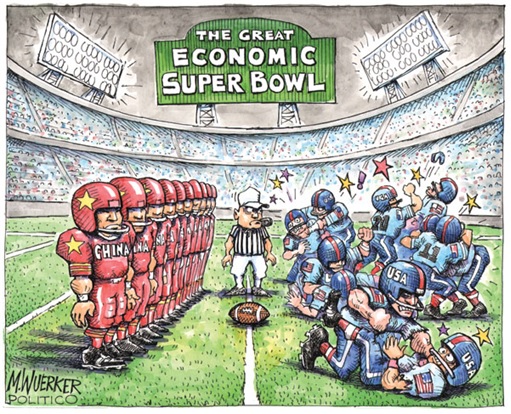

There’s a new bank established to rival the World Bank, but it was boycotted by the world superpower United States and its supporters. The new leader who will control this new “supposedly” Asia bank is none other than China, the emerging biggest economic powerhouse that will give United States a run for their money. And the new bank will be known as Asian Infrastructure Investment Bank (AIIB).

It appears, at least for now, China and 20 other countries had signed a memorandum on Friday, 24 Oct 2014, endorsing to create the international development bank. However, the war between the United States and China has already begun long before yesterday’s signing ceremony. Countries were made to pick sides – either you’re with the U.S. or against the U.S.; or rather, either you’re with the democracy or with the communist.

U.S.-friendly countries include Japan, Australia, South Korea and Indonesia – all were not represented at Beijing. Countries that were seen to be aligned to China are India, Malaysia, Thailand, Vietnam and the Philippines. Naturally, AIIB which was proposed by China’s President Xi Jinping a year ago was seen as an attempt to undercut the World Bank and the Asian Development Bank (ADB), both dominated by the U.S. and Japan.

China, which pledged an initial US$50 billion in capital into AIIB, will be the largest shareholder with a stake of up to 50%. But does Asia need another bank when there’s already the US$175 billion ADB founded back in 1966? Going by the China’s reason, ADB’s primary focus was on “poverty reduction” while the newly set up AIIB’s goal is on “infrastructure construction”. However ADB’s president Takehiko Nakao disagreed.

Interestingly, although South Korea didn’t present for the signing, the country emphasized the needs for a commitment from the new bank to meet international standards on issues like the environmental impact of projects, before the country considers joining the club. The AIIB is expected to begin operations in 2015, with its headquarters in Beijing, and Jin Liqun, ex-chairman of investment bank China International Capital Corp taking the leading role.

For now, the voting rights have not been determined but it is expected to be based on combination of GDP and Purchasing Power Parity (PPP). Based on this formula, India will be second largest shareholder of the bank after China. As much as the United States and its allies see the new AIIB as cash-rich China’s attempt to influence the region economically, the fact remains that not all countries in this region support the U.S.

Perhaps, China and Russia see United States is at its weakest point now, what more with the lamest duck Barack Obama in Washington. It can’t be wrong to assume such when even Ali Younesi, senior adviser to Iranian President Hassan Rouhani, commented that President Barack Obama is “the weakest of U.S. presidents” and his time in the White House has been “humiliating”. But AIIB was not the first bank initiated by China to flex its muscle regionally.

Earlier in July this year, BRICS (Brazil, Russia, India, China and South Africa) Development Bank was formed, which will be based in Shanghai, with India as its President. Other AIIB members are Singapore, Cambodia, Brunei, Uzbekistan, Sri Lanka, Qatar, Oman, Pakistan, Nepal, Bangladesh, Kazakhstan, Kuwait, Lao PDR, Mongolia and Myanmar. Obviously, China which has a 6.5% stake in the ADB wants a bigger say hence the setting up of AIIB.

Amusingly, Wei Jianguo, a former Chinese commerce minister has this to say about U.S. objection – “You could think of this as a basketball game in which the U.S. wants to set the duration of the game, the size of the court, the height of the basket and everything else to suit itself”. While this is a perfectly valid argument, isn’t this exactly what every country does, including China itself in respect to Hong Kong’s fight for one country two systems?

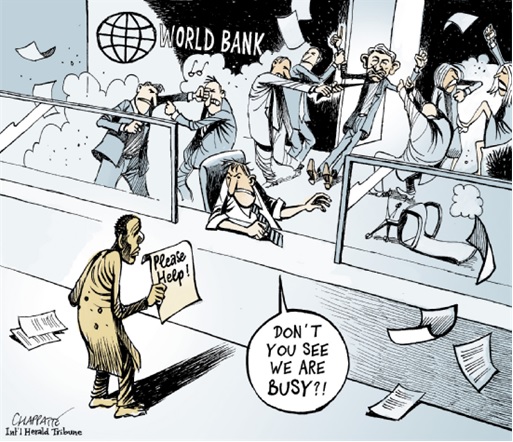

Nevertheless, there’s no reason why another lender should not co-exist with existing giant lenders. Every country needs money, the more the merrier. It’s estimated that funding needs for infrastructure projects in developing countries would probably reach US$1 trillion a year. And World Bank only offered US$24 billion in infrastructure loans with another US$9 billion in private financing last year. In Asia, ADB admitted that less than 5% of the annual infrastructure needs of US$800 billion had been secured.

Beside economic and political influence, China is also cleverly using its huge cash reserves to work harder in the name of diversification. Considering many governments in Asia are struggling to finance major infrastructure investments and are actively seeking private financing, it makes perfect sense for China to set up AIIB. It’s similar to a “loan shark” extending loans to poor people who “couldn’t secure (competitive) loans” to start their hawker stall businesses, literally speaking.

While time will tell if China-backed AIIB will succeed under a set of soon-to-be-established “international standard” or fail due to the country’s autocracy, other countries which chose to join AIIB have only one goal – to diversify their sole reliance on 48-year-old ADB, World Bank or even IMF, for that matter. Perhaps it’s about time to have two-superpower system to provide effective check and balance, something which has not happen economically on planet Earth.

Other Articles That May Interest You …

- Here’re 5 Spectacular Signs Global Economy May Get Ebola

- C.Y. Leung’s Corrupt Scandal – Allegedly Took HKD$50 Million Secretly

- China – Ain’t Sick Man Of Asia, Too Wealthy For Anyone To Lecture Them

- Jack Ma Kept Talking “Trust” – Did He Try To Signal He Won’t Scam Your Money?

- Meet Billionaire Stephen Hung, Who Just Ordered 30 Rolls-Royces For Louis VIII

- Imagine Obama As A Stock – At 38% Low, This Share Is Crashing!!

- Here’re Insider Reasons Why Malaysia Airlines Bailout Will Not Work

|

|

October 25th, 2014 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply