Five months ago, China did the unthinkable – “Yuan Devaluation“. President Xi Jinping was facing multiple problems back then. The Chinese stock market crashed 30% within 3-weeks. His enemy, former leader Jiang Zemin, was plotting against him by systematically selling shares in an attempt to further depress the stock market.

China’s economy was virtually going south with escalating unemployment. The economy was growing at 4-5% instead of the trumpeted 7%. The country’s export plunged by an unexpectedly huge margin of 8.3% in July, a month before the decision to devalue the yuan / renminbi. As a consequence, global currency market collapses and has never recovered.

This week the Chinese Yuan trades at four-month low – the lowest level since Augusts’ 2% devaluation. With USD/CNY trading above the 6.42 levels last seen after the August 11 surprise devaluation, it’s back to the drawing board again for the currency speculators and analysts – will the Chinese artificially devalue its currency again?

No rocket science here. If People’s Bank of China decides to devalue the Yuan again, it will surely spark another round of currency war, particularly in the fragile Asian countries. Asian currencies especially the Malaysian Ringgit and Indonesian Rupiah will be the hardest hit, going by the yardstick since the August Yuan depreciation.

After spending tens of billions of dollars defending their respective currencies, it’s hard to imagine both countries would do the same again. Still licking their wounds with no space yet for replenishment, investors and speculators would gladly short the ringgit or rupiah, making it tougher for Malaysia and Indonesia to catch a falling knife.

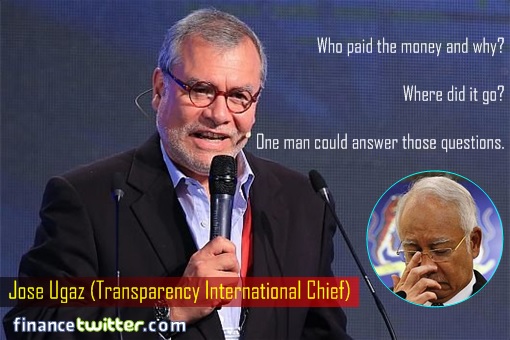

Malaysia, for example, is still haunted by its domestic scandals particularly the RM42 billion 1MDB and RM2.6 billion private donation found in the private account of Prime Minister Najib Razak. Foreign funds have fled but yet to return in full since the August yuan devaluation. And there’s no compelling reason why they should.

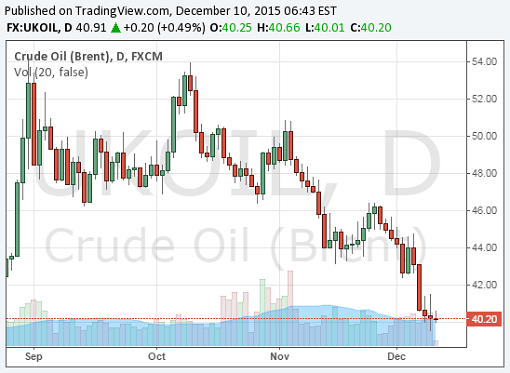

Although the country should be enjoying the benefits of lower crude oil price where the Brent crude hit the lowest level since Feb. 24, 2009, it hasn’t benefits the people at large. On the contrary, the reverse is happening. PM Najib Razak is racing against time to recover billions of dollars to cover up losses registered by its pet project – 1MDB.

Obviously, the fastest and easiest way get money is to “demand” from taxpayers. Public transports have been identified by Najib administration as the unfortunate “donors” this time. Starting January 1, 2016, the KLIA Express fare is to increase by 57% with a one-way journey to cost a whopping RM64.

In the same breath, KTMB (Keretapi Tanah Melayu Berhad) announced a 36% increase in its fare effective next year. MyRapid’s monorail system – Light Rail Transit (LRT) – has also announced its fare hike from RM35 to RM55 per person. Taxi fares have already went up by 20-67% while express bus fares increased by 22.6% in May.

If not for the coming Sarawak state election, TNB (Tenaga Nasional Berhad) would have had announced a tariff increase effective January 1, 2016. The bailout of 1MDB’s Edra Global Energy Berhad by China General Nuclear Power Corp for RM9.83 billion also means the public is about to be slapped with higher electricity rate so that the Chinese firm can recoup their investment.

Effective January 1, 2016, the population of 30 million Malaysians will wake up to a pricier cooking oil and rice too, thanks to subsidies cut due to lower budget allocation as announced during the Budget 2016 presentation by PM Najib Razak, who has been busy scraping the bottom of the barrel to serve his lavish spending.

So, instead of lower cost of living due to chain reaction caused by lower crude oil prices, a country such as Malaysia is facing an extraordinary high inflation simply because the government is practicing corruption, mismanagement, lavish spending and whatnot. Throw in further currency depreciation when the Chinese Yuan devaluation kicks in for the second time, and you’re seeing troubles all over the wall.

Other Articles That May Interest You …

- Forget About US$30 Oil Price – It Could Hit US$20 Per Barrel Next Year

- One Big Family Of Crooks? Najib’s In-Law Took Hermes Bags Without Paying

- Budget 2016 – What Najib Razak Doesn’t Want You To Know

- Jokowi’s Ambitious Plan – Taking Indonesia Into High-Tech Era

- 20% Lost – This Chart Shows Malaysia The Champion In Reserves Fall1

- Be Very Afraid Najib, Mahathir Has Unleashed Altantuya Card

- Here’s Why China’s Yuan Devaluation Is Such A Big Deal

- A Remaking Of 1997 Asian Financial Crisis By Najib Razak In 2015

- The Chinese Are Coming!! The Chinese Are Coming!!

- How Come The Chinese Always Get The Blames & Beatings?

|

|

December 10th, 2015 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply