On 31-Mar-1993, Tenaga Nasional Berhad (TNB), Malaysia’s main energy provider and a government-linked company signed a 21-year Electricity Power Purchase Agreement (PPA) with IPP (Independent Power Producers) Yeoh Tiong Lay Corporation Bhd. (YTL). This was the first PPA ever signed by TNB with an IPP license for the Paka and Pasir Gudang Power Stations. Very few people know that their nightmare was about to begin, with lopsided agreement deliberately drafted to benefit the IPP.

The electricity PPA signed had opened the flood-gate for other players, all of them are either cronies or somehow related to the royals, to jump onto the gravy-train. In 1995, TNB’s monopoly in electricity generation sector ended with the establishment of five IPPs which supplied 30.99 per cent of electricity supply to the National Grid. The five were YTL Power Generation Sdn. Bhd. (the first player that signed the PPA with TNB), Segari Energy Ventures Sdn. Bhd., Port Dickson Power Bhd., Powertek Bhd. and Genting Sanyen Power Sdn. Bhd.

It all started when a massive blackout occured in 1992 that shut down much of the country for up to 48 hours, triggering public anger and outcry. As a result, the then prime minister Mahathir Mohamad dismantled TNB’s monopoly in electricity generation and replaced that role with the IPP program. Practically all the well-connected political groups rushed to bid for the IPP licenses. It was cash-cow so naturally everyone wanted to have a piece of the cake. At one point as many as 150 applications flooded in to the Economic Planning Unit.

Experience in the power sector was not a necessary qualification but the strength of political connections to the government was the vital criteria. Tycoons such as Yeoh Tiong Lay (YTL), Ananda Krishnan (Maxis), Lim Goh Tong (Genting) and Syed Mokhtar Al-Bukhary were some who rushed for the lucrative contracts and benefited from their very close connection with Mahathir back then. IPPs signed long-term power supply contracts with TNB and the fact that the PPAs were signed with heavy “presence” of the government, IPPs’ profit were almost guaranteed. Of course in return these IPPs would need to scratch the politician’s (mainly UMNO) back as far as war-chest is concerned.

Early birds get the worm, and so the first 5 (five) consortiums in the first wave or batch that bid for the IPP contracts were guaranteed returns of 20% spanning a period of 21-year contract although the actual profits were much higher. The second batch of players who bid for the IPP contracts which began in 2001 got lower contract rates than the first wave. In addition, the IPP projects were only for companies that have 30% bumiputra ownership and foreign investors were prohibited from taking more than 30% stake, not to mention it was not awarded through open tender.

The IPP contracts were so lucrative that by early 1997, months before the Asian financial crisis, the country had almost 50% surplus capacity from a shortage just couple of years ago. Mahathir administration gave out too many licenses in such a short period of time that the sudden over-capacity prompted Mahathir to urge consumers to use more electricity. Since the PPA agreement was lopsided and TNB was obliged to purchase from IPP even though it does not need the electricity, TNB itself had to turn off its own facilities in order to use them.

Obviously every analyst would say the first five IPP had been laughing all the way to the bank because they had been enjoying favourable terms not found anywhere else in the world. Average-Joes were wondering why IPP were so powerful and untouchable so much so that even during the 1997 Asian financial crisis and TNB suffered its worst losses, nobody could get IPP to renegotiate the lopsided terms. In reality, the government didn’t want to rock the cash-cow IPP because the simple solution was to raise electricity rate and let the consumers absorb TNB’s high operating costs.

But is TNB the only player suffering from losses till this day due to lopsided PPA agreement drafted by Mahathir’s administration? Could Malaysians actually enjoy lower cost of electricity if TNB had managed itself professionally in the first place so that IPP wouldn’t have exist in the first place? But I suppose it’s water under the bridge now as we can’t possibly turn back the clock, can we? What about Petronas, the country’s national petroleum corporation that has been milked since its establishment in 1974?

