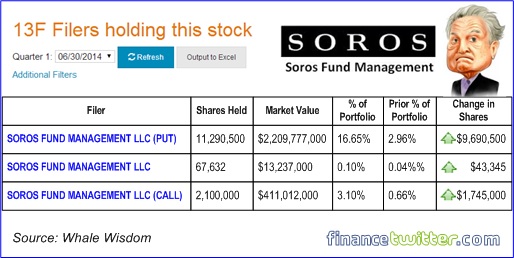

What have you done since we published an article about grand-daddy George Soros betting US$2 billion on SPY Puts? If you have been trimming your stock portfolio and take some money off the table, congratulations. If you have done nothing, it’s okay, because by nature you’re just a normal human. You’re no fund manager, let alone Warren Buffett. Hence your sentimental value towards your stocks is understandable (*tongue-in-cheek*).

Well, if you want us to comfort you that you did nothing wrong by holding to your shares, here goes. The month of October has been traditionally volatile, with plenty of ups and downs teasing and provoking you to make a decision. It could be because the holiday season is around the corner thus fund managers would be busy buying and selling like crazy, depending on their portfolio strategies. The see-saw is part of the game.

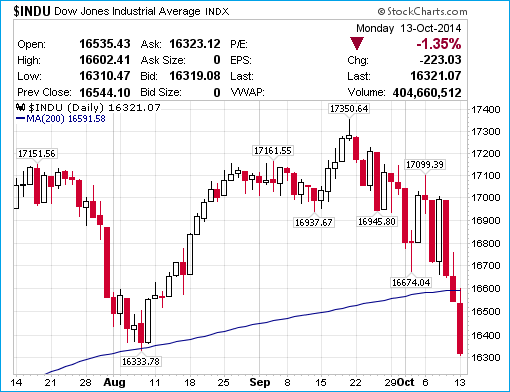

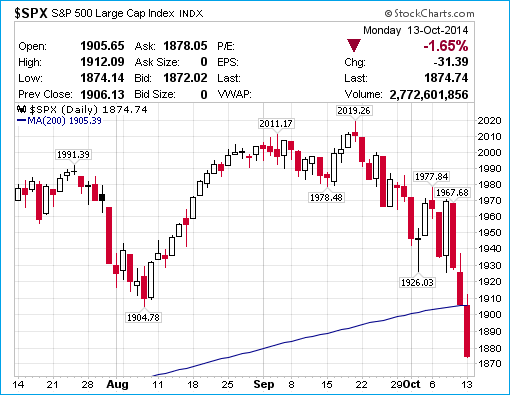

But what if you’re wrong for holding to your stocks and this is the beginning of a long and brutal bear market slaughter (*grin*)? Monday’s 223-point losses marked the fifth consecutive day of 1% moves for the S&P 500 and triple-digit moves for the Dow Jones Industrial Average. For the last three trading days, the Dow Jones had lost more than 600-points. So, was George Soros right about the whole stock market 2-months before it crashes? Here’re 5 signs that things could only get worse.

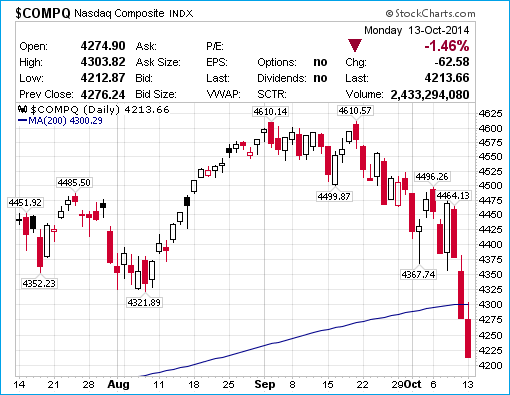

{ 1 } Technical Charts Say It’s Ebola Now

The S&P 500 broke below its 200-day moving average, while its cousin Nasdaq Composite off 8.6% from its September record. And nobody wanna wait to see it breaks 10% before screaming sell. On the trading floor, when the S&P couldn’t stay above 1,900 psychology after 3 o-clock Monday, it was as good as game over for the day. And since the level has been broken for the first time since November 2012, it was panic sell.

If that was not enough to tell every Tom, Dick and his dog that the bear is set to rule the trading floor, the CBOE Volatility Index spiked 16% to 24.64, a closing level it hadn’t seen since June 2012. What’s the turning point? Only when we see the S&P 500 and Nasdaq Composite close back above their 200-day moving averages at 1,900 and 4,300 respectively. The last time the S&P 500 broke below its 200-day moving average, in November 2012, it stayed there for “about a week.”

{ 2 } China Steel As Cheap As Cabbage

Monday’s data from the China Iron & Steel Association (CISA) showed that domestic steel prices have been falling for 12 straight weeks, with the Steel Composite Price Index down more than 13% compared since the end of last year. The average price for the range of steel products on offer has fallen to 3,212 yuan (US$525; £326; RM1,705) per metric ton for the first half of the year, down 28% from the average price in 2012.

What this means is the steel is now almost as cheap by weight as Chinese cabbage (*grin*). Beside showing slowing demand for this commodity domestically, which is already bad to the country’s economy especially in the housing industry, this also means oversupply headache for steel makers in the rest of Asia, including Malaysia. According to CISA, the profit margin for China’s large and medium-sized steel companies was at pathetic 0.54% for the first seven months of 2014.

{ 3 } OPEC Desperately Selling Oil Below Market Price

Oil prices are going south and OPEC members are going bonkers. The oil cartel which is supposed to move in unison stabilizing oil prices is not doing their job. Worse, they’re undercutting each other trying to sell their black gold. Iraq cut the price of Basrah Light crude in November for Asian and European buyers by 65 cents – a discount of $3.15 a barrel below the Oman/Dubai benchmark for Asian customers and $5.40 below the Brent benchmark for European customers.

Saudi Arabia is betting on lower prices. Privately, officials from the world’s largest crude producer have been telling investors that they are prepared to stomach oil prices below US$90, and potentially as low as US$80, for as long as two years. It appears the rich kingdom is reluctant to slash production despite weakening global demand and rampant supply. Regardless of Saudi’s real intentions, the price will not go above US$100 anytime soon. But it clearly shows global market has no appetite for oil like before.

{ 4 } Germany’s Economy Is Slowing Down

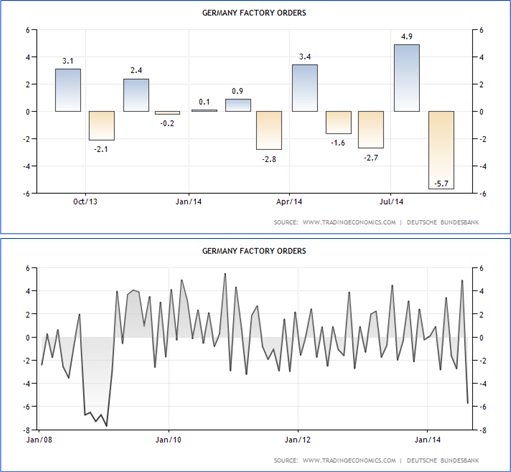

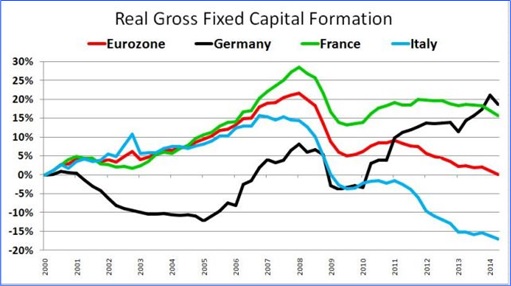

Germany last week reported its biggest one-month plunge in factory orders (-5.7%) since the bad old days of the 2008/2009 recession/depression. Germany also posted its biggest one-month drops in industrial output and exports (-4.0%) since 2008/2009. Germany’s economy, the largest in Europe, is deteriorating. International Monetary Fund cut German’s 2014 growth forecast to 1.4% from 1.9% previously, and its 2015 outlook to 1.5% from 1.7%.

The trouble is, while Germany has been prospering and growing since the 2008/2009 recession, its cousins in Europe such as France, Italy, Greece, Spain and the Eurozone are in decline for the same period. Now that Germany is slowing down, it could take the global economy together with it. Germany is Europe’s economic engine, and it appears to be driving the continent right into a recession.

{ 5 } Japan’s Economy Is Fragile

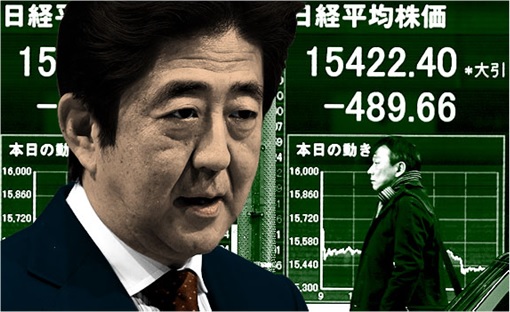

In 2010, Greece, and later Portugal, Ireland and Italy decided to cut spending and raise taxes in exchange for bailouts. By 2012, those countries were toast. Japan decided to do the same thing in April this year – raised sales tax to 8% from 5%. And now, the country could be heading for its recession. Last week, IMF slashed Japan’s growth forecast and put its recession odds at 1 in 4, citing a bigger-than-expected hit from its national sales-tax increase.

That’s not the end yet, as Prime Minister Shinzo Abe is scratching his head whether to approve the sales tax once again to 10% from 8% for next year. Japan has a rather unique problem – high government debt and an aging population. Japan’s borrowing is twice the economy’s size; while 1 in 4 Japanese are 65 years or older. Both figures are the highest in the world. Witha a large 7.1% fall in its Gross Domestic Product in the three months after the sales tax hike but interest rates are at lows of near zero, it’s gloom and doom for Japan.

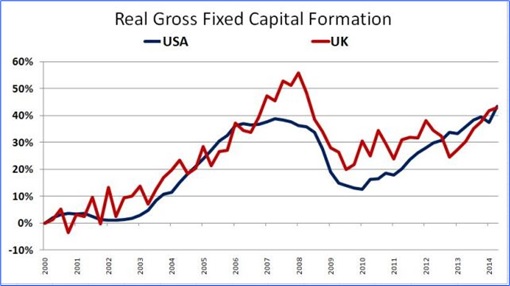

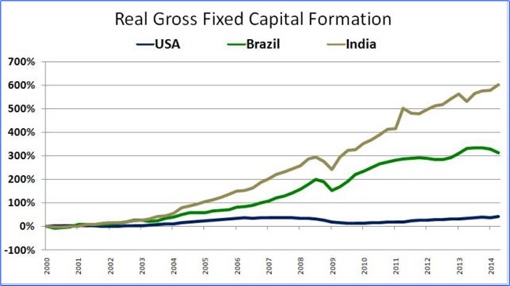

The only economy giants that look good on paper is United States, United Kingdom and India. Even Brazil doesn’t look very optimistic. But should the Murphy Law has its way and China, Japan and Germany economy continue to go south, not even U.S. and U.K. could stop a global economic meltdown. The only thing that could possibly halt Wall Street, and other stock markets for that matter, from further crashing is a spectacular corporate earnings on Tuesday.

Other Articles That May Interest You …

- Exposed – The Hidden Lives Of The Rich Kids Of Tehran

- Here’s How Malaysian ATMs Were Hacked Of RM3 Million By Latin Americans

- Real Estate Investment – Here’re 20 Global Hottest Property Markets (Q2-2014)

- Recession Hit Hollywood – More Jobs Cut, Producers Are Going Global

- Jobless And Need One Urgently? Go To Australia Now – The Land Of Jobs

- Here’s Proof UK Housing Bubble May Pop – Tiniest House For £275,000

- Soros Bet $2.2 Billion On SPY Puts – Does He Know Something We Don’t?

- It’s Raining Money – UK Benefits System Is So Crazy You Don’t Have To Work

|

|

October 14th, 2014 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply