Saudi Arabia is starting to learn the real meaning of “what goes around, comes around”. It’s a public knowledge that Saudi Arabia had funded the 9/11 attacks, and they were pretty happy about their ability in creating havoc against the world’s superpower. Unfortunately they couldn’t control and contain the monster that they’ve created.

What did mommy say about not playing with fire at home? Terror group al-Qaeda, funded by Saudi to the tune of billions of dollars, soon saw the emergence of ISIS, a subsidiary of al-Qaeda based in Iraq. This split group has been growing in strength and has even carried attacks inside Saudi Arabia’s perimeter, and all hell breaks loose.

Today, not only the Saudi royal family is leading the Sunni cause against a resurgent Iran, the kingdom is also fighting another war against ISIS. According to U.S. CIA, the Saudis are having a very serious problem because the Iranian proxies are running Yemen, Syria, Iraq and Lebanon. The new King Salman has launched a costly war against the Houthis in Yemen.

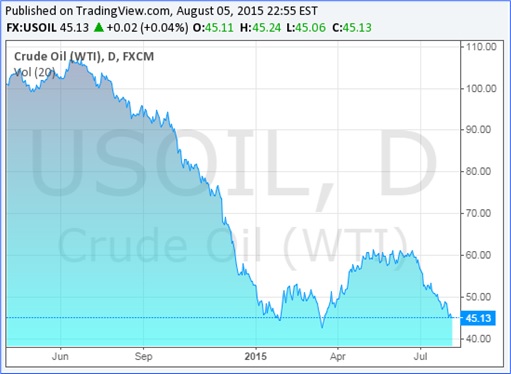

As we speak, the crude oil (WTI) price is tumbling to US$45.15 a barrel. If you think the Saudi would have been more prudent with its spending after the commodity took a plunge from its US$100 a barrel about a year ago, think again. King Salman couldn’t care less and had actually given away US$32 billion in a coronation bonus for all workers and pensioners.

Saudi citizens pay zero tax on income, interest or stock dividends, not to mention pay a negligible US$0.12 a litre at petrol stations. Electricity is literally free at US$0.013 a kilowatt. While the citizens have every reason to smile, the same cannot be said about the country’s coffer.

Arrogantly, the Saudis took a huge gamble last November when they stopped supporting prices and opted instead to flood the market with cheap oil and drive out (American) rivals, boosting their own output to 10.6 million barrels a day. The mission – to choke the U.S. shale industry and run them down.

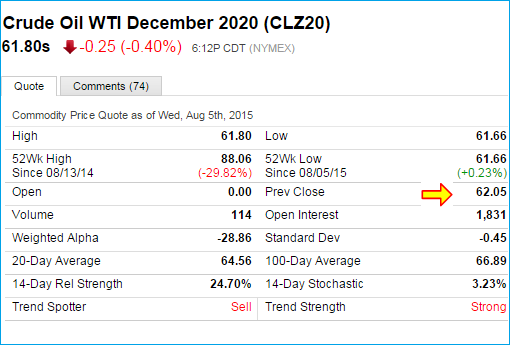

It doesn’t work too well, if the oil futures market is any indicator. No rocket science here. The contract price of U.S. crude oil for delivery in December 2020 is currently US$62.05. Clearly nobody is anticipating the black gold would return to its former glory days of US$100 a barrel, at least for the next 5-years.

