Yesterday, we wrote about the happy and sad consequences as a result of US dollar bull run. Americans are cheering a stronger dollar for a simple reason that their purchasing power will be higher. It will cost them lesser for a vacation in Paris or Bangkok, for example. Since Americans don’t believe in saving, they would spend more and this drive businesses. As a result, employment skyrockets and voila, economy is back in business and the Federal Reserve has every reason to raise interest rate.

And when the Feds raises interest rates, money that had flowed out to other markets will come back to Uncle Sam, for obvious reason. That’s why you can see Asia markets are slowly but surely seeing funds exiting in droves. Like it or not, this is the rule of the game. When someone propers, someone else suffers. The difference is whether you’ve over borrowed the U.S. dollars but have tons of cash to inject it for a stimulus, or otherwise.

A slowdown in economy would bring in many other unimaginable ugly chain reactions. For example, your central bank may have little options but to raise interest rate, in its attempt to stop excessive funds overflowing. This also helps banks in cash building. Needless to say, the first group of people to be hit will be real estate speculators who hold tons of mortgage which generate negative cash flow.

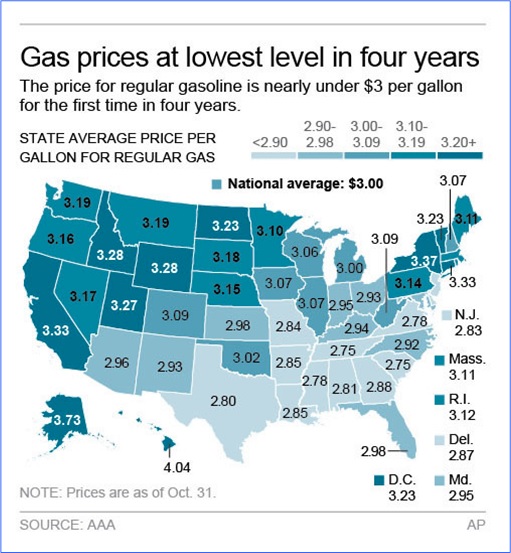

If the strengthening of U.S. dollar was not bad enough, Americans now have another reason to cheer – cheaper fuel prices. According to AAA, the national average price of gasoline fell 33 cents to end October at US$3 a gallon and dipped Saturday to US$2.995. This means for the very first time in 4-years, Americans can enjoy gas at below US$3 a gallon (3.78 litres) once again, thanks to Saudi Arabia.

The Kingdom of Saudi Arabia has gone bonkers and offers discount on oil sold to the United States, triggering another 2% drop Tuesday to $77.19, but not before falling to lowest of $75.84 at one point, the lowest level since October 2011. This means since the summer, oil prices have depreciated by a whopping 25%. Not bad for the black gold when it was trading at US$100 a barrel barely 4-months ago in July.

This is considered a windfall, sort of, to the U.S. and China economy as it could add about 0.4% and 0.8% to GDP for both countries respectively, provided China’s housing bubble doesn’t burst. However, this is not a good news to oil producing countries such as Venezuela, Russia, Gulf states and of course Malaysia. In fact, the tumbling of crude oil prices have been so crazy that billionaire Prince Alwaleed bin Talal told his nephew King Abdullah it has reached a dangerous level to Saudi Arabia.

It’s too early to tell if this was another grand plan by Uncle Sam to manipulate global oil prices by forcing Saudi Arabia for a fire-sale. Beside creating havoc to Russia economy, the oil price drops will save the U.S. economy US$187 million a day, and also boost the profits of shippers, airlines, and any company that sends employees out on sales calls. For the time being, New York’s average of US$3.365 is the highest in the continental U.S. South Carolina and Tennessee are the lowest, with an average of US$2.74.

Heck, if you think the story about China’s steel price being cheaper than cabbage is funny, wait till you hear this. At US$3 a gallon, gasoline is now cheaper than milk, where the national average price of milk in September was US$3.73 a gallon (*grin*). At US$2.74 a gallon or 3.78 litres, that’s about RM9.13 for the same amount of fuel, not too far from Malaysian’s RM2.30 per litre for RON-95, or roughly RM8.70 a gallon. So, will Najib administration slash gasoline prices if the global price continues to drop?

Other Articles That May Interest You …

- Dollar Bull Run Could Wreck Havoc In Asia, Particularly Malaysia

- Here’re 5 Spectacular Signs Global Economy May Get Ebola

- Here’s What $100 Is Actually Worth In Each State Of America

- Soros Bet $2.2 Billion On SPY Puts – Does He Know Something We Don’t?

- How To Save Money This Year – 15 Exciting Tips

- Psst !!! Remember Your Bread And Butter Issues?

- Govt, TNB & IPP Milking Petronas & People – These Charts Tell All

|

|

November 5th, 2014 by financetwitter

|

|

|

|

|

|

|

But is it not strenghtening of USD will hurt USA export badly too ? Doesn’t this translates to job losses for the Yankees ?

Just thinking aloud.