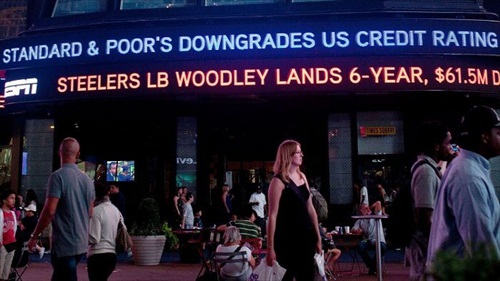

The U.S. stock market joined a sell-off around the world today (Monday) in the first trading since Standard & Poor’s downgraded American debt by one notch – from AAA, the highest rating, to AA+. The Dow Jones industrial average fell more than 250 points minutes after the opening bell on Wall Street. As expected the Treasury market didn’t appear to be affected by the downgrade except for equity market. Earlier, Asian equities were all trading down, with markets seeing losses from 2% to as much as 7% for the KOSPI.

As we speak, officials at Standard & Poor’ downgraded the credit ratings of Fannie Mae and Freddie Mac and other agencies linked to long-term U.S. debt. According to S&P’s calculations, the total U.S. public debt, which includes local, state and federal government debt, will be $11 trillion this year, and will rise to $14 trillion in 2015 and to $20 trillion by 2021. However, Treasury Secretary Timothy Geithner ripped Standard & Poor’s saying the stunning move was based on a “lack of knowledge” about the nation’s finances. Yet even as he criticized S&P he acknowledged that public finances are in poor condition.

Investors are adopting “sell first, ask questions later” attitude as Standard & Poor hinted it may downgrade the long-term credit rating of the U.S. once again in less than 3 months. Hence, economists are getting ready for another round of similar downgrade – from AA+ to AA by November or December. While many were upset with the downgrade, the fact remains that the U.S. doesn’t deserve a AAA credit rating in the first place for the simple fact that the country was unlikely to be able to pay off its debt. Heck, an investor, Jim Rogers, claimed the U.S. doesn’t even deserve the AA+, let alone the original AAA.

In reality, Standard & Poor’s rating cut had come too late and should have happened long ago. It was long overdue and when the rating was cut, everybody seems to be unable to accept the fact and thus the bitching, crying and screaming (at Standard & Poor) but the music has to stop somewhere, somehow. It’s amusing how a few hours after the downgrade, the Fed and FDIC announced that AA+ US debt is as good as AAA, and thus banks’ reserve requirements will not change and bank lending should not change either.

Everytime S&P downgrades a AAA rated country, it’s taken about 10 years for that country to get back to a AAA rating again, and it’s that serious. But why blamed Standard & Poor when the U.S. government didn’t show any urgency especially on the debt ceiling – instead lawmakers waited till last minute for a settlement. Even the, the Republicans and Democrats had only been able to agree “relatively modest savings”, which fell “well short” of what had been envisaged by Standard & Poor earlier.

You know what, for all you know, those who were crying about the rating cut didn’t actually care about the consequences but rather the “losing face” because this was the first time the U.S. was downgraded since it first received a triple-AAA rating from Moody’s in 1917. As much as Obama administration tries to beat around the bush, this debt downgrade is a symbolic embarrassment to his administration, not to mention the increase in difficulty in combating the economic problem since this could raise the cost of US government borrowing.

Well, looking back, if Treasury Secretary Timothy Geithner was adamant that there’s no risk the U.S. would never meet its obligations, which is true, then why foam at mouth with the latest rating cut? He should just smile and tell the whole world that the latest cut was just a ceremonial event since the U.S. cost of borrowing is unlikely to increase, at least not now, thanks to PIIGS (Portugal, Italy, Ireland, Greece, and Spain) that are rampaging through Europe right now. After all, this rating cut is just a emotional thing so it’s business as usual.

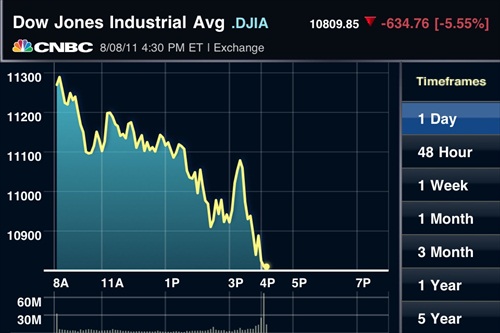

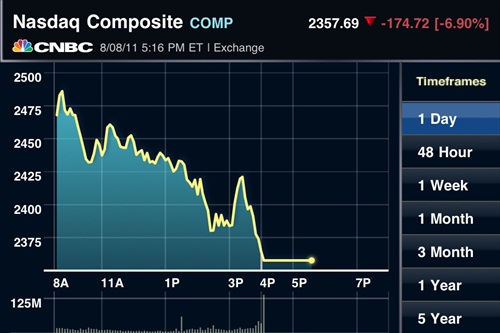

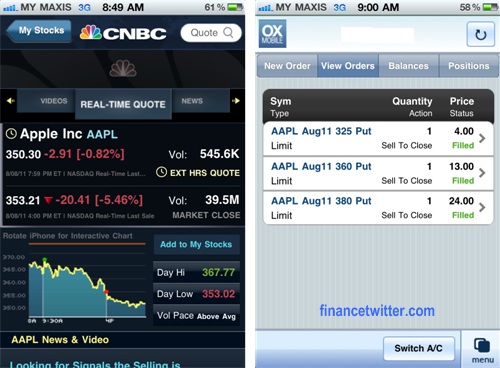

My position got triggered after hit my sell-limit – as the market was getting too hot to handle, I decided to use trading-limit and closed the session (and do something else) as fear and greed was slowly but surely taking control of me. I was surprise when I saw the Dow tumbled 634.76 points (or 5.5%) while Nasdaq slumped 174.72 points (or 6.90%) and S&P dropped 79.92 points (or 6.66%) after closing bell, though I’m not complaining (*grin*) with my 228% profit on AAPL Aug11 380 Put Option. Heck, even the AAPL Aug11 360 Put Option I bought last Friday made a cool 125% profit. Of course, I didn’t expect Dow and hence AAPL to drop so much by the end of the day so there’s no reason for kicking myself for making less $700 bucks – you can sell at the highest.

As I’ve mentioned many time, you’ll make very fast and huge money during bear than when you do during bull market. Now, that the Dow is nearing the 10,600 support level, there should be a rebound Tuesday, otherwise it would be a very bad bad situation. Either way, I still can open new position(s). Don’t you love bear market especially in such a panic selling situation?

Other Articles That May Interest You …

- Debts & Deficits – 21 Currencies That Have Gone Bust

- Welcome To Chaos, Welcome To Panic Selling

- 7 Things That Would Happen If The USA Is Downgraded

- Just How Much Is $14.3 Trillion, US Debt Ceiling?

- Should You “Sell In May And Go Away” This Round?

- The 10 Expensive Mistakes That You May Not Know

- China To Become New Economic Powerhouse in 2016?

- The Junk US Dollar Skyrockets but whose fault is it?

|

|

August 9th, 2011 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply