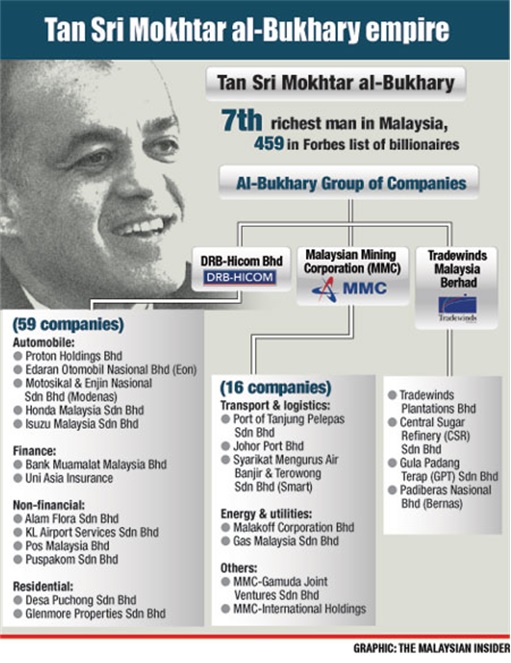

Low-profile tycoon Syed Mokhtar Al-Bukhary, the man closely tied to Malaysia dominant political party UMNO, and one of many cronies aligned to influential former prime minister Mahathir Mohamad, is offering about 1.5 billion shares in Malakoff Corp, a subsidiary of MMC Corp, in exchange for RM1.80 a share. If fully subscribed, the 1,521,740,000 IPO shares would bring in a whopping RM2,739,132,000 new fund.

Institutional investors are being offered 1,279,240,000 shares while the remaining 242,500,000 would be allocated to retail investors including staffs of Malakoff. Should the company decides to exercise the over-allotment option, the total shares offered will be increased to about 1.75 billion, raising a mind-boggling RM3.15 billion (US$870 million, £580 million). So far, this is the biggest IPO offering in Southeast Asia, for this year.

Flashback – MMC announced privatization of Malakoff in May 2006, offering RM10.35 a share and had acquired all its assets and liabilities for a total cash consideration of RM9.3 billion, valueing the company at RM16.8 billion. Subsequently, Malakoff was delisted in 2007. About 8-years later now, billionaire Syed Mokhtar makes a comeback with the same valuation when it was privatised in 2006.

This latest IPO offering is so huge that the main underwriter, Maybank, is roping in big names such as Credit Suisse, JP Morgan, Bank of America, Merrill Lynch, Deutsche Bank, HSBC and Morgan Stanley. In case you didn’t know, Malakoff is the largest IPP (independent power producer) in Southeast Asia, generating 6,036 megawatts. It’s other business involves water desalination, producing about 358,850 cubic meters of water.

Presently, Malakoff has a total of 6 operational plants in the country, with one (Tanjung Bin Energy in Pontian, Johor) under construction and is scheduled to start operations in March 2016, adding 1,000 megawatts to the company’s local capacity of 5,346 megawatts. The company also owns 4 plants (power and water desalination) in the Middle East, North Africa and Australia – Kuwait, Bahrain, Saudi Arabia, Algeria and Australia.

So far, it was reported that the institutional investors have gobbled and oversubscribed the IPO shares by more than two times. But what does Malakoff plans to do with the new fund from this IPO exercise? The company claims that the initial IPO proceeds will be used to fully redeem RM1.8 billion Junior Sukuk Musharakah while the balance will be used for future business expansion, working capital fees and expenses for the listing exercise.

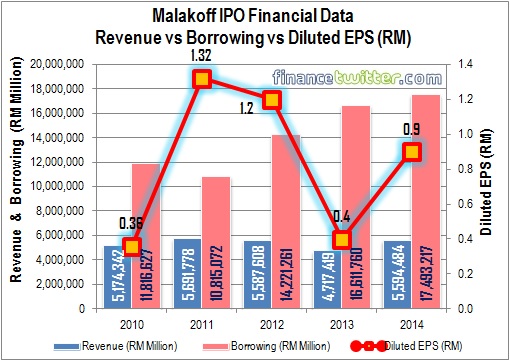

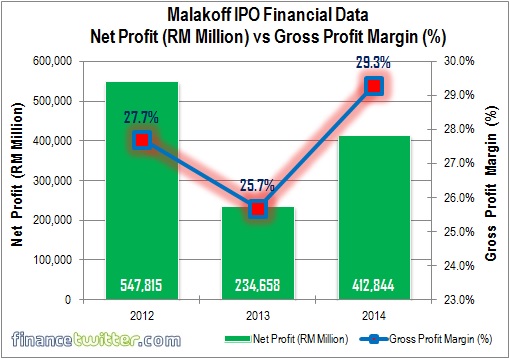

It was the intention to save RM113.4 million annually by means of early redemption of the sukuk that Syed Mokhtar is asking for your help, or rather your money. The problem with this company is its massive loans and borrowings, which have ballooned to RM18.158 billion (US$4.96 billion, £3.32 billion). This triggers another question – will investors lose money the same way FGV (Felda Global Venture) investors did?

Clearly, it’s not easy to forget how the marketing hypes about FGV IPO, then trumpeted as the world’s second largest IPO of the year, has turned into nightmares when investors are poorer by more than 50% today. But Malakoff is not FGV. While FGV depends heavily on global palm oil prices, Malakoff relies on global oil prices. However, unlike FGV, Malakoff’s profit is almost guaranteed when it sells back to sole distributor Tenaga Nasional.

In short, the only major risk for Malakoff is when Tenaga Nasional Berhad fails to make payments under PPA. However, Tenaga Nasional has not fail for once in making such payments. Tenaga itself is profitable every year, and if its shareholders need more profit, they’ll simply raise tariff rate so that consumers are “forced” to pay. Heck, forget about the complexity of the business.

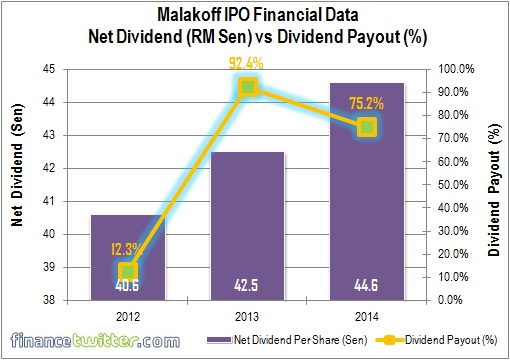

The only reason why investors scramble for Malakoff IPO is for its dividend, and that’s precisely the marketing talk Malakoff is trumpeting in its prospectus. The company is offering a dividend payout ratio of at least 70% of its profits. Interestingly, it has been paying handsome dividends for the last three financial years. Of course, they may not be able to pay any dividend at all, as highlighed in its prospectus, as part of the risks

Still, considering Malaysian Public (non-Malakoff and subsidiaries’ staffs) would only be left with 150,000,000 issue shares to fight for through balloting, it could be easily oversubscribed. And out of that 150 million shares, half of it (75,000,000) have been set aside for application by Bumiputera (*grin*). Hence, the public would be fighting for only 9.85% of the total IPO shares.

Based on a study by Frost and Sullivan, Malakoff is now contributing 24.9% of Malaysia’s power generation capacity. So, Malakoff is a different animal as compared to its delisting 8-years ago. It has expanded ferociously. Investors also take comfort that the company will see the inclusion of some new cash cows such as Port Dickson Power Plant, Macarthur Wind Farm in Australia, Hidd IWPP in Bahrain and Al Ghubrah IWP in Oman.

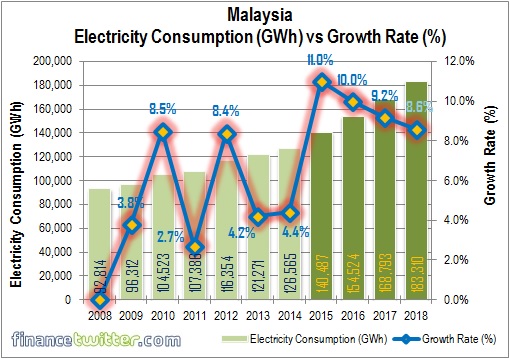

What this means is Malakoff has almost doubled its effective power generation capacity from 3,128.7 megawatts in 2007 to the present 6,036 megawatts. Frost and Sullivan also forecasts growth in electricity demand in Malaysia at 9.7% annually between 2014 to 2018, while Saudi Arabia, Algeria and Bahrain are expected to grow at 6.3%, 7.5% and 4.1% respectively during the same period.

As much as we like Malakoff’s boastful statement about increasing its power generation capacity to 10,000 megawatts and water production capacity by 150% by 2020, we think the IPO price is rather pricey. In an enlarged 5 billion floating shares, at RM1.80, it translates to a 21.4 times 2015 estimated PE (price earnings) based on a forecast earnings per share of 8.4 sen and net profit of RM420 million.

At PE ratio of 21.4, that’s higher than Tenaga Nasional’s 11.6 times. Perhaps Malakoff uses Petronas Gas PE ratio of 24.6 times as guidelines. If it’s true, then there’s an upside of RM0.30 profit for Malakoff share price post-IPO. Better still, if Malakoff could reach the same PE ratio of Petronas Dagangan, the share could jump to RM4.20 a share to reach PE ratio of 50 times. Perhaps that’s what Syed Mokhtar (and investors) hopes for (*grin*).

Other Articles That May Interest You …

- 1MDB Scandal – An Ali-Baba “Scam” Partnership Goes Bust

- BOOM!! RON95 Cheapest Since 2008 Recession, But Nothing Else’s Cheaper

- How To Save Money This Year – 15 Exciting Tips

- Budget 2014: Sugar & GST – Newly Found Cash Cows

- Budget 2013 – What the Govt Doesn’t Want You to Know

- FGVH IPO – What You Should Know Before Investing

- Govt, TNB & IPP Milking Petronas & People – These Charts Tell All

|

|

April 22nd, 2015 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply