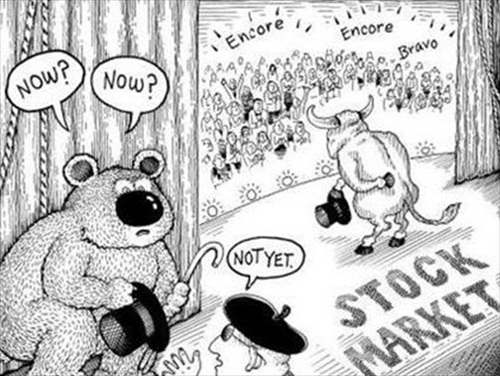

As we enter the month of May (2011), we’re once again greeted with the question of whether we should “Sell in May and Go Away”. With earnings season coming to an end, investors will shift their focus to economic data next week such as the April employment report on Friday as investors will scrutinize the jobs data for signs of improvement in the labour market. Obviously the overbought signs are everywhere but it’s kinda tricky especially after the S&P broke well above the 1,340 range.

The market wisdom has it that stock market returns during the period May-October are generally negative or lower than the short-term interest rate. The period from November-April meanwhile register stronger growth than the other months. The reason behind the trend – most investors leave for summer vacation hence trim their positions and in the process, gains from the stock market slowly evaporating. Normally the recommendations was to turn your stocks to cash or short-term treasurys until the selling subsides.

Since 1950, the Dow Jones average has produced an average gain of 7.4% from November through April and merely 0.4% from May through October. So an investor who invested $10,000 into the Dow during the “best” six-month period (November through April) and switched to bonds during the “worst” six months in every year since 1950 would have posted a return of $527,388 (*whoa*). Applying the same approach to the S&P 500 – returns from Nov-Apr have beaten May-Oct 71% of the time datng back to 1945.

Coincidently (really?) the stock market crashes of 1929, 1987 and 2008 occured between the period May to October. Interestingly this philosophy of “Sell in May and Go Away” works particularly well with the European indexes than the U.S. indexes. On the paper, you wouldn’t want to do otherwise but to stick with the majority investors. Spain would be joining Portugal, Greece and Ireland seeking bailout. Libya’s crisis would only get worse with protests going on in Yemen, Oman, Bahrain, Pakistan and whatnot. Nigeria is toying with the idea of postponing the May election.

Oil and gas prices skyrocket as if there’s no tomorrow and with the year low consumer snetiment, U.S. stocks will definitely make a pullback especially when the QE2 ends in June, unless of course it gets an extended lifeline. So shall you sell in accordance to the proven record? Absolutely, why not since you still can make money trading or betting the opposite way? Having said that, it’s wise to keep track on the market pulses, just in case the reverse happens.

Other Articles That May Interest You …

- Nuclear Fears Rips Global Stocks, Ain’t Over Yet

- How Obama Wish the China’s Economy Is at His Backyard

- 7 Things about Investing Stocks in October You Should Know

- Top 20 Stocks with Good Dividend Yield

- US Home Sales Plunged 27.2%, The Worst Just Started?

|

|

May 2nd, 2011 by financetwitter

|

|

|

|

|

|

|

[…] Should You “Sell In May And Go Away” This Round? […]