Oil prices, both Brent and WTI, are above US$30 a barrel today. The price fluctuations, nevertheless, have been extremely volatile. Thankfully it hasn’t breached below US$20 a barrel. It would be a total chaos if the price goes below that level. But shall we conclude the worst is over on oil apocalypse? Not so fast.

The only reason why oil prices have turned to what seems to be bullish now is laughable though. Saudi Arabia and Russia, apparently, have reportedly agreed about “freezing” oil production. It was all about freezing and not “cutting” output and speculators have started going bonkers about recovery, therefore sending oil prices north.

First of all, it wasn’t a deal between OPEC and Russia or non-OPEC at all. Heck, the deal, if you can call it a “deal” in the first place, was nothing but a sketchy plan. But Saudi and Russia didn’t need to make a formal agreement about the so-called deal. What they need to do was to “verbally” say they agree that oil production should be frozen, and voila, oil prices skyrocket.

Until OPEC meets in June, everything is nothing but pure rumours, speculations, plans and whatnot that could change anytime. One has to remember how Saudi Arabia stubbornly refuses to cut production when the free fall started about 1½ year ago. It didn’t care to do so when oil price plunged from US$110 a barrel to US$28 a barrel. So why should it cut now?

Considering Saudi still possesses US$608 billion of foreign reserves (Dec 2015), why should the arrogant kingdom lose face by freezing on output, let alone cutting production when the U.S. shale oil producers are still alive and kicking? Make no mistake about it. Saudi is not about to be insulted with a defeat by cutting output.

But even if Saudi and Russia agree to an output freeze, the market is still flooded with oil surplus. As of January 2016’s output record, Russia was pumping at a post-Soviet Union high of about 10.8 million barrels a day while Saudi Arabia was producing about 10.2 million barrels a day. Iraq volumes reached a record of 4.35 million barrels a day.

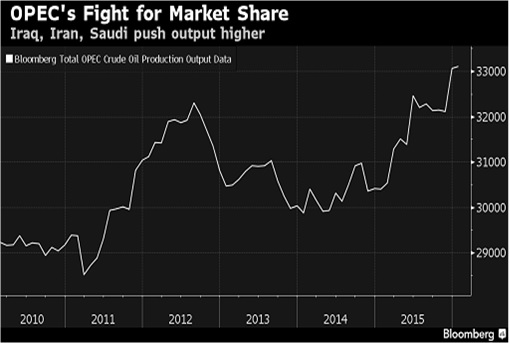

According to data from IEA (International Energy Agency), production from OPEC’s 13 members climbed by 280,000 to 32.63 million barrels a day last month. In fact, IEA estimated that supply may exceed consumption by an average of 1.75 million barrels a day in the first half of 2016. Clearly a production cut, not freeze, is required here.

Iran has promised to bring back 500,000 barrels a day to the market immediately and 500,000 barrels later on. Rough figures show Iran may have delivered 280,000 to 300,000 a day from floating storage, for now. Iranian Oil Minister Bijan Zanganeh met with ministers from Venezuela, Qatar and Iraq on Wednesday but he did not confirm the country would freeze production.

With Saudi-Iran conflict in place, there’s no reason why Iran should follow instruction for an output freeze. Even if Iran agrees to, take that with a pinch of salt because this is the time to recapture its market share it had lost during economic sanction. As a matter of fact, the oil production freeze deal between Saudi and Russia could very well end up as another empty promise too.

After all, Russia had promised but didn’t honour deals of similar nature in the 1990s and the latest in 2001. Dennis Gartman, founder and publisher of “The Gartman Letter” said – “One thing you should know about OPEC is they cheat. They cheat on everything. Even if they had announced a production cut, nobody would have taken it seriously”.

Okay, let’s assume for some miracles Russia and OPEC do freeze their output. The real problem is still there – China. The latest indicator from Japan shows the country’s annual exports in January 2016 fell the most since the 2008 global financial crisis, thanks to weakened demand from China and other major export destinations.

Japan’s Ministry of Finance data showed exports fell 12.9% year-on-year in January 2016 versus market estimate for an 11.3% drop. This is the country’s fourth straight month of declines. Japanese exports to China alone, its biggest trading partner, fell 17.5% from a year earlier – dragged down by steel and oil products.

Just like European Central Bank, Japan joined the club when it adopted negative interest rates since 29 January, 2016. What this means is the Europe and Japan is now running out of tools to simulate their stagnant economies. Therefore, don’t bother about any news on oil production freeze. It can’t genuinely push up oil prices.

Other Articles That May Interest You …

- 1 Salmon For 1 Barrel Of Oil, Anyone?

- Soros – We’re About To See Something That Hasn’t Happened in “80 Years”

- China Declares 6.9% Growth But Analysts Predict A Financial “Ice Age”

- Forget $1 Gasoline, It’s Happening — 46-Cents A Gallon In Michigan

- Cheaper Than Water – This British Bank Thinks Oil Would Go To $10 / Barrel

- China (Secretly) “Devalues” Yuan – Global Recession Is Calling

- Meet United States – The World’s Latest Oil Exporter – After 40 Years

- The Glory Days Are Over – OPEC Warlord Saudi Has Started Borrowing

|

|

February 18th, 2016 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply