People make mistakes and some of them could be very costly. Some knew of the consequences but still the sex pleasures overrule everything. Many don’t really care because it was the public money. Some tried to cover their mistake but it got worsen and the hole got bigger. And of course some thought things can’t get so bad especially when you have unlimited control of nation’s coffers. But mistakes are unpredictable.

1) Tiger Woods Sex Affairs

World golfers and the public were shocked by Tiger Woods’s exposure in extramarital affairs at the end of 2009. It was not one, not two but with up to ten sex partners while Tiger Woods was still married to Elin Nordegren. At one time Tiger Woods and wife Elin Nordegren was reportedly to have hammered out a blockbuster divorce settlement that will net the ex-model $750 million, which translates to three-fourths of the golfer’s known $1 billion fortune.

Divorce Settlement in 2010: US$110 million. However indirect losses ranges from US$5 billion to US$12 billion in collective sponsorship from Nike, Gatorade, Gillete, Accenture etc.

2) Elderly woman’s hubby threw away lottery ticket

An elderly woman in central England said she thinks she may have had the winning Euromillions lottery ticket worth €129 million (US$181 million) – before her husband threw it away. Apparently she played the Euromillions and Thunderball lottery every week. Her husband however has the habit of taking her tickets away and never return it so she always write the numbers down.

After the ticket remained unclaimed for over a week, she checked her notepad and found the winning numbers – 09, 30, 35, 39, 46, and the Lucky Star numbers were 06 and 08.

3) Faulty equipment causes stealth bomber crash

An Air Force B-2 Stealth Bomber, U.S.’s most expensive jet, abruptly pitched up, rolled and yawn to the left before plunging to the ground at Andersen Air Force Base on the island of Guam. Apparently water distorted preflight readings in three of the plane’s 24 because the correct technique to evaporate moisture wasn’t applied, causing the plane to a stall and crash thereafter.

Loss in 2008: US$1.4 billion. Although the crew was able to safely eject, it was indeed a very expensive accident.

4) Rupert Mudoch’s Affair with Wendi Deng

After 32 years of marriage, Rupert and Anna Murdoch called it quits in 1999. But barely 17-days after the divorce was finalized in June 1999, the big boss of News Corp. media empire married 30-year-old Chinese-born Wendi Deng. Three years after their divorce, Anna broke her silence and claimed Rupert ruined the marriage by having an affair with his then-translator Deng.

Rupert Murdoch denied there was an affair between him and Wendi but the divorce settlement costs him a whopping US$1.7 billion.

5) Nuclear Meltdown at Three Mile Island due to Faulty Equipment

The Three Mile Island accident was a core meltdown in Unit 2, an accident that began on Mar 1979 with failures in the non-nuclear secondary system. The main feedwater pumps stopped running, caused by either a mechanical or electrical failure, which prevented the steam generators from removing heat. The mechanical failures were compounded by the initial failure of plant operators to recognize the situation as a loss-of-coolant-accident due to inadequate training and human factors.

Loss in 1979: US$836.9 million. Three Mile Island was the America’s worst nuclear accident although it didn’t cause any death.

6) Mr Copper Hamanaka corners copper market

Yasuo Hamanaka, popularly known as Mr Five Percent or Mr Copper, used Japanese trading company Sumitomo’s size and large cash reserves to both corner and squeeze (up to 5% of world’s traded copper) the market via the London Metal Exchange (LME), kept copper price artificially high for nearly a decade leading up to 1995. Hamanaka profited from the sale of Sumitomo’s physical coppers as well as commission on other copper transaction he handled.

The commodiies market changed in 1995, thanks to resurgence of mining in China. Increase supply caused a correction in copper prices and Hamanaka couldn’t fight the force of the market. Eventually Sumitomo reported a loss of US$1.8 billion on June 1996 in unauthorized copper trading by Hamanaka. By Sept 1996, Sumitomo disclosed losses of up to US$2.6 billion. Hamanaka was sentenced to seven years of jail.

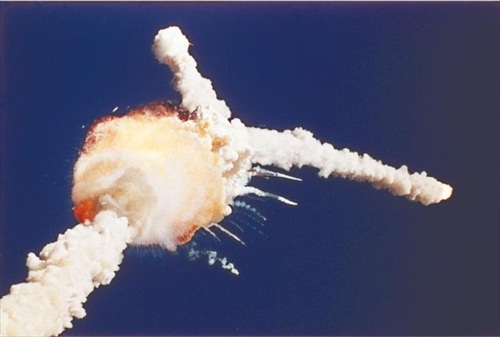

7) Space Shuttle Challenger explosion during liftoff

In Jan 1986, Space Shutte Challenger exploded after 73 seconds into its flight and all its seven crew members onboard died. Apparently the spacecraft disintegrated over the Atlantic ocean after an O-ring seal in its right solid rocket boosted failed at liftoff. The O-ring failure caused a breach in the SRB joint it sealed, allowing pressurized hot gas from within the solid rocket motor to reach the outside and impinge upon the adjacent SRB attachment hardware and external fuel tank.

Cost of replacing Challenger Space Shuttle in 1986: US$2 billion

8) Columbia crash during re-entry into Earth’s atmosphere

The disaster happened when space shuttle Columbia disintegrated over Texas during re-entry into the Earth’s atmospherein 2003, killing instantly all its seven crew members. The loss of Columbia was a result of damage sustained during launch when a piece of foam insulation the size of a small briefcase broke off from the space shuttle external tank. The debris struck the leading edge of the left wing, damaging the Shuttle’s thermal protection system (TPS), which shields it from heat generated with the atmosphere during re-entry.

Some engineers suspected damage, but NASAmanagers limited the investigation, on the grounds that little could be done even if problems were found. The lost in 2003: US$13 billion.

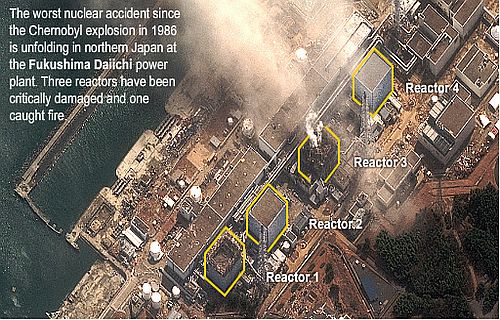

9) TEPCO ignore warnings Fukushima nuclear plant can’t withstand tsunami

Despite IEAE’s warning in Dec 2008 that a strong earthquakes would pose a serious problem to nuclear power plants, Japan authorities didn’t react to it. The Japanese government even overturn a court order to shutdown reactor that was vulnerable to earthquake. Worst still, TEPCO went to the extent of recycling nuclear fuel to maximize profits.

After the tsunami hit Japan and caused havoc to the Fukushima nuclear plant, operator TEPCO said the cost of the disaster would be around US$12 billion.

10) Malaysia’s failed bet in forex speculation

In the year 1992 – 1994 under Mahathir’s administration, Malaysia’s Central Bank was actively speculating foreign exchange. It was a known fact that the Central Bank was the biggest player in the forex. George Soros is known as “the Man Who Broke the Bank of England” after he made a reported $1 billion during the 1992 UK currency crisis. He bet Bank of England would not support the pound participation in the European Exchange Rate Mechanism indefinitely by jacking up interest rates in an economy already in recession. Malaysia’s Central Bank bet otherwise.

Despite the huge losses which occurred between 1992 and 1994, Nor Yakcop (was then the head of forex trading) together with his partners – the late Bank Negara (Central Bank) governor Jaffar Hussein and former Finance Minister Daim Zainuddin, no action was taken against either one of them. Total estimated losses: US$10 billion (RM30 billion)

Other Articles That May Interest You …

- 10 Sex Partners and Still Make Money – Tiger Woods

- Tiger’s Mistress Tells All – He Liked Three-Way Sex

- Japan’s Chernobyl – Greed For Profits Above Safety?

- Nuclear Fears Rips Global Stocks, Ain’t Over Yet

- Japan Tsunami’s Greatest Problem – Nuclear Meltdown

- Photo Galleries: The Day After Japan’s Tsunami

- Marcos, Mubarak & Mahathir – Who’s The Richest Man?

- Will Currency Speculators Attack Malaysia Next?

|

|

April 29th, 2011 by financetwitter

|

|

|

|

|

|

|

Put that in present value perspective 🙂 a whole new ranking