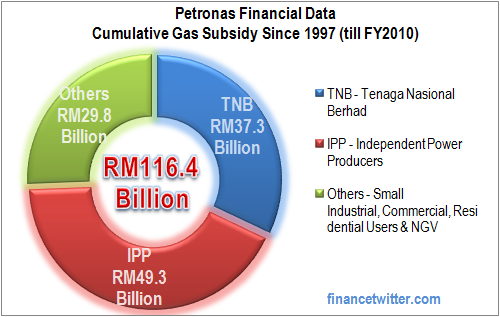

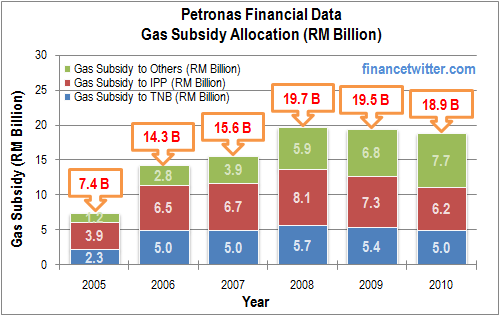

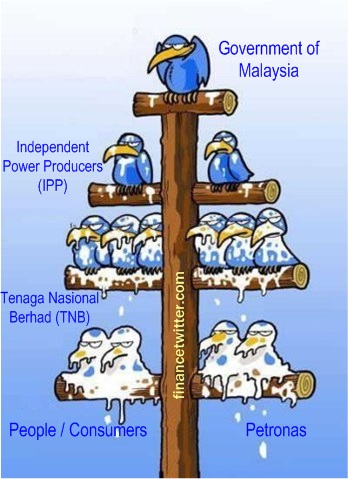

Poor Petronas’s enormous wealth has been evaporating till today, thanks to mismanagement, leakages, bailout, cronies enrichment program and whatnot from the government of the day. Since 1997 until FY2010, Petronas’s cumulative gas subsidy was at a staggering amount of RM116.4 billion – IPP enjoyed the lion share of RM49.3 billion (42.3%) follow by TNB (RM37.3 billion or 32%) and others such as small industrial, commercial, residential users and NGV who enjoyed RM29.8 billion or 25.6%. The fact that IPP and TNB alone enjoyed a combine RM86.6 billion or 74.4% of the total gas subsidy since 1997 is simply jaw-dropping.

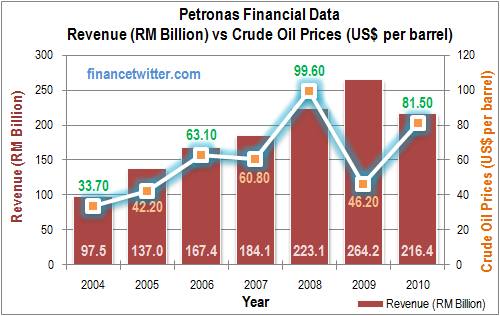

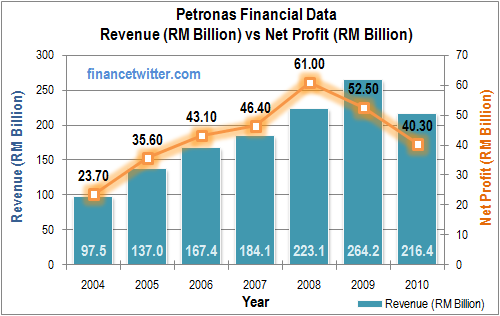

To date, Petronas paid a whopping RM529 billion to both Federal and State Governments, making it the biggest contributor to the nation’s coffer, without which the government would have collapse ages ago. It paid a total of RM74 billion in 2009 for the dividends, taxes, petroleum proceeds, export duties and to the state governments. In spite of Petronas’s healthy revenue, the subsidy to IPP and TNB has taken its toll on the net profit. Every year, Petronas pays billions of dollars in gas subsidy mainly to IPP and TNB. In 2008 alone, its gas subsidy reached the peak of RM19.7 billion with IPP and TNB taken the lion share of RM8.1 billion and RM5.7 billion respectively.

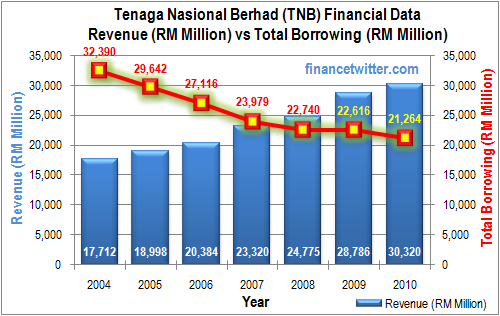

What about TNB itself? There’re quite a number of problems with the national power provider. It’s main problem was the huge borrowings, which has been declining so let’s hope the management continues the job of bringing this double-digit of billions to a more managable level. Now that the local currency has strengthern against the foreign currencies, it should be a bonus to the top management in servicing the debts so the CEO Of The Year, Che Khalib Mohamad Noh, should stop giving childish excuse about high debts eating into the profit.

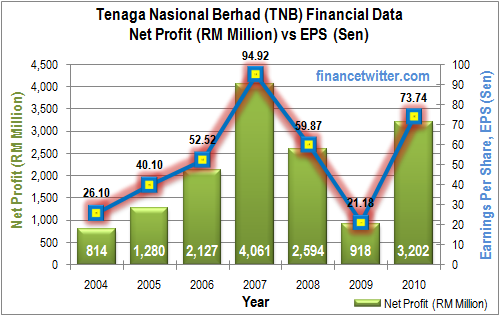

TNB consistently registers billions of Ringgit in net profit so there was no reason for an electricity rate hike, at least that was the argument from the man on the street. On the other hand, TNB is a public listed company hence it has to answer to its shareholders and naturally profit and loss was the main agenda. However there’s no other power provider except TNB and consumers who were at the lowest chain cycle were made to pay, no matter how unfair it was. TNB made about RM3.2 billion in net profit for the financial year 2010.

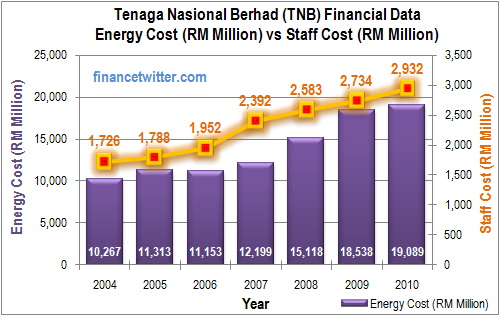

Within the core of its business however, TNB is a very inefficient entity especially its operating cost. In 2005, the company’s 40.5% operating costs were spent in purchasing electricity from IPP. For the financial year 2010, TNB’s energy cost grew by 2.4% to RM17,379.0 million from RM16,974.4 million recorded in 2009 – mainly due to higher payment to Independent Power Producers (IPP), totaling RM12,528.0 million, an increase of 5.9% compared to the previous (RM11,827.0 million) financial year. Fortunately, lower fuel costs incurred during the year somewhat offsets the increase in IPP purchases, at least temporary. You don’t have to be rocket scientist to see how IPPs are sucking both Petronas gas subsidy and TNB energy cost dry.

TNB also should do something about its forever escalating staff cost which is eating up nearly RM3 billion for the financial year 2010 alone. Within 7-year since 2004, the staff cost jumped almost 70% from RM1,726 million to RM2,932 million, and that’s a lot of money. Maybe CEO Che Khalib Mohamad Noh should start looking seriously at the forever bloating workforce. With the electricity generation job outsourced to IPP, TNB should have an easier job managing its core business but to see it almost double the workforce’s expenses within 10-year period is obviously inefficient.

