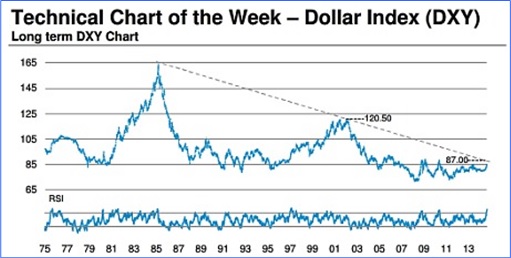

Forget about Islamic State militants, tumbling oil prices, China’s weakening economy, Japan’s recession, Germany’s slowing economic data and whatnot. There’s a new problem which will affect every single country on planet Earth. The US dollar has surged to a four-year high against a basket of currencies, breaching key technical resistance. The index – a mix of six major currencies – hit 87.406 on Monday, rising above the key level of 87.

As Federal Reserve prepares to tighten monetary policy, the so-called dollar index has finally broken above its 30-year downtrend line. Based on Chicago Mercantile Exchange’s data, speculative dollars bet are against the euro, the yen, the Australian dollar, Mexican peso, the Canadian dollar, the Swiss franc, sterling, and the New Zealand dollar, in that particular order. The Swedish and Norwegian currencies are also coming under heavy pressure.

The US dollar topped 114.20 yen on Monday, its strongest point in nearly 7-years, as yen come under heavy selling pressure after the Bank of Japan, in a surprise announcement last Friday, said it would increase its massive bond-buying program to kick-start its sluggish economy.The Australian dollars fell as low as 86.78 US cents, its weakest level since October 16.

David Bloom, currency chief at HSBC, believes the present dollar bull run is only at the early stages and could appreciate a staggering 20 percent over a 12-month period. Hans Redeker, from Morgan Stanley, said the dollar rally is almost unstoppable at this stage given the roaring US recovery. Hans, on the other hand, believes this will be a four to five-year bull-market in the dollar.

If you think above is bad enough, wait till you see the euro reaches $1.12 to the dollar by next year and will be even weaker than the yen, at least that was what the analysts predict. The rule of thumb is that each 10 percent rise in the dollar cuts the inflation rate of 0.5 percent a year later in the United States, hence there’re tons of reason to cheer a stronger dollar, at least to the Americans. But at the same time, this also spells problem to whoever that has huge exposure in the dollar.

Companies in Asia that have borrowed heavily in the US currency during the Fed’s QE phase, betting it would continue to fall, could be in deep trouble if they’re over exposed. Corporate debt in dollars across Asia has jumped from US$300 billion (£187 billion; RM998 billion) to US$2.5 trillion (£1.6 trillion; RM8.3 trillion) since 2005. Data from the Bank for International Settlements show that the dollar “carry-trade” from Hong Kong into China may have reached US$1.2 trillion.

The International Monetary Fund said US$650 billion (£406 billion; RM2.1 trillion) of capital has flowed into emerging markets as a result of QE that would not otherwise have gone there. Interestingly, this potential problem is not confined to companies that borrowed the US currency. Countries that thought US dollar has no other way to go but south, thus borrowed heavily would be in S-H-I-T as well.

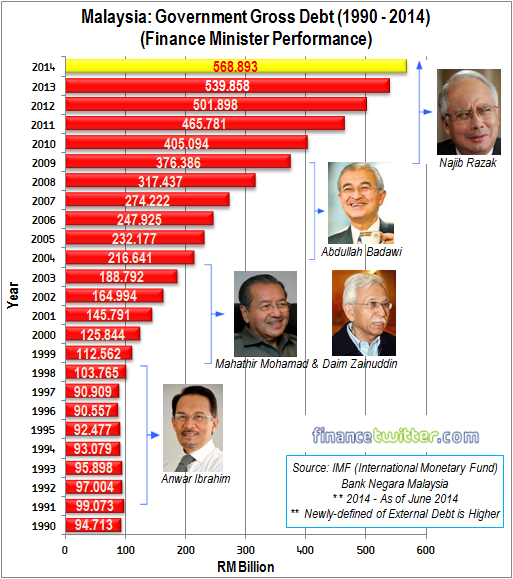

Take for example Malaysia. At 86.8% (as of March 2014), Malaysia’s household-debt-to-GDP level is not only highest in Asean but also Asia. Throw in the federal government’s debt of over RM568 billion (US$170 billion; £106 billion) as of June-2014, and you’ve found the formula to economic destruction, if things get spicy enough for a debt-bubble burst. Forget about Najib administration’s marketing talk about debt at 52.8% of GDP, which the government shamelessly claimed to be prudent and within manageable level.

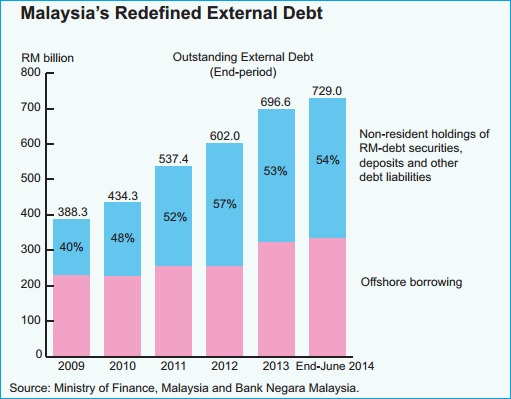

Following the redefinition of “external debt”, which now comprise offshore borrowing by the Malaysian Federal Government, public enterprises and the private sector as well as non-resident holdings of ringgit-denominated debt securities, non-resident deposits, trade credit and other debt liabilities, the country’s newly-defined external debt stood at a staggering RM729 billion (as of June-2014) or 67.6% of GDP – up from RM696 billion last year (2013).

Malaysian Federal Government offshore debt alone amounts to RM16.2 billion. Sure, this is quite a small amount as compare to the total offshore borrowing of RM335 billion or 46% of total external debt. But the fact that the country under Najib administration allocates RM20.7 billion and RM23.2 billion for financial year 2013 and 2014 respectively in “debt services” speaks volumes about the wisdom of PM Najib, who happens to be the Finance Minister as well.

Now, do you understand why the big spender Najib Razak is adamant about slapping 6% GST next year on everybody, rich or poor, not to mention the expected further cut in fuel and gas subsidies? Thanks to his so-called “prudent” financial management, the country’s debt has only one way to go – north – and could turn for the worse if US dollar continues to strengthen. Can you imagine the US dollar appreciates by 20% over the next 12-months?

Other Articles That May Interest You …

- Beware – Here’re 10 Strange Things About Denmark You Should Know

- Take A Look At Norway’s New Notes – The World’s Best Money Ever Designed

- Here’re 5 Spectacular Signs Global Economy May Get Ebola

- From Robbers To The Homeless, Swedes Ready For “Cash Is No Longer King”

- Here’s What $100 Is Actually Worth In Each State Of America

- Soros Bet $2.2 Billion On SPY Puts – Does He Know Something We Don’t?

- How To Save Money This Year – 15 Exciting Tips

|

|

November 4th, 2014 by financetwitter

|

|

|

|

|

|

|

ADB claimed when he took over from TDM the coffer was near empty that he cancelled the ‘crooked bridge’. Then looking at the gross debt under present PM, coffer must be in very bad shape