According to U.S. Treasury, major foreign holders of treasury securities amounted to a mind-boggling $4,478,000,000,000 (that’s about $4.5 trillion), as of July 2011, compared to $4.125 trillion registered a year ago in Jul 2010. Going by the rate the country is borrowing, the debts can only go one way – up. As of June, 2011, United States have borrowed and must pay back about $14.3 trillion in public debt. Out of the $14.3 trillion in public debt, about 31.4% or $4.5 trillion is held by foreign countries. So, theoretically, if all these countries start asking the economic power United States to pay the debts, the global economy will collapse simply because the U.S. will not be able to pay.

Technically, it is the U.S. government that owes the massive $4.5 trillion debt to other countries; from China, Japan, United Kingdom and Russia to Malaysia. However we know the government actually does not have money and that’s why you should know at the end of the day, the citizens, in this case the Americans would have to take the bill, one way or another. The fact is the U.S. is broke and there’s no easy and simple solution in solving the debt problem. And it seems the country is going to leave the debt as it is with a quick fix – money printing.

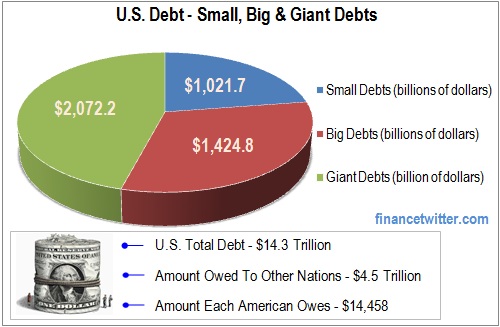

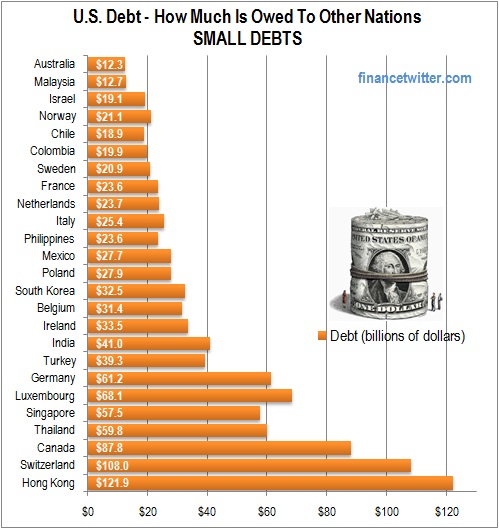

The economic powerhouse will keep printing money for as long as needed to gets the country functioning. Based on the statistics from the U.S. Treasury, the huge $4.5 trillion debt can be divided into three main categories – Small Debts, Big Debts and Giant Debts. Small Debts include countries such as financial centers Hong Kong, Switzerland and Singapore; European countries such as Germany, France, Sweden and Italy; Asia countries such as India, Thailand, South Korea and Malaysia. United States owes these small debts countries ranging from $120 billion to a mere $12 billion.

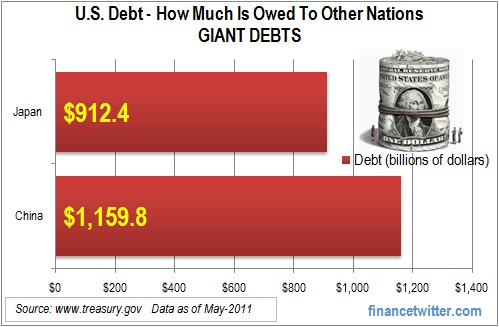

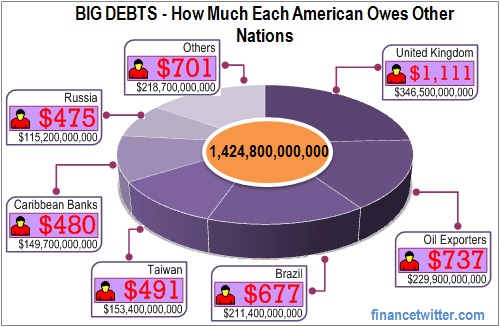

The next category – Big Debts countries such as the United Kingdom, Oil Exporters (inclusive of Ecuador, Venezuela, Indonesia, Bahrain, Iran, Iraq, Kuwait, Oman, Qatar,Saudi Arabia, the United Arab Emirates, Algeria, Gabon, Libya, and Nigeria), Brazil, Taiwan, Caribbean Banking Centers, Russia and Other Countries. These countries hold 50% more than what the small debts countries are holding in terms of the U.S. debt. And of course the Giant Debts countries, China and Japan, are holding about $2 trillion in U.S. treasury securities.

If the U.S. were to pay off the $4.5 trillion debt to these countries, each American needs to dig into their pocket for $14,458.00 to pay these nations with amount ranging from $39 to the Australian Government to $3,719 to the Chinese Government. Surely it would be super-fun watching these lenders queuing for their turn in getting their money from each of the U.S. citizen.

Other Articles That May Interest You …

- Here’re 11 Amazing Hidden Messages On Dollar Bills

- 15 World’s Biggest Gold Reserves Cheering Record Price

- Debts & Deficits – 21 Currencies That Have Gone Bust

- 7 Things That Would Happen If The USA Is Downgraded

- Top 20 Countries With Highest Proportion of Millionaires

- Just How Much Is $14.3 Trillion, US Debt Ceiling?

- The 10 Expensive Mistakes That You May Not Know

|

|

September 27th, 2011 by financetwitter

|

|

|

|

|

|

|

Comments

Wop sorry it 14.9t now will be 15t by next month

and the

Social Security + Medicaid + Medicare = are at 116T now 😉

So,

Foreign debt owed per person is US 14,500.

US GDP per person is US 56,500.

Furthermore, average wealth per person in USA

is US 301,000 based on the latest Credit Suisse Global Wealth report.

US net worth is US 84.9 T.

that is only the Veteran Benefits + Federal Employee Benefits + Federal Debt

the 14t

u forgot about the real BIG DEBT

the Social Security + Medicaid + Medicare = about 66t i think 😛