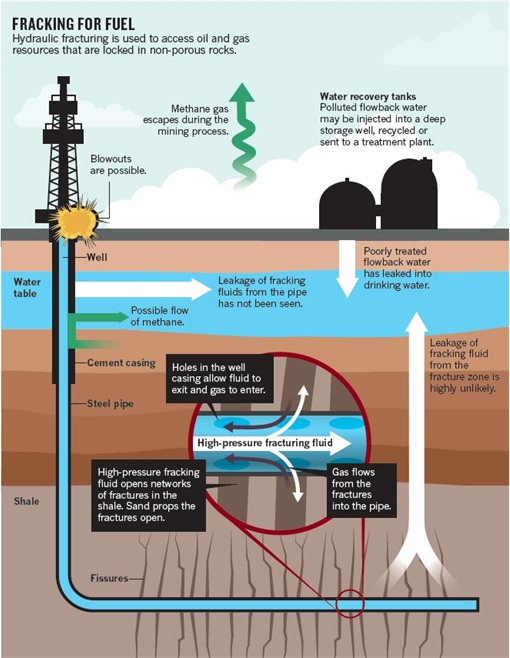

Saudi has single-handedly caused the oil price to crash, which means any high-cost ventures are not viable now. Consultants Wood Mackenzie claim that the major oil and gas companies have shelved 46 large projects, deferring US$200 billion of investments. Saudi couldn’t or pretended not to accept the fact that U.S. shale frackers are not high-cost business.

Advanced pad drilling techniques allow U.S. frackers to launch five or ten wells in different directions from the same site. If that was not bad enough, John Hess, head of the Hess Corporation has claimed that they’ve driven down drilling costs by 50%, and foresee another 30% ahead.

Scott Sheffield, head of Pioneer Natural Resources, happily pronounced that they have just drilled an 18,000-ft well in 16-days in the Permian Basin, when it took them 30-days last year. Sure, the North American rig-count has dropped to 664 from 1,608 in October but output still rose to a 43-year high of 9.6 million barrels a day in June (*grin*).

Saudi Arabia relies on oil for 90% of its budget revenues. After the governor of the Saudi Arabian Monetary Agency admitted last month that Riyadh had already issued its first US$4 billion in local bonds, the first sovereign issuance since 2007, the supposedly wealthy kingdom plans to raise US$27 billion in bond issues by the end of the year.

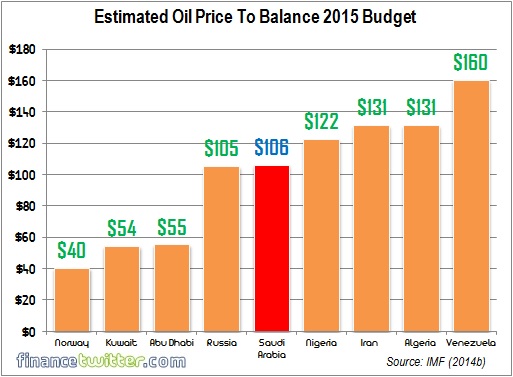

They can play dumb but the fact remains that King Salman requires an oil price of US$105 a barrel to balance its budget. Since the oil plunge began last June, the kingdom has drained a whopping US$65 billion of its reserve to maintain government expenditure. Now, it has US$672 billion in foreign reserves, down from their peak of US$737 billion in August 2014.

At the present prices, Saudi is burning US$12 billion a month. So, it’s possible that the Kingdom of Saudi Arabia may go broke in less than 5-years, before the U.S. oil industry collapse in totality. But with its military spending (they’ve even given away free US$700 million to Malaysian PM Najib), their reserves may be down to US$200 billion by 2018, or earlier.

The Saudis are now in deep shit. They cannot possibly win this war against U.S. shale frackers. Even if these frackers go bust, it would be temporary because the technology and infrastructure are still there. Once oil climbs back to US$60 or even US$55, they would be back pumping almost instantly. The glory days are over for Saudi Arabia.

Other Articles That May Interest You …

- So, They’re Spinning A New Tale: RM2.62 Billion For Fighting Terror?

- Nuclear Deal – The Secret Reason Behind Giving Iran “A License To Kill”

- Saudi’s Past Arrogance & Terrorists Funding – Is This Karma?

- Meet World’s Biggest Hotel “Abraj Kudai” – 10,000 Rooms, 12 Towers, 4 Helipads

- Saudi King Abdullah Dies, Queen Elizabeth Now World’s Oldest Monarch

- The Answer To ISIS Invasion Threat – The Great Wall Of Saudi

- Victory For Women In Saudi Arabia – They Can Now Drive But …

- World’s Tallest Building In Saudi Arabia, Kingdom Tower

|

|

August 6th, 2015 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply