Chaos ruled the trading floor when investors sold their stocks in a big wave triggering what appears to be the worst stock-market selloff since the middle of financial crisis in early 2009. Both Dow Jones and S&P-500 dropped more than 4% while the Nasdaq lost 5% on fear that the still-trying-to-recover United States may hit another round of recession. Two-year Treasury yields fell to a record low while analysts predicted further losses even though stocks have fallen on nine of the last 10 days.

It was indeed a panic day when investors sold their stocks and fled into the relative safety of Treasuries, the Swiss franc and yen. The slide in the S&P 500 drove up the cost of using options to insure against further declines by the most since February 2007 when the VIX (Chicago Board Options Exchange Volatility Index) jumped 35% to a 13-month high of 31.66. If you think it was a gloomy day, wait till you see the market reaction if tomorrow’s payroll shows another disappointment – analysts are expecting Commerce Department to show U.S. employers added 85,000 jobs in July.

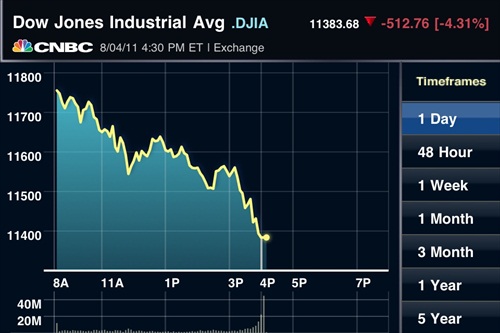

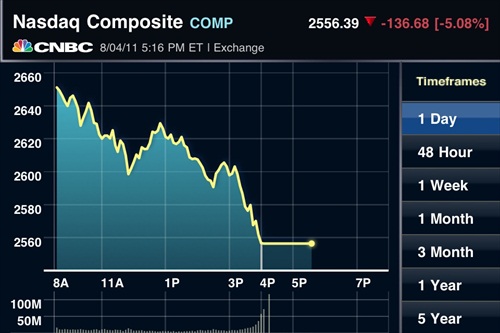

The sight of Dow plunged 512.76 points (or 4.31% to 11,383.68), Nasdaq tumbled 136.68 points (or 5.08% to 2,556.39) and S&P dropped 60.27 points (or 4.78% to 1,200.07) is rare after the United States got out of the 2008 subprime crisis which triggered global recession. Interestingly, while it was a panic day, the selloff was in orderly manner with huge volume (14 billion shares) and volatility. Just how bad it was – how about 850 stocks triggered short-sale circuit breakers after declining at least 10% from their closing price yesterday?

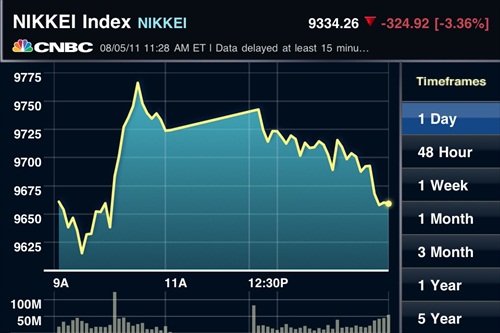

Speculation the Federal Reserve will start a third round of quantitative easing, or “QE3,” is increasing after U.S. data in the past week showed manufacturing grew at the weakest pace in two years, spending unexpectedly fell and service industries grew at the slowest pace since February 2010. The panic spills over into Asia when Japanese, Australian and Korean stocks dropped about 2% right after the opening bell and later to 4% of losses. Hong Kong and Singapore dropped by 4.5% and 3.6% respectively while London FTSE tumbled 3.43%, Frankfurt DAX plunged 3.4% and France CAC dropped 3.9%.

Now, the question is how much more will Dow drop? According to the technical charts, it seems the Dow could drop another 700 points before finding its support. If you read the head and shoulder pattern in the Dow Jones, the downside target is around 10,600. As for Nasdaq, it could hit 2,300, another 250 points to go (down). Obviously, Friday will be another gloomy day considering it’s the last day of the week.

While the stocks were sold systematically, something weird happens when Bank of New York Mellon, the largest custodial bank in the U.S., announced that it would start charging customers with balances over $50 million, when it fact the bank should pay interest on cash deposits. Bank of New York says it will charge 0.13% on accounts with an average monthly balance of more than $50 million. This means the banks believe people are willing to lost money to stay out of other financial instruments such as stocks.

Other Articles That May Interest You …

- 7 Things That Would Happen If The USA Is Downgraded

- Just How Much Is $14.3 Trillion, US Debt Ceiling?

- Should You “Sell In May And Go Away” This Round?

- Top 20 Stocks with Good Dividend Yield

- How Obama Wish the China’s Economy Is at His Backyard

- Wake-up, Prepare Your Kids for China

- US Home Sales Plunged 27.2%, The Worst Just Started?

- A Second Round of Recession or Major Correction?

|

|

August 5th, 2011 by financetwitter

|

|

|

|

|

|

|

[…] Welcome To Chaos, Welcome To Panic Selling […]