Investors make money by buy low sell high. Seems like an easy formula to become rich, no? People then ask when is the time to buy low or how do I know now is the time to buy? And that’s the mistake because people are obsessed with finding the Holy Grail – when to buy. Very few realize that the answer is actually “when to sell” that makes a trade either profitable or otherwise. And do you know why we behave in such a way? That’s because we were taught to “buy” instead of “sell” since childhood.

As strange as it may sound, as long as you sell at a higher price than your buying price, you make profit and if you were to repeat the process again and again, you’re on your way to riches (*really?*). That was how certain people (very few of them actually) make money trading either stocks, options, gold, oil, silver, currency etc with the guidance of support and resistance analysis. You don’t really need super complicated technical analysis to buy low and sell high. Does it work all the time? Of course not silly otherwise it won’t be fun anymore, would it (*grin*)?

Since the death of Osama bin Laden, the oil prices have somehow pullback. The US Energy Information Administration reported Wednesday the Crude Oil inventories rose 3.4 million barrels in the week ending April 27, almost 2 times analysts’ expectation. Supply increase pressured the markets and the WTI Crude Oil for June delivery fell below US$110 to US$109.24 per barrel. Disappointing job data also help to pull down the oil prices.

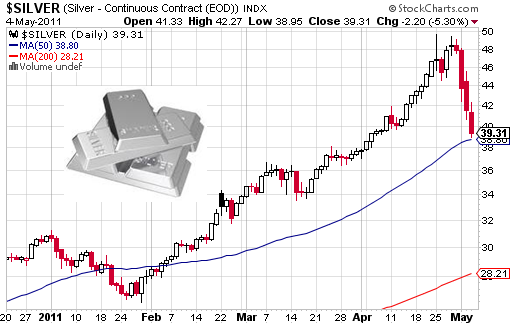

The excitement would nevertheless in the commodity particularly silver. Silver has been riding on Gold’s back and the news that speculator George Soros has been seller of gold and silver lately spook the commodity market. And now after a 20% decline in silver price, world’s richest man, Mexican billionaire Carlos Slim, is also selling silver futures. Of course those who bought silver in January are still in the profitable territory but you can bet that they’re equally nervous about the current fierce sell-off.

Gold contract for June delivery fell 25.1, or 1.6%, to US$1,515.3 oz. while Silver for July delivery fell 3.197, or 7.5% to US$39.388 oz. Of course gold’s demand is always greater than silver as gold is considered international currency. Silver is more of a speculative play. Did George Soros or Carlos Slim somehow knew the commodity bubble is about to burst hence the selling? Of course not. George Soros just thought that the gold and silver prices are already overbought hence the profit-taking, or at least that was what he wants people to think so.

Soros also knew that other players would most probably follow him once the news of him selling gold and silver is out hence the mini panic-selling. Heck, maybe it was a trap by the, you know who, to create panic-selling so that they can scoop dirt-cheap gold and silver in the process. Maybe Soros was selling the “paper” gold and silver but on the other hand buys physical gold. Anyhow since the Fed started buying Treasury bonds in the second round of its quantitative easing program, silver futures have risen 53%, crude oil 27% , coffee futures 42% and corn 23%.

As the QE2 comes to a soft landing, investors have to decide whether to cash out and take the money off the table or stay in the game and take whatever risks coming soon. Furthermore it’s “Sell in May and Go Away” month now. Now, didn’t I say investing and trading are so much fun?

Other Articles That May Interest You …

- Should You “Sell In May And Go Away” This Round?

- The 10 Expensive Mistakes That You May Not Know

- Ready for $100 Oil and $1,500 Gold for 2011?

- Gold Investing – Taking the Cue from Soros

- Richest Man on Earth – Financial or Political Genius?

|

|

May 5th, 2011 by financetwitter

|

|

|

|

|

|

|

[…] Silver Correction Or Speculation Trap By Soros? […]