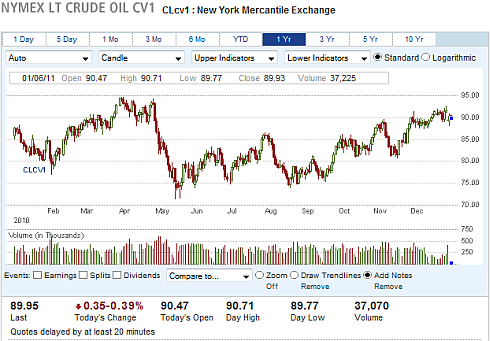

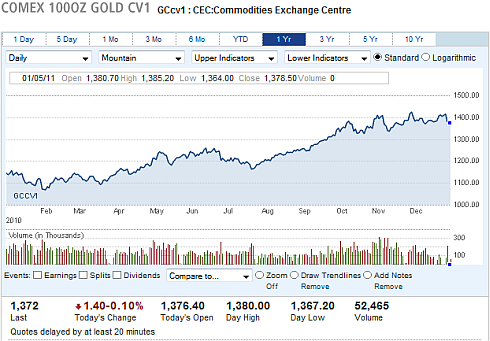

Commodity prices had performed superbly 2010 and experts believe the bullish momentum would continue this year, 2011. Oil prices rose 15% and gold gained 30% in 2010. According to survey, investment strategists from Goldman Sachs, Jefferies & Co., Wells Fargo and other investment houses are predicting two main commodities namely oil and gold to rise 4% and 1% respectively by end of 2011.

As U.S. dollar under pressure, those who were investing gold should remember the almost daily records made by gold in 2010. It was usual that investors would flock to gold when dollar and economy were struggling to stay afloat. Although I wish the gold price would continue its spectacular climb in 2011, it seems the dollar and U.S. economy may strengthen and the gold price would stabilize.

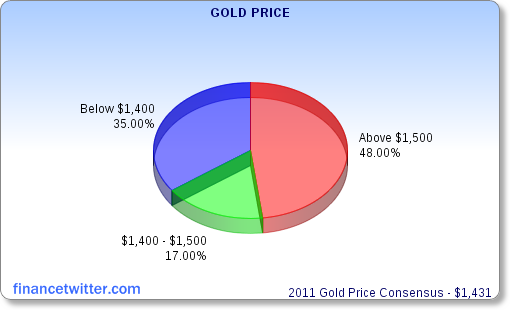

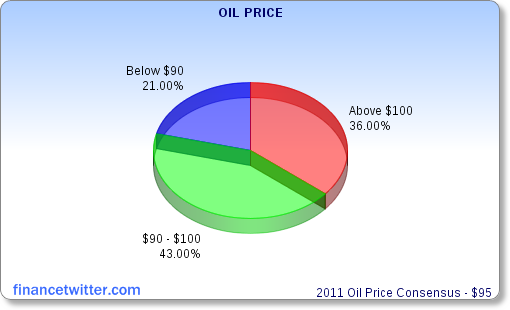

In fact, if the consensus of oil and gold prices in 2011 is correct, the U.S. economy would do better than the previous year. Hence analysts are rather bullish about black-gold than yellow-gold. About 36% of the survey respondents predict the crude-oil will hit $100 or more by end of 2011 while about 48% of those surveyed think gold will rise to $1,500 an ounce or more by end of this year.

As expected, the hunger for the commodities would come from China and India. As emerging markets continue to grow and build more roads, highways and other infrastructure, the demand for oil and refined products will rise. Middle-class will get wealthier and naturally gold become their investment or collection.

After 10 consecutive years of shooting north from $300 to $1,400 an ounce, many analysts think it’s time for gold to take a rest Another minor factor that will continue to become the pillar of support for oil and gold prices are the dollar which was predicted to remain weak.

However between the two, oil price is more volatile and fluctuates wildly almost daily. The motor gasoline consumption of oil in U.S. is pretty stagnant – 2009’s total 3.283 billion barrels compared to 2007’s 3.389 billion barrels. U.S. weak economy and high unemployment may keep many from driving to work or vacations which in turn will keep oil price from skyrocket crazily as seen in 2008 when the black-gold hit $145 a barrel.

Other Articles That May Interest You …

- How Obama Wish the China’s Economy Is at His Backyard

- Gold Investing – Taking the Cue from Soros

- Wake-up, Prepare Your Kids for China

- A Second Round of Recession or Major Correction?

|

|

January 6th, 2011 by financetwitter

|

|

|

|

|

|

|

[…] Ready for $100 Oil and $1,500 Gold for 2011? […]