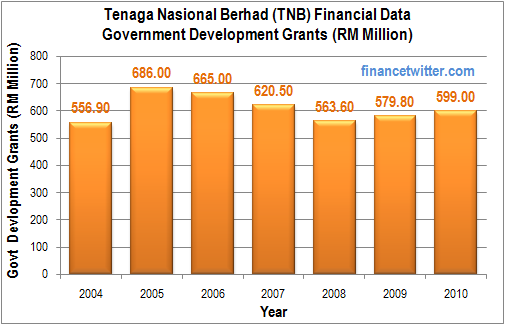

Another interesting area that you may not know is that TNB receives Government Development Grants every year, whatever that means. And the amount is not small to the tune of more than RM500 million each year. Whether the grants were another nicely packaged subsidy is everyone’s guess. Nobody knows what has TNB develop with the half of billion of Ringgit grants. What everyone knows is the company will cry to daddy government asking for electricity hike every year without fail. After all, this is the tax-payer money that the government is awarding to TNB.

Now, can you blame the people who cry-fouls after the government agreed to the proposal by TNB in increasing the electricity tariff by 7.12% starting June 1 this year? The main culprit is the government so stop insulting people’s intelligence with marketing hype such as reducing “misallocation of resources” or economic distortion or calling the people opium addicts for not willing to let go of subsidy. The government dare not answer the simple question of why the people must bear the cost of reducing subsidy when the IPP and TNB continue to enjoy the gas subsidy from Petronas.

Sure, the government claimed that since the PPA agreements were signed, it can’t do anything about it, no matter how lopsided it is. Fair enough, since the corrupt and inefficient government dare not raise its voice to get IPP to renegotiate the agreement, why not slap them with Extraordinary Tax, which is perfectly legal, not that the government has not done it previously? Then use the gains to offset whatever tariff hike it planned to implement? Maybe the present government is really a big bully who only bullies the average-Joes while letting the untouchable IPP, who are still laughing all the way to the bank, continue sucking free subsidy.

Other Articles That May Interest You …

- How Much Fuel Hike Will It Be – 5 sen, 20 sen, 40 sen or None?

- Marcos, Mubarak & Mahathir – Who’s The Richest Man?

- ETP – Wishful Thinking Against Reality Hidden from You

- Nuclear Plant – Tenaga’s new Toy worth RM10 billion?

- Oil Prices Debate – Shabery slaughtered by Anwar

- Windfall Tax – Punishment or Desperation for Money?

- Windfall Tax – why Discriminate and Petronas not in?

|

|

June 2nd, 2011 by financetwitter

|

|

|

|

|

|

|

Comments

The problem of finance articles is they are written by “finance people” who lacks technical knowledge in engineering, so they judge these companies’ efficiency solely by RM.

Technical wise, efficiency to the eye of TNB engineers as an example, involves numerous parameters for current, voltage, power, reactive power, volume, temperature, cost, time & etc.

To saythat TNB is inefficient due to rising staff cost is so unfair because their system minutes & SAIDI are significantly improving to the level that they’re one of the best in the world. These ‘system minutes’ & SAIDI are reliability indicators which tells us how often electricity users experience power interruption on average.

As an analogy, TNB is like a car which 5 years ago experienced breakdown about 9 times per year on average, now it only breaks 1 time per year. Obviously the car owner would have to spend more on his mechanics to conduct frequent maintenance. So does TNB, their excellent performance nowadays (engineering wise) definitely requires extra manpower which results in higher staff cost. But considering that their reliability record is at least 10 times better than before, are they still inefficient if we consider all factors?

Not entirely true. As far as TNB is concern you can only draw you conclusion that TNB milking Petronas if you can prove that it is TNB that keeps the dirty earned money.

Even from your article you should know that this is NOT the case for TNB. The article says that TNB enjoys RM 37.3 billion since 1997. It is 14 years by now right? The problem is the average TNB annual profit since 1997 at best is slightly above 2 billion/annum or RM24 billion in 14 years, i.e lower than the figure TNB milked Petronas. So where does the remaining RM 13.3 billion has gone?

Quite confusing right? Indeed you will be in the state of confusing if you don’t want to accept my explanation that it is the consumers & PROBABLY the IPPs that milk the Petronas. As far as TNB is concern with regard to Petrogas subsidized gas supply it is only as a milk dispatcher. Too bad you are accusing an honest dispatcher of stealing!

Anyway most of the facts mentioned by this article is valid.

hello patricia,

thanx for your commment …

maybe TNB can spend some time to look into why they need to dispatch a battalion of technicians to change a street light’s bulb, as a start?

cheers …

hello Namatimangan08,

http://www.thesundaily.my/news/226799

maybe you wanna spend some minutes to read what Chief Executive Officer Shamsul Azhar Abbas has to say?

cheers …

Very corrupted organization. If you need electriciry to connect to your house the TNB guy want you to go through their appointed agent and pay a certain amount of the so-called fees. Otherwise sorrylah.

PETRONAS says that they are selling the gas below market price to TNB, of coz they will suffer loss of profit from that, understandable. At the same time electricity tariff is being controlled by the government, so basically TNB also is forced to sell electricity at low profit? Then at the same time IPPs is sucking money out of TNB hence also out of PETRONAS. So if we get rid of IPPs will it help to solve the problem?

Hi, I’m currently a final year student and I’m doing a project titled: “The advancement of natural gas in Power Generation in Malaysia.” Would you mind helping me in my questions about the incline and decline trend of natural gas usage in power sector? Your help will be much appreciated! Thanks you..

I think you have overlooked how IPPs got a foot in the door.

The problem TNB experienced in 1992 was very probably pre-planned, allowing super crony YTL to build the first IPP at the site of an existing gas fired TNB station in Paka. You need to question why TNB was not allowed to expand Paka but the job given to YTL with a very lucrative PPA. It is inconceivable that TNB had not made any plans for capacity expansion at Paka and elsewhere but they needed approval from the government to proceed. Approval which were probably deliberately delayed or withheld to create a shortage.

You may also remember that as a result of the so-called problems in 1992, massively overpriced aero-derivative gas turbines which run on expensive diesel were air flown in by various assorted cronies at great expense and a lot of fanfare to “alleviate” the problem. It was cronydom all the way.

It should be noted that the YTL IPP was the only one to have a “take or pay” agreement with an excessively high energy price but no capacity charge. The other IPPs have a PPA consisting of a Capacity Charge and an Energy Charge. The Capacity Charge was highly inflated as it was based on an inflated project price (awarded to an associated crony company) allowing an extra killing at the front end. The Energy Charge was supposed to be a pass-through cost but they still made a bundle as the O&M portion was predicated on a very inefficient operator and any operator worth his salt would do it much cheaper and make a good profit.

The bottom line is, bolehman aka apanama is evil personified who facilitated profiteering by cronies at the expense of the whole nation.

I think ‘the real deal’ is absolutely correct. 1992 blackout was a conspiracy to pave the way for cronies’ IPPs whose profits are guaranteed, to this day. The greatest misfortune in bolehland is the sheer ignorance of millions of ppl. If u ask randomly anyone on the streets, 99% don’t even know what IPP stands for. I tried that many times & was rewarded with blank, dazed looks.

Problem with the internet is how fake analysts can put up graphs, charts and statistics to prove things, and when challenged will give links to interviews to prove their point. I suggest financetwitter try to understand infrastructure business and why it’s a natural monopoly the world over and why the UK experiment with open model is not working as intended. One finding from above writeup and comments is that I do agree that fat contracts were given out to supercronies. Why then is the conclusion that TNB is an inefficient organisation? Are you mixing up cause and correlation? No one is saying TNB is superclean but are your conclusions intended to say what was mentioned above? Have you taken care to be precise with your analysis, or are you letting confirmation biases clouding your conclusions, and then perpetuating allegations and insinuations about people of a certain race? Without facts and understanding, these sort of articles are just ‘feelgood’ about being armchair observers and chatting over your yamseng sessions.

Hi , there if its possible you could give me some related articles or fact sheets on all those things you have said above??