This is not a drill. And certainly not about the spread of Chinese influence around the world, buying everything they can get their hands on, as it prepares to overtake America as the world’s economic superpower. But before they can even think about becoming the global superpower, China needs to learn how to manage a major economic crisis.

As Facebook supremo Mark Zuckerberg celebrates his entry into the top-10 richest person in the world (he’s at the ninth place now), Apple is facing a delicate situation. Being the biggest publicly traded company on planet Earth, its stock movement is one of major barometers of the world’s economy.

Nope, it’s not about the U.S. economy which worries investors, so much so that Apple Inc. (Nasdaq: Stock, AAPL) shares were being whacked down more than 4%. It was about China’s economy. Apple reported fiscal third-quarter Greater China (Hong Kong, Taiwan, mainland China) revenue of US$13.23 billion, a 112% gain from US$6.23 billion in the year-ago period.

So, if the sales figures beat earnings estimates, what’s wrong with China? That’s because Apple’s management gave a “cautious” outlook for the current quarter and didn’t provide much detail on how the company’s new smartwatch was doing. And the giant plans to cut annual spending by US$1 billion, reducing spending on purchasing manufacturing equipment, data centres and retail stores.

At one point, Apple shares briefly fell below its 200-day moving average on Tuesday. Did investors and analysts over-react by wiping US$62 billion off the value of Apple at its lowest point on Tuesday, which essentially was the size of the entire market capitalization of Priceline Group or German automaker BMW? Not if you put other economic pieces together.

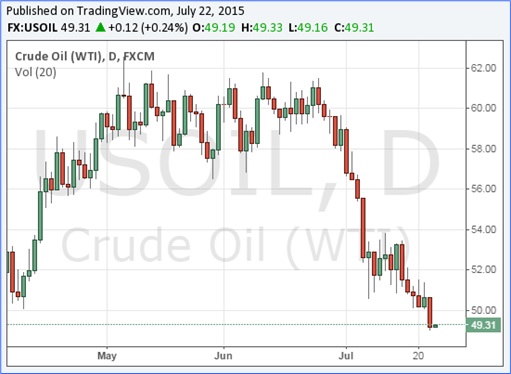

Coincidently, shares in mining and commodity firms also tumble to their lowest levels since the 2008 stock market crash. Investors normally regard the mining and commodities industries – oil, gold, copper, zinc, platinum – as indicators of China’s economy. The crude oil (WTI) is now trading at below US$50 a barrel, when it was above US$60 a month ago.

In normal circumstances, oil inventories typically shrink this time of year because demand is high. But surprisingly, the U.S. Energy Information Administration’s weekly status report showed an increase in crude inventories by 2.5 million barrels, versus analysts’ expectation of a decline of 1.9 million barrels.

Despite China’s claim of 7% economic growth, consultancy firm Oxford Economics said its reading showed the country expanding at merely between 4-5%, while analysts at broker Cowen pointed to “evidence of a widespread demand reset from China”. The recent collapse in the Chinese stock market also raises concerns that losses from 90 million Chinese retail investors may reduce their spending ability.

Regardless whether this is just a temporary pullback, or the beginning of a major recession in China, the fact remains that Apple’s CEO, Tim Cook, refuses to give details of sales of the Apple Watch (launched in April). Previously, he has emphasised the importance of Chinese growth to Apple’s future growth. Hence it’s worrying that he stops blowing the same trumpet.

After a terrifying 30% crash in three weeks, China’s stock market has rebounded significantly. But that’s because the Chinese government is banning investors holding stakes of more than 5% in companies from selling shares in the next 6-months. The idea was for the government, being the main player, to pump money into the casino.

Retail investors tend to exhibit herding behaviour, so when they saw government buying and pushing shares up, essentially they would stop selling. After this intervention, what’s going to happen? Will Beijing continue to buy shares to artificially keep the index to a certain level? Clearly, the Chinese government cannot intervene in the market forever.

Interestingly, while we wait for the bubble to officially burst, and it will eventually, doctors in China have reported a surge in what they’re calling “Stock Market Anxiety Syndrome.” Students have dropped out of university, unable to give up their habit of tracking their investments. A 52-year-old woman was treated for depression, after she lost 1 million renminbi, about US$160,000, in two weeks.

Then, you have Frank Feng, a 26-year-old financial news reporter in Beijing who lost around 60,000 renminbi, almost all his savings. He has become extremely moody and is almost on the verge of a nervous breakdown. Naturally, potential social unrests caused by stock market meltdown could be the only justification for Beijing to keep pumping trillions of dollars into the casino.

Other Articles That May Interest You …

- Here’s Why Najib Is “TOAST”, Even If The RM2.62 Billion Was A Donation

- How Come The Chinese Always Get The Blames & Beatings?

- China vs Hong Kong Rivalry – These 22 “Naughty” Graphics Tell All

- China Stocks Lose US$3 Trillion, And Counting – Ready For A Huge Burst?

- Awesome Backyard Inventions From China That ROCK!!!

- Forget About US$10,000 Apple Watch. Here’s China Version For Just US$40

|

|

July 23rd, 2015 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply