Some important commodities are being whacked as we enter the month of December. Swiss voters overwhelmingly rejected proposals to boost gold reserves in a referendum, resulting in the glittering metal tumbled more than 2% at one point to US$1,142.90 per ounce. Copper also fell to as low as $6,230.75, breaching below its March low to hit its lowest levels since mid-2010. But the most crucial problem is oil prices.

Since June till now, crude oil has been on free-fall, with the latest U.S. crude fell more than 2% to a five-year low of $64.10 per barrel. That’s more than 40% depreciation, mind you. Thanks to Saudi Arabia who stubbornly refuses to cut production, the global crude oil prices drop like a rock. With oil prices at 5-year low and copper prices at 4-year low, do you really need to be a rocket scientist to understand why most stock markets are in red?

As of mid-day, Malaysia stock market drops more than 2.5% or 45 points, the worst Asia performer after Hong Kong Hnag Seng Index, on the first day of December. Many think that Saudi Arabia has effectively declared wars on America shale oil boom. During last week meeting with OPEC’s poorer members, Saudi Arabia’s Oil Minister Ali al-Naimi revealed such rivalry with the United States.

But who on earth would believe such a childish story? Saudi Arabia and America are very close, as if they’re brothers from different mommies. Even if Saudi has gone bonkers and decided to go on war with the American oil players, do you really think they can win? The only logical reason why Saudi deliberately “crashes” the crude oil is to use the black gold to depress Russian economy.

There couldn’t be any other explanation. Saudi Arabia and United States are working hand in glove to weaken Russia’s economy, and in the process put pressure on President Vladimir Vladimirovich Putin. And it’s working marvellously. Last Friday, Russian currency – Ruble – crashed past historic 50 to a U.S. dollar. Ruble reached 50.4 against the dollar in after-hours trading, its lowest level since the currency was redenominated in 1998.

In fact, the Russian Ruble lost over 11% within last week alone. Amusingly, President Putin tried to act cool and said he wasn’t surprised in OPEC’s decision. He also played his psychology card by predicting the oil prices will not balance themselves till middle of next year. Surely, he must have been losing sleep, considering Ruble has lost almost 35% of its value against the dollar this year alone.

Interestingly, it was President Putin himself who said on October 17 that if the oil price stayed at US$80 a barrel for any substantial length of time the world’s economy would “collapse.” Igor Sechin, the most powerful figure in Russia’s energy industry, predicts the average price for oil next year – 2015 – would be between US$70 and US$75 a barrel. Earlier, Finance Minister Anton Siluanov admitted that the Western sanctions on Moscow and oil price falls will cost the Russian economy US$130-140 billion a year.

Russia earned US$194 billion from oil exports last year, and about US$28 billion from natural gas exports. For every US$1 decline in the oil price, about US$2 billion is shaved off Russia’s revenues every year. Russia pumped 523 million tons of oil in 2013, 525.3 million tons in 2014 and an estimated 526 million tons in 2017. But with badass America and Saudi manipulating oil prices, no amount of oil produced could save Russia from recession.

Already, Russians aren’t sure if they should blame price rises, deteriorating quality of life and a worsening of Russia’s economic health on Moscow’s annexation of Crimea or on Western sanctions. Well, if you think at present US$60-plus a barrel is bad enough, wait till you hear what some others have to say. Canadian billionaire Murray Edwards, chairman of Canadian Natural Resource, apparently thinks oil prices could fall down further – to as low as US$30 bucks a barrel.

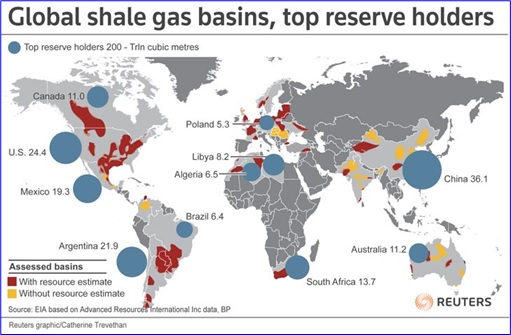

As crazy as it may sound, prices between US$30 to US$40 a barrel make perfect sense. After all, it did went down to US$35 during 2008 recession, although for a very short period of time. Sure, the world isn’t going to end even if oil prices reach US$30 a barrel. But the fact that U.S. shale oil boom would see the country emerges as the world’s biggest oil producer, bypassing Saudi Arabia, speaks volumes about America’s new economic weapon.

Perhaps, that’s the very reason why Saudi Arabia came to its senses and didn’t try to cut production, unlike how it quadrupled oil prices in 1973 and threw the world into a deep recession. But you may need to revisit another problem with falling oil prices – a stronger dollar, which we had an article published not many moons ago. Assuming everything goes according to the plan, are you ready for oil prices at US$30 a barrel (*grin*)?

Other Articles That May Interest You …

- Scrapping RON95 & Diesel Subsidies – Why It Will Do More Harm Than Good

- Busted!! Russia Latest Stunt On Fake MH17 Images Fails Miserably

- Foreign Exchange Scandal – 5 Big Banks Fined A Paltry US$3.3 billion

- After China Steel Cheaper Than Cabbage, Now U.S. Gasoline Cheaper Than Milk

- Dollar Bull Run Could Wreck Havoc In Asia, Particularly Malaysia

- There’s A New Bank On The Block, And The U.S. Isn’t Happy About It

- Here’re 5 Spectacular Signs Global Economy May Get Ebola

|

|

December 1st, 2014 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply