First, the good news – China didn’t use the word “devaluation” like it did back in August 2015. The bad news – China secretly devalues its Yuan / Renminbi and as a result everything you could think of – stock markets, currency exchange and even oil prices – is going haywire.

China’s central bank – the People’s Bank of China (PBOC) – deliberately set the Yuan reference rate at 6.5646 against the U.S. dollar today, down 0.51% from yesterday’s fix (6.5554) – the lowest mid-point since 2011. In other words, this is the second time China allowed the biggest fall in the Yuan since 5-months ago.

What happened 5-months ago? It was the August 2% Yuan devaluation, of course. We wrote 5-months ago that the real problem isn’t the 2% devaluation at all. The real problem was whether China would continue to devalue until they get it right. We also wrote to get ready for a second round of devaluation roughly a month ago. Today, it happens.

In fact, both devaluations (August, 2015 and January, 2016) have weakened the Yuan / Renminbi by a total 6.18%. That’s a serious and mind-boggling figure. Similar to the previous August exercise, the central bank had intervened later (today) to reverse a more than 1% fall in offshore rates for the yuan after they hit a record low of 6.7600 per dollar.

Clearly Beijing didn’t want to create unnecessary panic by shouting “devaluation” this round. But its latest action speaks volumes about its determination to boost domestic exports, regardless of how many rounds of “secret devaluation” it sees fit. Unfortunately, people are more than panicked with its latest method in devaluating the currency.

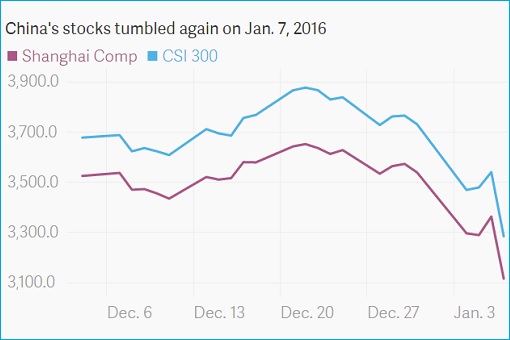

China’s CSI 300 tumbled more than 7% in early trade today at 9:59 a.m., again triggering the market’s circuit-breaker for a second time this week. The Shanghai Composite was down 7.32% at the time of the halt, while the Shenzhen Composite saw losses of 8.34%. The CSI 300, which tracks stocks in Shanghai and Shenzhen, has already fallen 12% in 2016 so far.

Unlike the first round, today’s circuit-breaker created a new record for the China’s 25-year stock trading history – the shortest trading day – merely 14-minutes of actual trading time. China’s version of circuit breaker halts exchanges for 15 minutes after a 5% drop in the CSI 300 index, and then halts them for the rest of the day after a 7% retreat.

The American circuit-breaker version works with much wider gaps. It temporarily halts trading after a 7% drop in the Standard & Poor’s 500 Index, then again at 13% – but suspends trading for the day only if losses reach 20%. Obviously, in China’s volatile market, where a 5% drop or jump isn’t uncommon in a normal trading day, the second trigger of 7% doesn’t make any sense.

With only 2% playground buffer, it would do nothing but create panic selling. This is another classic example why we’ve been bitching that the China authorities have zero experience in containing and controlling panics in its financial systems. However, even if China adopts the U.S.’ circuit-breaker style, there’s no guarantee it would work.

Tomorrow (Friday) is the expiration date of a ban imposed on July 8 last year whereby investors with shareholdings exceeding 5% were prohibited from selling stocks for a 6-month period. Naturally, global financial markets will crash again tomorrow as selling is expected to skyrocket. So, what is China’s strategy to solve this problem?

Easy, the Chinese securities regulator issued new set of rules to restrict the percentage of shares major shareholders in listed companies can sell every three months. Shareholders are not allowed to sell more than 1% of a company’s share in that period. Obviously, there’s no transparency, let alone consistency, in both currency and stock markets’ decision-making and problem-solving.

