RHB was incorporated in 1983 by Tan Sri Abdul Rashid Hussain. That was more than 30 years ago. Many of our readers were not even born yet. Of course, the founder was not a “Tan Sri” yet, and the company was not known as RHB as in Rashid Hussain Berhad. Many didn’t know that the company started as a small pure “securities” firm without the banking arm attached – Rashid Hussain Securities (RHS).

Do you also know that there was another low-profile co-founder? Yes, Rashid Hussain, who is also the son-in-law of Robert Kuok (richest man in Malaysia with net worth of US$11.7 billion), didn’t established RHS alone. The brain behind RHS was co-founder Chua Ma Yu. It was Chua Ma Yu that RHS grew to become the biggest stock-broking firm in the country before the 1997 Financial Crisis.

Nevertheless, it was Rashid Hussain’s close relationship with Daim Zainuddin, the former Finance Minister and possibly one of the richest person in Malaysia, that got the former into banking industry and catapulted him as a “banker”. Rashid Hussain was one of Daim’s protégés. In fact Daim Zainuddin, Chua Ma Yu and Rashid Hussain were closely connected and they treated the then KLSE (Kuala Lumpur Stock Exchange) as a “casino” where they would go in and out to make pocket money, whenever they like.

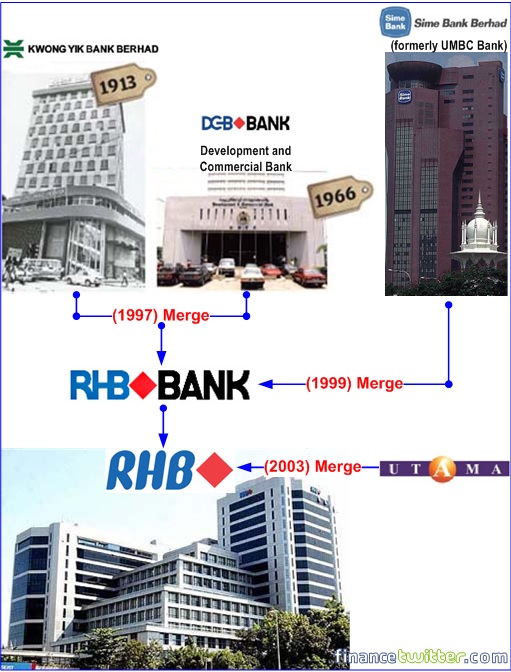

If the exposure by former Cabinet Minister Sanusi Junid was any indicator, Rashid Hussain was lucky to be at the right time at the right place when former PM Dr Mahathir and former Finance Minister Daim Zainuddin conspired not to give banking licenses to non-Malay. Hence the plan to eliminate Chinese-owned banks disguised under “Merger and Acquisition”. Forcefully, Kwong Yik Bank and DCB Bank were merged in 1997 into RHB Bank – to become the third largest bank.

The celebration was short-lived as three months later, the financial crisis hit Asia. Needless to say, RHB was badly hit due to over-exposure. But perhaps his biggest mistake was in extending loans to Ling Liong Sik’s son (Ling Hee Leong) as part of the politician’s ambitious plan to jump-start his son as an instant billionaire via acquisition of Rekapacific Berhad (now defunct).

After Rashid Hussain sold his remaining 17.3% stake to Utama Banking Group (now defunct) in 2003, which in turn was sold to EPF (or rather bail-out), the founder was sued by the very same company he once founded for a total sum of RM1.43 billion for alleged breach of fiduciary duties and alleged negligence in 2005. That was roughly the loan figure (RM1.2 billion) that Ling Liong Sik’s son got to become a billionaire, though Ling junior didn’t make it. Later, the lawsuit was dropped suddenly without any good reason.

Now with the mega-merger between CIMB Group, RHB Capital and Malaysia Building Society Berhad (MBSB) to create Malaysia’s largest banking group, the iconic “Rashid Hussain” name would be erased from the banking industry. The ambitious plan will dwarfed the present biggest bank – Malayan Banking Berhad (Maybank).

The combination of CIMB, RHB and MBSB would have total assets of RM613.7 billion (Maybank’s RM578 billion), market capitalization of RM88.4 billion (Maybank’s RM91.22 billion), net profit of RM7 billion (Maybank’s RM6.55 billion). In short, CIMB may have to pay a whopping RM36.7 billion (US$11.52 billion, £6.72 billion) to become the biggest bank, based on price-book multiple of 1.75 times.

That would value RHB and MBSB at RM11.80 and RM2.55 a share respectively. Thus, CIMB would pay a staggering RM30.09 billion and RM6.69 billion for RHB and MBSB respectively, albeit in a share-swap deal. Interestingly, this merger happens days after Nazir Razak – brother of PM Najib Razak – relinquish his position as CIMB Group CEO to take over the chairmanship. At the same time, he was also appointed to the powerful Khazanah Nasional Berhad’s Board of Directors.

But why the needs to create such a mega-merger now? It was not like either CIMB, RHB or MBSB were in bad shape that they need a bail-out. Considering Malaysia’s population of merely 30 million, how small is the number of banks that can be considered strong and healthy? The country had merged its 54 banks prior to 1997-1998 Financial Crisis to the present 9 banks. Is this not an ideal figure?

Surely it wasn’t done in the interest of the minority shareholders. The fact that Bank Negara (Central Bank) gave the three financial institutions approval in less than 24 hours after they wrote to it is a sure sign that it is in favour of the merger. But the fact that the authority agrees to the 90-day exclusive clause agreement also shows that minority shareholders are not getting any better deal from other interested parties.

The lame excuses given – RHB is not being sold and to minimize disruptions. Was this a pre-planned move to fulfill PM Najib’s dream to install his brother as the supremo of the largest bank in the country? Or was it to simply fulfill Bank Negara governor Zeti’s ego to establish a mega Islamic bank with a capitalization of US$1 billion (RM3.2 billion) as her trademark, before her contract expires in 2016?

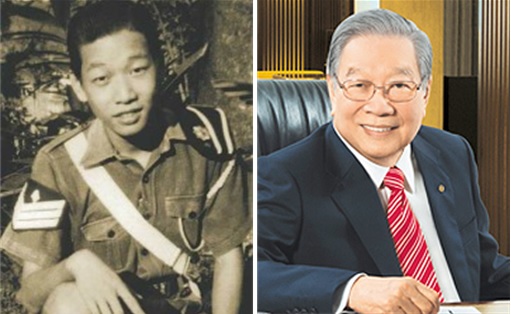

Coincidently, Public Bank surprised the market when it proposed a RM5 billion rights issue 2-months ago, deliberately “over capitalising” it in terms of its capital requirements for Basel III. With paid up capital of over 3.88 billion shares, market capitalization of RM77.95 billion, price-to-book valuation of 3.4 times, Public Bank is now the most expensive bank to be acquired.

So, did 84-year-old Teh Hong Piow, who owns 24.08% of Public Bank, actually knew something was cooking in CIMB, so much so that he didn’t blink his eyes about pumping RM1.2 billion of his own money for the rights issue exercise? Did CIMB plans to acquire Public Bank instead in the first place? Perhaps it was both – to acquire RHB and MBSB, together with Public Bank. If it’s true, then Teh Hong Piow has save the bank he founded some 48 years ago from a “force merger”, at least for now.

One has to remember that CIMB was the result of a merger between CIMB, Bumiputra-Commerce Bank and Southern Bank Bhd in 2006. But the merger was infamous due to its hostile nature – the “very successful” Southern Bank’s Tan Teong Hean was “forced” to sell it to Nazir Razak, the same brother of the then Deputy Prime Minister Najib Razak. Tan Teong Hean was simply no match for Nazir Razak’s strong political connections.

