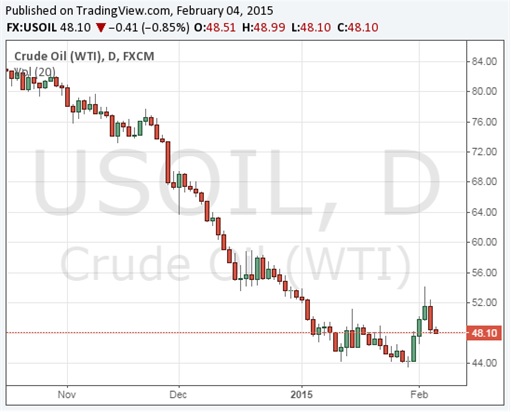

The last four days were excited, and if you eat, drink, sleep and breathe crude oil, we bet you must have thought the oil crisis was over. You must have thought that since the oil prices rebounced a whopping 19% in the four days, the market had found its bottom. Guess what, after the oil price jumped from US$44 to US$54 a barrel, it crashes, again. The crude oil WTI is now trading at under US$48 a barrel.

One of the reasons crude oil crashes is because the U.S. inventory has excessive stocks. America happily added another 6.3 million barrels last week to 413.06 million, the highest ever recorded since 1982. Forget about oil crisis for now. The present low oil prices are not that disastrous as if it was an apocalypse. Low gasoline price is actually good for consumers and businesses. It was manipulation that took oil to above 100 bucks a barrel.

There’s another more serious problem – an economic apocalypse – if we dare to say. If you can still remember, we expressed our concern about China’s economy. After the 2007/2008 American subprime crisis, we don’t really care about U.S. economy, simply because the country is experienced enough to solve its own problem. China, on the other hand, is a huge problem, simply because it has not had a real depression before.

According to a new study by the influential consultancy McKinsey Global Institute, global debt has grown by US$57 trillion or 17% points of GDP or worldwide income since 2007/2008 U.S. economic crisis, to nearly US$199 trillion now, equivalent to 286% of GDP. McKinsey’s coverage of study includes debt across 47 countries in the world. Overall debt relative to GDP is now higher in most nations than it was before the crisis.

Interestingly, almost half of the increase in global debt since 2007/2008 was in developing economies. The countries facing potential vulnerabilities include Netherlands, South Korea, Canada, Sweden, Australia, Thailand and Malaysia. In these countries, McKinsey was particularly concerned about their high household debt. Only 5 countries have succeeded in reducing their debts, namely Israel, Egypt, Romania, Saudi Arabia and Argentina.

Equally, there’re 5 countries that have increased their debt greatly – China (83%), Portugal (100%), Greece (103%), Singapore (129%) and Ireland (172%). Our interest is on China. The country’s financial borrowing since 2007/2008 has almost quadrupled, from US$7.4 trillion to US$28.2 trillion, or from 158% of GDP to 282% of GDP. China got to its current situation largely due to explosion in liabilities relating to property developments.

Here’s the apocalypse – when the massive chunk of China’s debt burst, it would be really ugly because property developers and speculators will simply go bust. The staggering debt will never be repaid. At debt of 282% of GDP, that’s higher than the U.S. McKinsey calculates that even if half of China property related loans defaulted and lost four-fifths of their value, the magnitude would be equivalent to the whole of UK’s public sector indebtness.

The study also mentions Spain, Japan, Portugal, France, Italy and the UK as countries needing to shrink their public sector deficits by around 2% of GDP if they are to have any chance of reducing their indebtedness. Otherwise, these European countries need to prepare for sales of assets, more unpopular taxes and whatnot. Still, nothing beats a China economy meltdown. Not even the present Russian economy crisis.

Other Articles That May Interest You …

- BOOM!! RON95 Cheapest Since 2008 Recession, But Nothing Else’s Cheaper

- Need Tips On Economy? Just Look At Women’s Makeup

- Only In China – Fake Bank Scams 200 Customers Of 200 Million Yuan

- Great Minds Think Alike – Both Obama & Najib Are Great Debt Accumulators

- Are You Ready For Crazy Oil Prices At US$30 A Barrel?

- Scrapping RON95 & Diesel Subsidies – Why It Will Do More Harm Than Good

- Dollar Bull Run Could Wreck Havoc In Asia, Particularly Malaysia

|

|

February 5th, 2015 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply