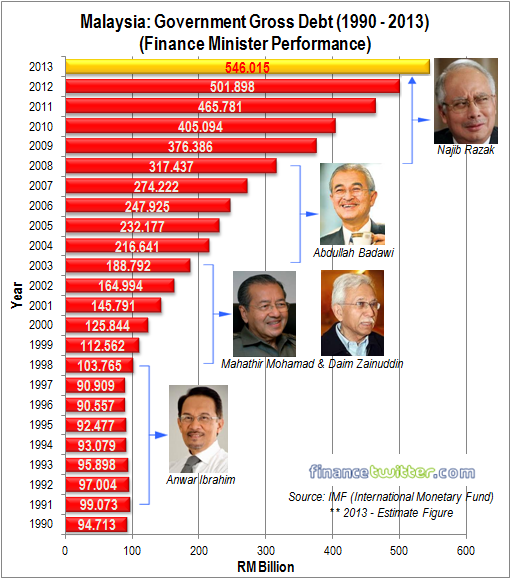

GST will be a new cash-cow for BN-led government to continue with their plundering. PM Najib’s own UMNO is now a hard to satisfy animal that needs bigger tits to feed. With more than RM500 billion (and counting) in government debt, you do not need to be a scientist to understand why GST is the beautiful solution to Najib administration. Perhaps it’s good to have GST after all. Perhaps GST is what it needs to wake those ignorant and dumb voters. But I suppose you can’t teach old dogs new tricks. They would most likely think GST is actually yummy Great Stew T-bone (*grin*).

Other Articles That May Interest You …

- Fuel Prices Hike – Can You Blame PM Najib Alone?

- BN Moneyfesto – Do You Know The Hidden Messages?

- Budget 2013 – What the Govt Doesn’t Want You to Know

- Govt, TNB & IPP Milking Petronas & People – These Charts Tell All

- Marcos, Mubarak & Mahathir – Who’s The Richest Man?

|

|

October 28th, 2013 by financetwitter

|

|

|

|

|

|

|

Comments

Looks at the PMO Budget and see where the so-called bilions saved through subsidy cuts of fuel and sugar then GST will be channelled thanks to anak Jala!

Its unnerving when he and his spouses jet around and live on the Rakyat for basic things and essentials – housing (free). utilities (free) and fuel (free).

so how do the Rakyat stop all these – freebies to the tune of millions/year and make them pay for it all so that they will feel the pinch the majority of Rakyat has to go through.

1 bloke and his Kadok takings cpuld feed the entire population of Malaysia.

When will the 3.2 million Melayu learn – bodo sokmo!

For those who voted BN or accurately UMNO, you were fully aware of what is in store for you. You did not want cheaper car, you wanted PTPTN, more expensive fuel, and more importantly GST. So budget 2014 is really a dream come true. So “enjoy” the govt of your CHOICE for the next 5 years…….For the remaining 52%, work harder. GE 14 isn’t all that far after all……

Beg to differ. Your comments on gst are not entirely correct. Esp on not having option but to pay gst on a can of coca cola. It is sales tax which is not visible to final consumers currently, being embedded in price of goods. It is under this SST regime that consumers may not even know they are paying tax on goods / services they buy. Gst on the other hand will be transparent to consumers. if you do not want to pay that gst, you have the option not to buy it. it’s true that prices generally will increase, expected to be a once off on implementation. Govt has not denied that. to mitigate irresponsible businesses from simply increasing prices to take advantage of gst implementation, govt introduced anti profiteering act, avenues/lines to report on profiteering activities, shopping guide for consumers.. Also govt will be reducing tax rates. These were all announced in the budget.

Foo,

Don’t bang your hope on GE14; EC Chairman and Deputy still at large and they would be even more astute come GE14.

47% (or rather 37% because of fraud) never learn and choose to be stupid.

Meanwhile those in power will keep on enjoying life; after all everything is paid by the voters who voted or did not vote for them.

Sad, very sad. But, it happens right before your eyes and you have to suffer and pay for all the nonsense.

It’s not just 6%. The end result (or damage) of GST will be greater if a piece of goods (services) passed through many layer of distributions because in each layer the cost will be markup and GST is base on the selling price. For example if product X is manufactured at RM1.00 and sale to Dist1 for RM1.06. Dist1 sale X to Dist2 with 30% margin for RM1.50 plus 6% GST at RM1.59. Dist2 sale X to retailer for RM2.27 (30% margin plus GST). The end user will need to pay RM3.24 for product X (30% margin and RM0.18 GST). From this example the consumer need to pay RM0.18 GST which is 18% of product X original price. This is based on 3 layer of distributions and 30% margin for each layer. The effect of GST will increase in tandem markup and layer of distributions.

Hey Mr FT, you are good real good, please write more regularly.

Thanks for this piece, cheers.