It shouldn’t surprise local bankers if the grand plan was to merge CIMB with RHB, MBSB and Public Bank to create a super duper bank with total assets of RM926.22 billion, market capitalization of RM166.35 billion and net profit of RM11 billion. This will be twice the size of Maybank and will certainly make Najib Razak proud. After Southern Bank, Public Bank is the “most successful” bank and it makes perfect sense for Nazir Razak to repeat his stunt again – forcefully take over Public Bank.

The only justification that makes sense for this CIMB-RHB-MBSB merger was the needs for EPF to go back to its role as a passive investor instead of an active one as of now. EPF owns 40.76% in RHB, 64.73% in MBSB and 14.46% in CIMB. But EPF has nobody to blame but itself for bailing out RHB thus taking an active role. Besides, if EPF can drives RHB for the last 10-years, it can surely continue to do the same without the need to rush into creating another giant bank.

Unless of course, there is the hidden risk of a recession coming soon. Unlike the 1997-98 Financial Crisis, the next recession would be due to property bubble. That was the reason the earlier measures to cool down the industry. And with the OPR (overnight policy rate) being raised by 25 basis point to 3.25% last Thursday, the writing is already on the wall that the government is getting ready for the worse.

Beside ignoring the interest of minority shareholders, there’s another risk for creating the biggest bank from such a merger. Taking the cue from United States’ 2008’s subprime crisis, a merged CIMB-RHB-MBSB will enjoys “too-big-to-fail” advantage. Just like Federal Reserve, Bank Negara and the Malaysian government would need to bail out this giant should it fails at a later stage. What that means is taxpayers’ money will again be used to bail out the “New CIMB” bank.

There’s also the problem of eliminating redundant branches and employees after the merger, not to mention the losing of competitiveness among banks to serve small businesses and individuals better. The new CIMB will become an arrogant animal which will care for nothing but its bottom line. And it can afford to do so, because the government would be at its mercy since the giant is Too-Big-To-Fail.

Other Articles That May Interest You …

- 30 Investing Tips & Tricks You Won’t Learn At School

- The Return of Daim Zainuddin’s Monopoly Game

- Hong Leong to Acquire Public Bank – A Matter of Time?4

- PM Najib’s Cronies and their Related Companies

- From stockbroker to selling ePetrol, goldmine for Rashid?

- The Rise, Fall and Re-emerge of Rashid Hussain Again?

- Does CIMB Plans to acquire more Banks?

- Chua Ma Yu sets to make Good Money Again

|

|

July 13th, 2014 by financetwitter

|

|

|

|

|

|

|

Comments

Maybe … that’s the general market perception … but why Teh Hong Piow deliberately “over capitalizing” his bank? … what was he afraid of?

Too big to fail?

Anything concrete mentioning that been big can cushions malaysia’s high deficit economics?

Even if EPF can bail out how long can epf bail out a mega bank?

cause been mega, had to be maintain and sacrifice the smaller one.

example a company with 80k employees and a company of 1k employees who is to save?

i think keeping multiple banks still best.

At least we do not depend on 1 bank. More brains in banking is better than 1 brain.

Get that facts. if not for personal gain. maybe to catapult a person into a forbes world top 10 list, or else what is the gain from banking operation mergers?

Not racist.

Politician like to racist to split among rakyat, so that rakyat will follow what they say. The aim is always benefits to themselve, not the rakyat or any race.

why you people, when you don’t get a license, you always blame because goverment conspired not to give licenses to non-Malay. i’m Malay and i also discriminate from this. So, pls dont be racist. just look as a cronyisme

I think PB is gearing up to acquire a smaller bank, not to be acquired by CIMB.

It is better to keep 1 or 2 chinese banker to create the illusion of ‘non-racial’ approach.

My bet is, PB will acquire AmBank or Affin. They are probably aiming for 5 big banks.