He’s worth a staggering US$24.5 billion (£17.23 billion; RM106.37 billion) based on Forbes’ estimation. He survived the Nazi-occupation of Hungary and fled the regime as a refugee for 15-years hence he has a soft spot for refugees currently flocking to the European Union. He worked as a railway porter and waiter in London before becoming the world’s richest hedge fund manager.

Famed for making a billion dollars by “breaking” the Bank of England in 1992, 85-year-old George Soros is in a semi-retirement. Ranked #16 in the Forbes 400, the billionaire doesn’t like presidential candidate Donald Trump for suggesting the closure of U.S. borders to Muslims. But then what do you expect from a Democrats fanatic?

However, when the billionaire starts talking about financial issues, one cannot help but to listen. So, what does George Soros think about the present financial chaos? During the World Economic Forum in Davos, Switzerland, on Thursday, he made full use of the 45-minute interview with Bloomberg to share his opinions.

In a nutshell, Soros is very bearish this year and warned that the global financial markets are seeing the repeat of 2008 Crisis. The root cause of the problems is different though. In 2008, it was the subprime crisis in America. In 2016, it’s the deflation crisis in China. But this year would be particularly worse than 2008 because there’re two additional problems.

Adding fuel to the China’s deflation problem are the plunging oil and other commodities’ prices, as well as currency devaluation. So, you have three major root causes destroying the global financial markets this year. As a currency speculator himself, Soros specifically takes issue with China’s currency devaluation attempts.

Although he believes China can manage its present financial meltdown due to the country’s deep pocket of US$3 trillion in foreign reserves, Beijing cannot avoid the eventuality – a hard landing for its economy. The founder of Soros Fund Management claims he has been observing China and concluded its slowdown has “spillover effects” on the rest of the world.

Soros declared he shorted the S&P 500 and his tip to investors is this – now is “NOT” the time to buy. Instead, now is the time for you to sell. What this means is you should look at any technical rebound as an opportunity to sell, before it’s too late. He also revealed he started the New Year 2016 by shorting the currencies of commodity producing countries, especially Asian currencies (read: Malaysia Ringgit).

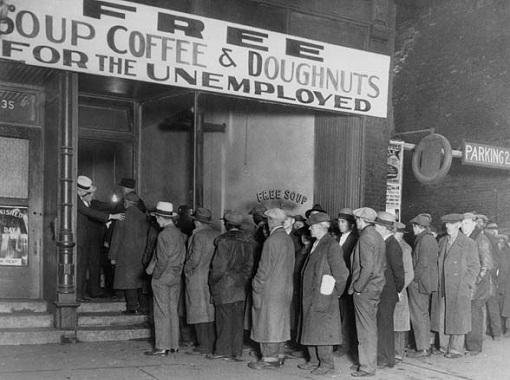

At the same time, Soros long U.S. Treasuries, readying for weaker-than-expected growth. He said that it has been 80 years since the world last faced deflation – the 1929-1930 Great Depression. And the Chinese situation today would create a “global deflation” that nobody knows how to handle or fix it.

Russia is clearly in a very weak position, says Soros, due to plunging crude oil prices. But he thinks Russia has enough reserves to last “a couple of years”. While he believes QE (quantitative easing) has saved U.S. and the world from deflation and a “Great Depression” similar to 1929-1930, he criticised Federal Reserve Janet Yellen for raising interest rate too late.

Despite being a refugee apologist, Soros admitted the European Union is on the “verge of collapse” over the migrant crisis. “We have reached a tipping point where the influx reduces the capacity of receiving countries assimilate or integrate the refugees and we have a panic. It is like a cinema on fire without exit signs.” – warned billionaire Soros.

Interestingly, George Soros predicts that Federal Reserve would not dare to raise any more rates for the rest of the year. True, he is notorious for painting the gloomiest financial markets money can buy so that it would benefit him financially. But here’s a billionaire whose hedge-fund firm gained about 20% a year on average from 1969 to 2011. He also made almost US$1 billion shorting the Japanese yen in 2012 and 2013.

.

Other Articles That May Interest You …

- China Declares 6.9% Growth But Analysts Predict A Financial “Ice Age”

- Forget $1 Gasoline, It’s Happening — 46-Cents A Gallon In Michigan

- Cheaper Than Water – This British Bank Thinks Oil Would Go To $10 / Barrel

- Already Panicking Over 1,000 “Rapefugees”? It’s Just The Beginning

- China (Secretly) “Devalues” Yuan – Global Recession Is Calling

- Europe Civil War – Swiss General Warns His People To Arm Themselves

- Forget About US$30 Oil Price – It Could Hit US$20 Per Barrel Next Year

- 10 Crazy Facts How The World Has Changed Since The Fed Last Raised Interest Rates

- 15 Successful, Rich and Famous People – Their Humble First Jobs

|

|

January 22nd, 2016 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply