Did you make any pocket money since our last bitching article? No, not the one about stocks related to Najib’s cronies. The one about all hell breaks loose when the local currency “Ringgit” breaches the psychology RM3.80 to a US dollar. Was it a coincidence that ringgit spiked into toilet bowl on Aug 4, the day Najib’s RM2.62 billion was declared as donation?

Yesterday, Malaysian “Ringgit” was so bloody valuable that for every US dollar, you need to fork out RM3.9225 at one point. It seems Bank Negara (Central Bank) doesn’t really care about spending money to support the currency. Anyway, Governor Zeti couldn’t care less because she’s currently in deep shit herself. And the foreign reserves isn’t promising either.

Let’s see what had since happened to the 1MDB special task force, supposedly set up to investigate Prime Minister Najib Razak’s pet project. It has been disbanded. The Attorney General has been sacked. The MACC’s Chief Commissioner has gone on leave, leaving his men behind as sitting duck ready to be slaughtered by “special police force”.

And since the Inspector General of Police is now under the control of new Deputy Prime Minister Hamid Zahidi, which means the next target is Governor Zeti. Like it or not, she’s trapped and it’s a matter of time before she is sacked or forced to resign. Either way, she’s tainted with dirty money from the 1MDB scandal.

She couldn’t pretend to do not know about the RM2.62 billion “donation” from some wealthy “Pak Arabs”. Neither could she admit knowing about the money because that would mean she was involved from the very beginning. The only reason why Najib doesn’t want to slaughter her now is to prevent a market backlash.

International community is still laughing at how PM Najib saves himself by sacking the prosecutor who was investigating him. And they haven’t stop laughing at how police were being used to investigate investigators (MACC) who were investigating 1MDB. If Governor Zeti is sacked, ringgit could easily hit another record of above RM4.00 to a US dollar.

Here’s the Catch-22 situation. The whole market has lost its confidence on Najib administration. If Najib remains as the country’s prime minister, the stock market and local currency would have tough time recover. But if Najib resigns, which very likely he wouldn’t, Deputy PM Zahid Hamidi doesn’t carry enough credentials to convince the market.

As the 12th largest pension fund in the world, Malaysian EPF with assets of US$175 billion has been selling in the local stock market. Below are some net selling done by EPF since Monday of the week, which contributed to the fall of KLCI. At the same time, PNB had sold 25,000,000 shares of Maybank. They also tried to support Tenaga Nasional and Telekom but the results speak for themselves.

- Sold 4,000,000 shares of DiGi

- Sold 778,400 shares of Petronas Gas

- Sold 4,445,700 shares of Ambank

- Sold 3,000,000 shares of Sime Darby

- Sold 3,518,400 shares of Public Bank

- Sold 1,440,300 shares of Hong Leong Bank

- Sold 661,400 shares of Maxis

- Sold 7,764,000 shares in IHH

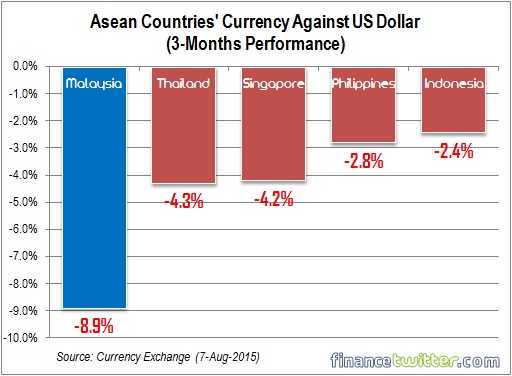

Malaysian Ringgit has lost 8.9% of its value since 3-months ago against the US dollar; compares to Singapore Dollar, Thai Baht, Indonesia Rupiah, Philippines Peso, which losses 4.2%, 4.3%, 2.4%, 2.8% of their values respectively. Vietnam and Cambodia currencies have actually appreciated against the US dollar.

Against its neighbours, Malaysian Ringgit lost 2.8% to Singapore, 3.8% to Thailand, 4.9% to Indonesia. Within the same 3-months period, the ringgit also losses 7.6% to Chinese Renminbi, 4.1% to Japanese Yen, 2% to Korean Won, and even a staggering 7.9% to Pakistan Rupee and 8% to Indian Rupee (*grin*).

The question is: how low could “Ringgit” go against not only the US dollar but also against currencies of its trading partners? Would ringgit breach the next dreadful level, which is RM4.00 to a US dollar? Why not, considering that during the climax of 1997/98 recession, the ringgit was traded as low as RM4.73 to US$1 dollar.

But there’s no economic crisis now, you may argue. Well, Najib Razak himself is a crisis. If a prime minister can pocketed RM2.62 billion and walks away a free man running the country, what is there to stop him from becoming the ultimate major shareholders of all the 940 public listed companies in the stock exchange? It’s the “Crisis of Confidence” that’s hitting the country.

Other Articles That May Interest You …

- The Glory Days Are Over – OPEC Warlord Saudi Has Started Borrowing

- Cleared & Innocent!! Now The World Must Apologise To PM Najib

- Ringgit Is Toast – Here’re Proof Malaysia The First Asian To Hit Recession

- Are You Ready For Crazy Oil Prices At US$30 A Barrel?

- CIMB-RHB-MBSB Mega Merger – The Danger Of Creating A Too-Big-To-Fail Biggest Bank

|

|

August 7th, 2015 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply