Oil is back!! Oil is going bonkers!! Oil is going through the roof!! West Texas Intermediate (WTI) keeps hitting new high almost everyday since mid-April this year. From the low of US$42 a barrel, it’s now trading at US$60.86 a barrel. That’s roughly 43% rally in less than 2-months. Still, nobody dares to say the worst is over, nor dares to bet the black gold would go back to US$42 and lower. So, who knows the future oil prices?

The answer – “Allah”.

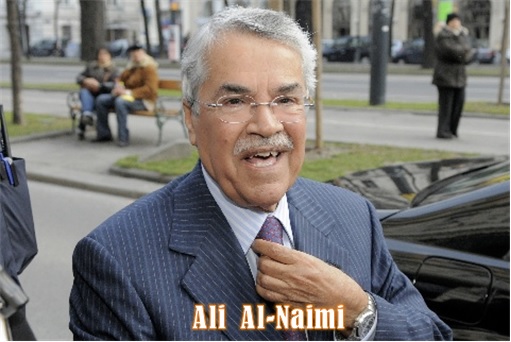

Before you jump the gun and start screaming till foam at mouth about us insulting Islam, the answer above didn’t come from us, or any economic specialists for that matter. Amusingly, it came from none other than the supposedly influential Saudi Oil Minister – Ali Al-Naimi – who said “no one can set the price of oil – it’s up to Allah.” That’s really funny, because why the heck the Kingdom of Saudi Arabia needs him, if the God has to do all the jobs?

The fact – Saudi Arabia is burning through its foreign reserves at a record rate to maintain its spending budget. The kingdom’s reserves have dropped by US$36 billion (£32 billion, RM129 billion) in two months alone. In February, it dropped US$20 billion, follows by a drop of US$16 billion in March. The country now has roughly US$708 billion left to burn, after spending about US$47 billion of foreign reserves since October last year.

If the rich kingdom burns an average US$20 billion a month, its reserves would be over within 3-years. But that will never happen, unless everybody stops using oil and gas in favour of solar power overnight. Al-Naimi insisted that he was “not worried at all” about the prospect of Iranian crude coming back onto the market if sanctions on Iran are lifted as part of an international nuclear deal. Of course, he was bullshitting.

While Saudi Arabia can maintain its decision not to cut production in order to maintain market share, it is equally worries about a continuous low oil prices. The country has been raising oil prices for sales to Asia in order to boost revenue, and that’s a single proof that oil prices does not depend on “Allah”, but Saudi government’s decision alone (*grin*). Obviously, the Saudi Oil Minister does not want to be seen secretly pushing up oil prices.

Apparently, Saudi is in a “Catch-22” situation. It realizes it can’t depend on oil commodity alone to fund its lavish spending, including the mega Kingdom Tower. It neither can lose face nor lose market share by cutting production. It can’t afford to have oil prices back to US$100 a barrel, which would benefit enemy Iran. It needs a nice balance so that it can buy time to diversify properly.

There’s no doubt that U.S. oil companies have been shutting down due to slumping prices. Last week, the U.S. oil rig count fell to 679, compares to 1,527 at the same time last year. But now that the price is back to above US$60 a barrel (WTI), the oil rigs could be back to business. And the cycle of lower oil prices repeats itself, again. One has to remember that the present rally is primarily due to “Yemen bombing” and “Libya protest”.

Theoretically, oil prices wouldn’t go back to US$110 a barrel. Saudi Arabia’s internal major re-engineering confirms that. The kingdom is set to open up its US$575 billion bourse to foreigner investors on June 15, although none would be allowed to own more than 10% of the stock market by value. They’re also spending tons of money on healthcare, the ICT sector, transportation and logistics, R&D, education and the mining sector.

While Saudi’s diversification takes years to realise, the immediate indicator for oil prices comes today. The EIA (Energy Information Administration) report to be released today will determine the direction of oil prices. How many million barrels have been built up in the U.S. oil supply since the last report? That inventory report will be your only indicator, for now.

Other Articles That May Interest You …

- Malakoff IPO – Billionaire Syed Mokhtar Needs Your Help (Money)

- BOOM!! – Here’re 6 Reasons Why US$30 Oil Is Haunting Again

- This Country Is So Badly Hit By Oil Prices That Having Sex Is Impossible

- Saudi King Abdullah Dies, Queen Elizabeth Now World’s Oldest Monarch

- The Answer To ISIS Invasion Threat – The Great Wall Of Saudi

- Victory For Women In Saudi Arabia – They Can Now Drive But …

- World’s Tallest Building In Saudi Arabia, Kingdom Tower

|

|

May 6th, 2015 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply