Forget about China’s housing bubble for the time being. Yeah, we know, we’ve written an article about how George Soros bet his US$2.2 billion on SPY Puts Option, all because he was so worry about China’s housing bubble. But before China’s bubble could burst, and it will for sure, another housing bubble which is much much bigger than the China’s could burst first.

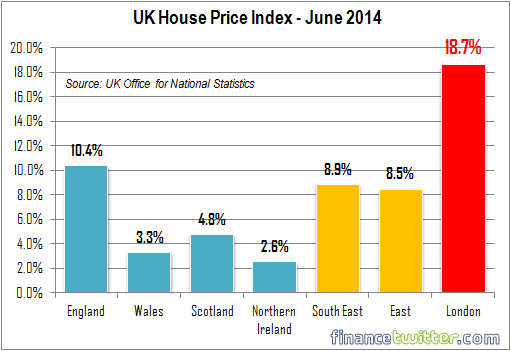

The UK’s Office for National Statistics showed that the cost of purchasing a home rose 9.9% in the year to April across the UK, with a double-digit growth rate of 10.4% in England. In comparison, China’s home price increase for the same period only spiked 6.8%. The craziest housing price increases was of course, London, which rises a mind boggling 18.7%.

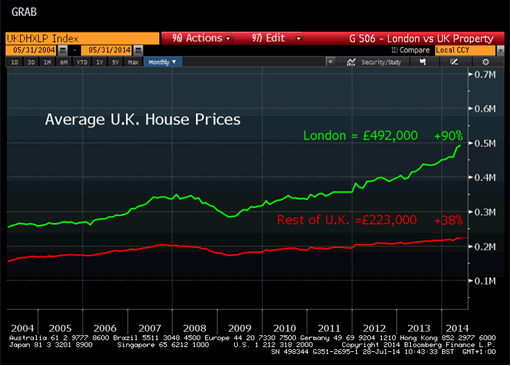

Excluding London and the South East, UK house prices increased by 6.3% in the 12 months to April 2014. Needless to say, London will be the center of UK housing bubble, and it’s not hard to understand why. While China’s property market is driven primarily by the Chinese people, London attracts buyers from around the globe, including the super rich from the China and corrupt politicians.

Take a look at this example to understand how ridiculous the housing prices have become in UK, especially London. Squeezed between rows of terraced houses in Barnsbury, Islington, there’s one cute miniature one-floor property. It is just five metres across at its widest point. This house, which can easily be the UK’s smallest house has merely 188 square feet.

The house is on the highly-sought after Richmond Avenue, one street away from Tony Blair’s former house on Richmond Crescent. Blair sold his house for £615,000 in 1997 but it is now worth more than £3million. And how much is this smallest house in the UK? It’s worth a staggering £275,000 – that’s a cool £1,462 per square feet. Let’s take a tour to see how fascinating this piece of property is.

Real estate agent claims there have been many calls asking about this house – easily the smallest in UK. In spite of its size, this house comes with its own gate.

The bed is on a mezzanine floor above the kitchen. You need to walk across the kitchen worktop before climbing steps to the bed.

This is the view from the bed, looking at downstairs. The living area consists of a small table and two chairs, with some cushions. No sofas could possibly squeezed in without jeorpardizing the limited space.

Welcome to the mezzanine bed. Obviously there’s no attached bathroom, let alone any huge wardrobe.

The bathroom is so small that there’s no sink. So the sink in the kitchen will be the most important area, to do whatever washing needed.

This is the stairs where you use to climb up to your bed. And it’s just above the lovely kitchen.

This is the living area, which is just next to the kitchen. Basically, you just need less than ten steps to go from the living room to the kitchen worktop before climbing steps to the bed- time saving. The raised living area comes complete with cushions and a small table.

So, if you don’t mind a house at a prime area in London where the bed is suspended above the lounge and has to be accessed using stairs from the top of kitchen units, this house is yours for a quarter of a million, British Pound. And don’t dream about have a bathtub when there’s not even space for a sink inside your lavatory. The real estate agent said this “unique” house is ideal for rental, and it’s not hard to see why.

Take a look at this studio flat where bedroom, kitchen and shower are in one room on Earl Court Road. The rental is at £563 a month. Targeting at students, this property is within walking distance of Imperial College.

This studio flat in north London where the single bed appears to be less than a metre from the entrance, has been let half 15-hours after it was listed online. The new tenant of this property in Kember Street, near Kings Cross station, is believed to be paying £737 per month.

So, are you still convinced that UK housing sector is still very healthy and there’s absolutely no bubble whatsoever? Well, according to figures from research company Hometrack Ltd., July marked the first month of no growth in London house prices since December 2012. And Lloyds Banking Group’s mortgage-lending unit reported that only 5% of people say the coming year is a good time to buy a home, a 29-point drop in just three months.

Other Articles That May Interest You …

- Free Scottish From British – Will We See A New Country This Month?

- Harry Set To Inherit £10 Million, After 17-Years Since Mom Diana’s Death

- It’s Raining Money – UK Benefits System Is So Crazy You Don’t Have To Work

- Soros Bet $2.2 Billion On SPY Puts – Does He Know Something We Don’t?

- Move Over Rolls-Royce, Here’s “Gold” Range Rover As Invasion Of Arab SuperCars Starts

- Are You Holding The World’s Most Powerful Passport?

- Britain – Promotes Women. Malaysian – Ridicules Women, Reason – Menstruation

- Beware Britain! Extremist Perkasa Who Threaten To “Chop Off Heads” Is Already In Town

|

|

September 9th, 2014 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply