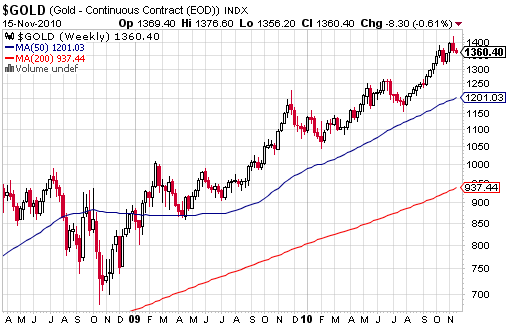

When I wrote about investing in gold back in May 2008, the metal was trading at about $920 – $930 (read here) and since then the gold price has skyrocket to above $1,400 – an increase of more than 50%. Assuming that I didn’t add more investment in gold, my primitive jewellery investment has suddenly increase in value by 50% and if you’ve done the same that’s an appreciation of 50% over 2 and a half years *grin*.

It wasn’t a very hard decision to make (investing in gold) though. The stock market was in really bad shape and the dollar was plunging. European Central Bank President, Jean-Claude Trichet and Warren Buffett warned that the credit crunch problem still persists. My favourite George Soros said in an interview with BBC Radio 4 that recession was almost a done deal. So it’s no-brainer that the next diversification investment instrument was GOLD.

The gold price has touched the $1,400 level but resistance seems to be strong beyond $1,420. According to recent 13F filings for the third quarter, it seems George Soros, who’s described gold’s surge as the “ultimate asset bubble,” has taken some money off the table when he dumped 547,689 shares of the SPDR Gold Shares (GLD) reducing his position to 4.7 million shares, making him the eighth largest holder from the seventh.

Soros, who made $1 billion breaking the Bank of England’s defense of the pound in 1992, described gold as a bubble in January, and said buying at the start of one is rational. He cut the SPDR Gold stake by 24 percent since Dec. 31. Meanwhile his rival Paulson & Co. maintained its 31.5 million SPDR Gold Trust shares, or 7.4% of the U.S. exchange- traded fund, as of Sept. 30. SPDR Gold Trust remained Paulson & Co.’s top holding as of the end of September, valued at about $4 billion.

Before the sales, Soros Fund Management’s holding in SPDR Gold Trust shares reached 6.2 million as of Dec. 31, 2009, according to an earlier 13F filing. With sales over the past three quarters, that’s been reduced by 24 percent – still the largest single holding by Soros Fund. Although Soros called gold the ultimate bubble, he maintains the metal rally may continue but he also recognize gold investment is not safe and just like any other investments, the rally won’t last forever hence the profit-taking. So are you taking this cue from billionaire George Soros?

Other Articles That May Interest You …

- Can the Stocks Cross the River of 11,000 Today?

- The Worst is Not Over Yet but We Can Survive, only if …

- Ahoy there, Dow is sinking below 7,000-level

- Soros, Buffett and Trichet said It Ain’t Over Yet

|

|

November 17th, 2010 by financetwitter

|

|

|

|

|

|

|

damn boring blog, no update for so long. might as well close it down 🙂