Federal Reserve chief Alan Greenspan was right when he said the “most effective” economic stimulus is rising stock prices, instead of government spending. The stock market is indeed a barometer of how the average-Joes feel. But the stock market bull has to be as genuine as possible, meaning the so-called index rising was not due to artificial push-up by invincible government hands on index-linked stocks.

So far the Dow Jones performance for the month of September is the best since 1954. The Standard & Poor’s 500 up 9.5% since August and the percentage of bullishness amongst investors have gone up. However according to Investment Company Institute said retail investors have pulled cash out of stock funds all three weeks in September to the tune of US$13.8 billion.

For a continuous bull market the participation of retail investors is of paramount important and there’s no two way about it. Certain governments who own significant stakes in index-related stocks have played the game of buying and selling the same stocks creating an artificial volume of demand and hence attracted retail investors. But sooner or later these retail investors would realize that it was a trap and would exit the stock market for a very long time.

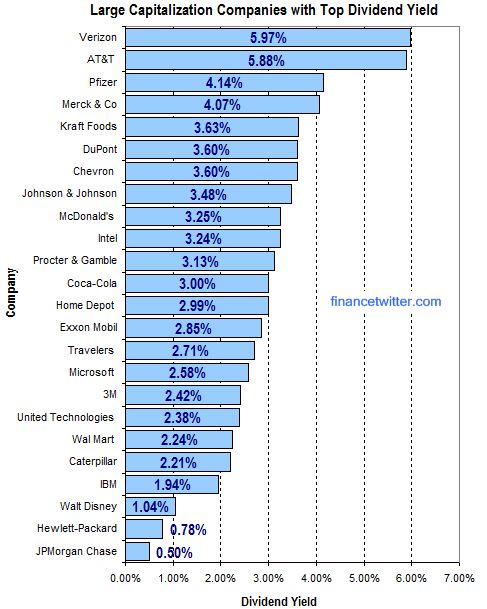

Even punters could not survive a market without retail investors simply because the market makers (in this case the government) would take the money off the table the moment the profits appear. Thus retail investors who still like to park their money in the stock market would do so investing good dividend yield stocks. And it’s not that difficult filtering stock that provides such dividends.

The best strategy to ensure your money continues to work for you during bearish market or gloomy economic climate is always to invest in defensive stocks that provide decent dividend yield.

|

|

September 27th, 2010 by financetwitter

|

|

|

|

|

|

|

what? GE is not in the list?