For a moment, we thought Alibaba could breached the US$100 a share and sent everyone on the trading floor jaw-dropping. But the stock hit its highest at US$99.70, just 30 cents of reaching the 100 bucks mark. On the first day of its listing on NYSE, Jack Ma’s baby was trading between the range of US$89.95 – US$99.70. After the closing bell Friday, Alibaba made an impressive 38.07% gain from the IPO price of US$68, to close at US$93.89 a share.

Besides Jack Ma, everybody on the NYSE trading floor was happy with the record-breaking IPO. It was like welcoming a rock star when Jack Ma arrived at NYSE. It opens at 92.70 dollars on 48 million shares, which dwarfed the Twitter opening. According to its regulatory filing, Alibaba’s profit was US$1.99 billion in the quarter ending on June 30, almost tripling that of the same period a year ago, while its quarterly revenue surged 46% to US$2.54 billion.

Alibaba’s major platforms include Taobao, China’s largest shopping site, and Tmall, where brands sell directly to consumers. It has also created a Paypal-like payment system Alipay to ensure transaction safety between buyers and sellers. Now that Alibaba share is worth US$93.89 a pop, the company is now valued at a mind-boggling US$231.44 billion. This means Alibaba has just raised US$29.7 billion, dwarfing previous record holder – VISA – which raised $17.9 billion in 2008.

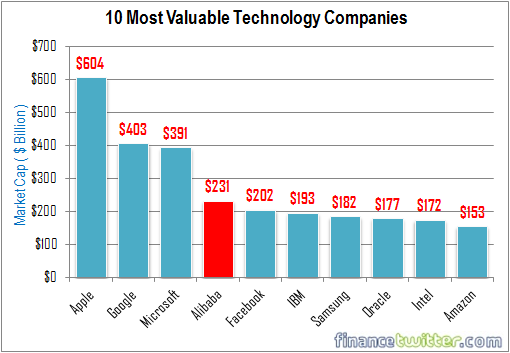

Amazingly, this also means Alibaba leapfrogged itself to be top-10 most valuable technology companies in the United States. It is now at the fourth spot, behind Apple (US$604 billion), Google (US$403 billion) and Microsoft (US$391 billion). Yes, Alibaba has a bigger market cap than Facebook (US$202 billion) and other famous brands such as IBM, Oracle, Samsung, Intel and even its rival Amazon.com.

But instead of talking about his success and all those boring stuffs a billionaire would normally bitch about, Jack Ma surprised everyone at NYSE Friday when he said his hero is “Forrest Gump”. Everytime the China richest man gets frustrated, he watches the movie. So, if you want to become like Jack Ma, who gained his passion and courage from Forrest Gump, make yourself useful by watching the movie again and again.

Nonetheless, the juiciest question is – should you get into the bandwagon as well, knowing Alibaba is bigger than Amazon and eBay combined? Well, perhaps you should digest a little bit more about the unchartered area about Alibaba. While Jack Ma was excited and happy about his company’s performance on the first day of IPO, he did say something quite extraordinary during CNBC’s “Squawk on the Street”.

“Today what we got is not money … What we got is the trust from the people,” Ma said. He further said the following when asked about Alibaba’s transparency – “Trust … Trust us, trust the market, and trust the young people. Trust the new technology. The world is getting more transparent. Everything you worry about, I’ve been worrying about in the past 15 years … I want to tell the investors, we take care of them”.

If you think the biggest problem with the company is the selling of counterfeit goods, you are dead wrong. What Jack Ma said about his company earning the trust from the people speaks volume about the hidden problem investing in the stock. Unlike IBM, Facebook or Apple, Alibaba’s IPO story relies on a legal but fragile structure known as V.I.E. (Variable Interest Entity) – required by the Chinese government for foreign ownership of certain industries, including Internet companies.

What does all this mumbo-jumbo means? It simply means, the moment you buy one share of Alibaba, you’re “NOT” actually buying shares in Alibaba China. But in reality, you’re getting a piece of paper in Alibaba Holdings Cayman Islands, while Jack Ma and partners are taking your money for real. Hence, you’re not getting any share in the Alibaba assets nor shareholder rights. You’re just getting a slice of the company’s profits.

Most of Alibaba’s Chinese assets are owned by Jack Ma and another founder and member of management, Simon Xie. The Cayman Islands company has contractual rights to the profits of Alibaba China, but it has no economic interest. The Chinese government forbids foreigners from investing directly in Internet services in China but they can invest in the security being offered in the IPO.

Hypothetically, if the China Government plays dirty and openly declare the V.I.E. structure illegal, there goes your money. In actual fact, the legality of V.I.E. model is already a huge question mark. In late 2012, the Supreme People’s Court of China invalidated a V.I.E. structure used by Minsheng Bank. The Chinese authority also stopped Walmart from using a V.I.E. to acquire a controlling stake in Yihaodian. China Unicom which used the same structure was also declared illegal and was forced to unwind.

In short, in an event of any future disputes, your legal arguments would be based on contracts between a Cayman Islands entity and one based in mainland China – not with the United States. But how can you fight your case if China Government does not recognize this V.I.E. in the first place? And one has to remember that in 2011 alone, Yahoo and Alibaba got into a dispute when Jack Ma transferred Alipay to another company he owned – without Yahoo’s permission.

And what could Yahoo do in that circumstances? Absolutely nothing. So, when you buy a single share in Alibaba, you’re at the mercy of Jack Ma and Mr. Xie, the holders of the Chinese assets of Alibaba. Jack Ma is basically running the show all by himself. Call him a dictator or whatever, but the United States’ S.E.C cannot ban offerings for being “too risky” or even for potentially being illegal. S.E.C can only request Alibaba to disclose it’s risk, which the company has done.

Sure, since you may be blinded by the Alibaba’s bullishness, you may say neither Jack Ma nor the Chinese Government would do such a disastrous thing. But that’s the risk you need to take and hopefully you don’t have to take your future disputes to the China Government. But hey, nowadays, who actually invest for long-term? Investors would probably buy and dump within the same day. So, perhaps what Jack Ma meant by “trust” was to believe he will (try his best) not scam your money.

Other Articles That May Interest You …

- Alibaba Jack Ma Raising Money Via IPO, But This Guy’s Raising Money Via Girlfriend Rental

- iPhone 6 – The Crazy Queue Starts In Australia, Because It Cost Triple In China

- Alibaba’s Jack Ma Is China’s Richest Man. Here’s Top-5 Richest People In China

- Apple Pay, iPhone 6 & Watch – Welcome To The Party, But You’re Late

- Want Cheap Smartphone? Here’re Two For You – $25 Nokia 130 & $110 Lumia 530

- Here’s How Xiaomi Secretly Steal Your Data For Chinese Govt, And How You Can Block It

- Here’s Proof That Apple Deliberately Slow Down Its Old Models, Before A New Release

|

|

September 21st, 2014 by financetwitter

|

|

|

|

|

|

|

First, I would like to congratulate Jack Ma. Second, I hope that he is trustworthy and honest. However, it is crazy for the Americans to push the share price of Alibaba to almost USD 100 when it is just listed without any proven record of profit making. It is dangerous. Warren Buffet would never buy this type of share.