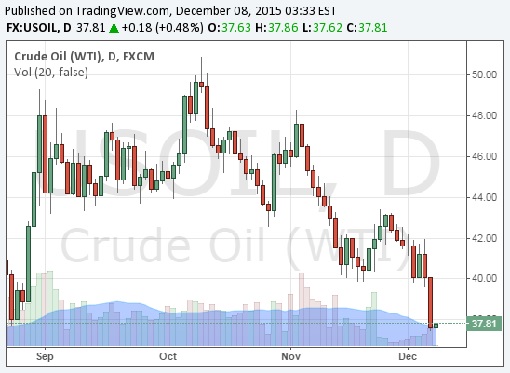

Crude oil futures tumbled to their lowest in nearly 7 years on Monday after OPEC failed to address a growing supply glut. Brent and U.S. crude futures fell as much as 6% in reaction to the Organization of the Petroleum Exporting Countries’ (OPEC) policy meeting on Friday which ended without an agreement to lower production.

OPEC has decided to maintain crude output at roughly 31 million barrels per day. U.S. crude’s West Texas Intermediate (WTI) futures settled at US$37.65 a barrel, down US$2.32, or 5.8%. On the other hand, Brent crude, the globally traded benchmark, was down $2.30 at $40.71 a barrel, having hit the lowest level since Feb. 24, 2009.

OPEC kingpin Saudi Arabia, the world’s biggest oil exporter, thinks unconventional oil producers, including U.S. shale drillers who have fed the glut, will eventually be squeezed out of the market by high production costs and low selling prices. Well, at least that was what Saudi hoped to see in order to use the black gold to control and manage the White House.

Having burning through about US$91.5 billion of its reserve assets, Saudi still has a whopping US$654.5 billion as of September (IMF figure). To replenish its coffer, Saudi Arabia was seeking to sell about US$5.3 billion in sovereign bonds every month till the end of the year. The strategy here is to stay afloat for as long as they could until all the shale drillers are eliminated.

However, both OPEC and Goldman Sachs agreed that oil prices could drop to as low as US$20 per barrel next year. With Iran set to announce its production targets after sanctions are lifted, other OPEC members are dead worry that the oil prices would hit at least mid-20s, if not US$20 a barrel in 2016.

Saudi Arabia needs oil prices of US$100 a barrel to balance its budget, but as the world’s biggest exporter of crude it is gambling that the low price will knock out shale drillers. It is too obsessed about maintaining its throne as the world’s “King of Oil” title. But if low oil prices and high spending persist, the Saudis will be forced to reduce spending.

OPEC members are seeing their annual revenue reduced to US$550 billion, from over US$1 trillion over the past 5-year. Obviously smaller and more vulnerable members such as Venezuela, Angola, Algeria, Nigeria and Ecuador aren’t happy with Saudi Arabia’s decision for prolonging a war with shale drillers.

Although rig counts in the United States continue to drop, daily oil production in the U.S. still exceeds 9 million barrels per day. It doesn’t help the situation when Russia is challenging the Saudis for the position of the world’s leading producer with over 10 million barrels per day of production.

Nothing short of more terrorist attacks or a full blown war between Turkey and Russia in the Middle-East could jump start a higher oil prices. The fact that the prices are this low even with the mess going on in Syria goes to show that OPEC’s influential in determining global oil prices has decreased dramatically.

Both the U.S. and Russia produce two-thirds of what the OPEC cartel produces. The Russians will pump more whenever the country sees fit in its attempt to dominate the energy market. Likewise, Iran could produce as much as it likes without the needs to comply with OPEC guidance or Saudi’s agenda. Iran has promised to pump at least 500,000 barrels per day in 2016.

Still, before the oil prices could reach US$20 a barrel, it has to break the symbolic US$40 price tag permanently with strong resistance to climb above it. Of course, there’s still the slowing Chinese economy factor which could easily pressure the oil prices further.

Other Articles That May Interest You …

- Here’s Why Turkey Could Be Alone In A “Nuclear War” With Russia

- ISIS’ New Cash Cow – US$50 Billion-A-Year Heroin In Europe & UK

- The Glory Days Are Over – OPEC Warlord Saudi Has Started Borrowing

- Stop Worrying About Oil Prices – Only “Allah” Knows It

- BOOM!! – Here’re 6 Reasons Why US$30 Oil Is Haunting Again

- This Country Is So Badly Hit By Oil Prices That Having Sex Is Impossible

- Forget About Oil Crisis, Here’s New US$57 Trillion Global Debt Crisis

|

|

December 8th, 2015 by financetwitter

|

|

|

|

|

|

|

What do you think the Oil Sheikh is saying to broker Mr G0ldman in the control room..?