Ever since U.S. notorious subprime crisis in 2008, U.S. companies have been building cash as if there’s no tomorrow. Some even joke that U.S. will never have another similar subprime crisis again considering the gigantic amount of cash reserve these companies have. Besides financial institutions, U.S. companies are holding a staggering US$1.64 trillion at the end of 2013. That’s “trillion” not “billion, mind you, and that’s about 10% of U.S. national debt.

If that was not enough to raise eyebrows, the above figure is a 12% increase from a year ago – according to Moody’s Investors Service. As expected, companies leading the cash-rich list are none other than Apple Inc. (Nasdaq: AAPL, stock), Google Inc.’s (Nasdaq: GOOG, stock) and other technology stocks. In fact, technology companies have improved their cash to US$309 billion at the end of 2013 as compared to 2009 – a mind-boggling 53%.

That’s not surprising, considering Apple alone has a cash pile of US$158.8 billion at the end of 2013, not bad for a company that had only US$5.46 billion in 2004. The iPhone maker has so much money that it reinstated dividends in 2012, under heavy pressure from shareholders. But just exactly how much is US$159 billion that Apple is holding?

Considering U.S. total population of 317.8 million as of Apr-2014, Apple’s US$159 billion would make every single American about US$500 richer. And if the same amount of money were to be distributed to Malaysia’s total population of 30 million, each would be getting about US$5,290 (RM17,086). And based on today’s exchange rate, US$159 billion (RM512 billion) could wipe out Malaysian Government gross debt totalled RM501 billion as at end of 2012.

With about 82.3 million high school and college students in U.S., Apple could use its cash reserve to give away not one, but two iPad Air (128GB, WiFi) to every student and still have roughly US$18 billion in spare cash. However, the most mind-boggling fact about Apple’s huge cash reserve is this: the company has more cash than dozens of other global countries’ cash or foreign reserves.

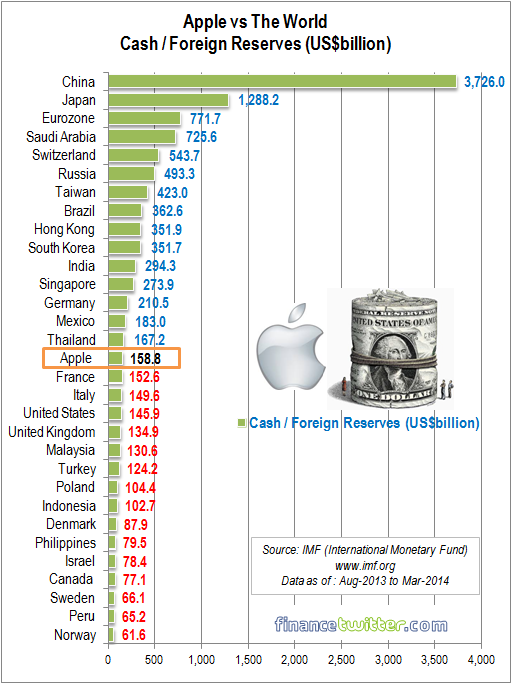

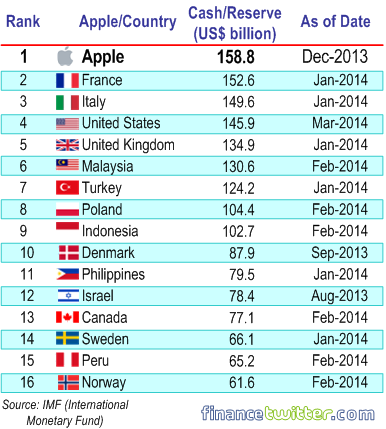

As a start, Apple’s cash reserve is more than France, Italy, Malaysia, United Kingdom, Turkey, Denmark, Canada and dozens more major economies around the world. Its US$159 billion is even more than United States’ own reserve of merely US$145.9 billion. Hence, if these countries are willing to be sold, Apple Inc. can actually buy some of them.

While Apple Inc’s own cash on hand is not enough to rival some giant economy powerhouse such as Brazil, Hong Kong, South Korea, India, Singapore, Germany, Mexico and Thailand, the company can gives these countries a run for their money if it join hands with Microsoft, Google, Verizon and Pfizer; with their combined cash of US$404 billion, at end of 2013.

With the exception of giant China’s foreign reserve of US$3.7 trilion, U.S. companies’ combined US$1.64 trillion in cash is more than any major countries on Earth. The second wealthiest nation in the world, Japan, has only US$1.2 trillion in its piggybank. Even Eurozone, Saudi Arabia and Switzerland have only US$771.7 billion, US$725.6 billion and US$543.7 billion respectively.

Other Articles That May Interest You …

- How To Save Money This Year – 15 Exciting Tips

- Here’s How To Tell If You’re A Samsung or Apple Fan

- iPad Mini, iPad 4, iMacs – Everything You Need to Know

- New iPad 3 (vs iPad 2) – 10 Things You Should Know

- How Much Is $500 Billion, Apple’s Total Value?

- U.S. Debt – How Much Does Each American Owe?

- Here’re 11 Amazing Hidden Messages On Dollar Bills

- Debts & Deficits – 21 Currencies That Have Gone Bust

- Top 20 Countries With Highest Proportion of Millionaires

|

|

April 9th, 2014 by financetwitter

|

|

|

|

|

|

|

With our system of education,what is a trillion? Pity, they don’t know what they don’t know.The thieves are laughing all the way to bank.