After injecting US$20 billion two days ago (Tuesday), China’s central bank conveniently declared that it would pump US$10.6 billion into the financial system. That’s funny because if US$20 billion couldn’t solve the problem, how could US$10.6 billion make any difference? In 2015 alone, China’s market crash registered trillions of dollars in losses and it only stabilized after Beijing spent at least US$236 billion.

Beijing’s data today also showed its foreign exchange reserves, the world’s largest, fell US$107.9 billion in December to US$3.33 trillion, the biggest monthly drop on record. For the financial year 2015, its foreign exchange reserves fell US$512.66 billion – the biggest annual drop on record in China’s 30-years of successful economic story.

The acceleration of money outflow from China may be due to its financial markets liberalization. But it may also a sign that the world’s second-largest economy is in deepening trouble, and Beijing is burning the midnight oil to cover as much as it possibly can. Investors are so panic that even oil price is being pulled down by the Chinese.

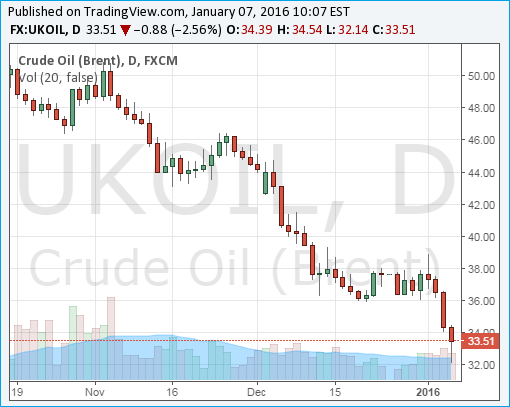

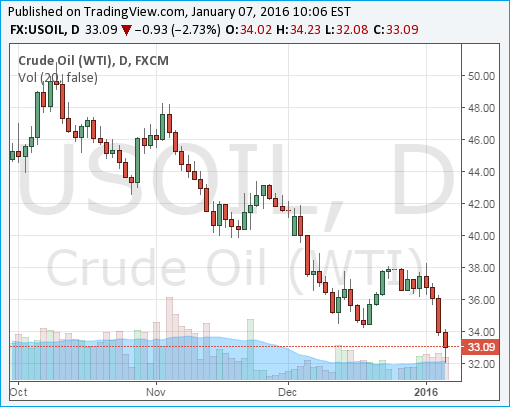

Thanks to rising US energy stockpiles and China’s weakening currency and tumbling stock markets; WTI crude traded below US$33 a barrel, the lowest point since touching $32.40 in December 2008 during the global financial crisis. Brent crude also fell below US$33 a barrel, its 11-year lows back in April 2004.

China still has trillions of dollars in foreign reserves but aside from that, Beijing practically has thrown every spanner to make its engine roars again. The central bank has cut interest rates. The regulators have suspended new share listings and threatened to jail short sellers. It has also pumped crazy amount of money to purchase shares.

Major shareholders are limited to 1% of shares selling, in every 3-month period, and must disclose their plans 15-days in advance. Beijing has been intervening, manipulating and distorting the nation’s financial markets too often and too ferociously that there’s little doubt the “casino” is going bust.

Other Articles That May Interest You …

- Mischievous Fire Monkey – Starting First Trading Day Of New Year With A “CRASH”

- If You Ain’t Scared Of 0.25% Rate Hike, There’re 3 More Coming – Up To 1.375%

- Next Year – 2016 – Will Be A Tough & Volatile Year For Businesses

- Get Ready For A Second Round Of Chinese Yuan Devaluation

- These 8 Charts Show How China’s Economy Meltdown Spreads To The World

- Here’s Why China’s Yuan Devaluation Is Such A Big Deal

- China vs Hong Kong Rivalry – These 22 “Naughty” Graphics Tell All

- China Stocks Lose US$3 Trillion, And Counting – Ready For A Huge Burst?

|

|

January 7th, 2016 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply