Legendary hedge fund manager George Soros has been buying and selling like crazy as of July 2014. George Soros, through his privately held investment management firm – Soros Fund Management – was buying TEVA, EQT, YPF, EGN, CZR while at the same time selling Google, Boeing, Microsoft and Harman International Industries.

Besides Warren Buffett, the other person who you should be watching is none other than George Soros. If you do not like Buffett’s investing style, then perhaps Soros is your idol. Last year, George Soros earned a whopping $4 billion (£2.4 billion, RM12.7 billion) – a return of 22%. Soros, the “Man Who Broke the Bank of England” has something up his sleeve, if his latest 13-F filing with the Securities and Exchange Commission is any indicator.

Apparently, Soros thinks and bets that United States stock market is going to collapse. And he’s betting a whopping $2 billion on it. How does he bet it? Actually he has been betting on it in various sizes of “put options” since couple of years ago. But that could be his hedge against his position. However the size started getting bigger since June-2013. And by June this year, it’s obvious he’s dead serious about it.

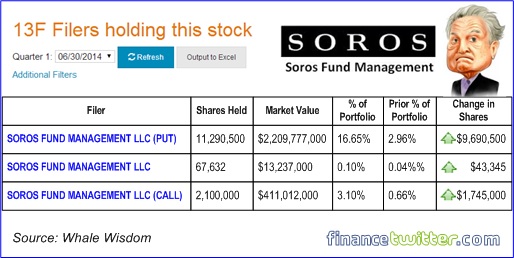

Soros increased his position to 11.3 million put options on the S&P 500 ETF (SPY), boosting the short position from 2.96% to 16.65%. In dollar value terms, this means his position soared to $2.2 billion (£1.3 billion, RM6.9 billion) from around $299 million (£179 million, RM947 million). At 16.65%, that position represents the biggest slice of the Soros Fund Management’s portfolio.

S&P 500 is a stock market index based on a collection of 500 large companies listed on the NYSE (New York Stock Exchange) or Nasdaq. Investors can bet on S&P 500 (code: SPY) if they are bullish (Call Option) or bearish (Put Option) about the index. In terms of quarter-to-quarter, Soros’ latest bet on S&P 500 Put for $2 billion is a staggering 605% increase, hence investors should pay attention.

Sure, Soros’ huge position could be a hedge or part of his trading strategy. Nevertheless the ratio of his $2.2 billion “Put” against $411 million Call is 5-to-1, and that would be one heck of a hedge position, if he’s not damn sure that U.S. stock market would collapse. Essentially, he is very worry about something, which is deadly enough for him to buy such a huge “insurance”.

Perhaps the answer could be found by looking back at what Soros had said earlier of the year. He wasn’t worry about Europe but actually compared the economy situation in China to that of the United States in 2008. Just like how American experienced subprime crisis in 2008, could China’s property market triggers a collapse eventually? Even if China economy collapse with a smaller magnitude than American’s, the effect will still be humongous.

As much as Soros recognise that China Government owns the banks and bulk of the country’s economy, the government can’t keep pumping money to keep it afloat, as it gets bigger and bigger. The Chinese Shanghai Composite surged 80% in 2009, fell 11% in 2010 and another 22% in 2011. It ended up 3% in 2012 before a decline of 6.75% in 2013.

Interestingly, Chinese analysts are equally worry that Chinese stocks have been rallying on both good and bad news. And that’s enough to confirm why George Soros was so worried that he dumped $2 billion betting the United States is going to collapse. But since the 13Fs are from the second quarter, we can only hope Soros didn’t actually increase his “put” options. Anyway, there’s nothing wrong to start taking some money off the table, as part of your profit-taking routine.

Other Articles That May Interest You …

- 15 Successful, Rich and Famous People – Their Humble First Jobs

- How to Get Back Your Genneva Gold and Money – 10 Things To Do

- Here’re 11 Amazing Hidden Messages On Dollar Bills

- Debts & Deficits – 21 Currencies That Have Gone Bust

- Silver Correction Or Speculation Trap By Soros?

|

|

August 17th, 2014 by financetwitter

|

|

|

|

|

|

|

Comments

Yes, it would be good to have your view on the property and stock market in Malaysia in the next 6 months or so.

Thank you in advance.

If United States collapse, we’re not worry about its effect on Malaysia … But if China collapse, the effect could be unthinkable, simply because it has NOT collapse in a big wave before …

Cheers …

If United States stock market collapse, how does it affect Malaysia economy?