Finally, Federal Reserve Chair Janet Yellen found her spine when she raises rates for the first time since 2006. For as long as one can remember, she has been accused of delaying interest rate hikes – deliberately – to protect big boss President Obama so that businesses could be stretched for survival and unemployment kept low, until the president’s final year.

Now that the rate has been hiked by 25 basis-points, the next president could have a real problem – “recession”. The FOMC took the rate to zero exactly seven years ago, on Dec. 16, 2008. The latest hike is the first increase since the panel pushed the key rate to 5.25% on June 29, 2006. Banks would move their rate from 0%-0.25% to 0.25%-0.5%.

Warren Buffett-owned Wells Fargo was one of major banks that announced it would increase its prime rate to 3.5% effective Thursday. Other banks quickly followed – Deutsche Bank, Citibank, U.S. Bancorp, JPMorgan Chase, HSBC, KeyCorp, M&T, BMO Harris Bank, SunTrust, Huntington Bancshares and Bank of America, just to name a few.

While time will tell if Yellen has been keeping rates too low for too long, the fact remains that the low rates, together with US$3.7 trillion (that’s a “T”, not “B” and certainly not “M”) in money printing known simply as quantitative easing (QE), did very little to boost the American’s economy.

Throughout the 7-year of zero rates, the U.S. annual growth has never gone above 2.7%, the worst recovery since the 1929 Great Depression. On the bright side, the stock market has boomed during the period of zero rates, rising 207% since the March 2009 low point. Unemployment (although mostly part-time jobs) has fallen to 5% while inflation was kept at 1.3%.

But why hasn’t Yellen continued the zero rates for one more year before President Barack Hussein Obama retires for good? That’s because the Fed policy has entered a dangerous stage. Cheap interest rates have allowed companies with lower credit quality to borrow in record numbers at low cost. At least three junk funds have collapsed recently.

If Janet Yellen continues to stubbornly defend the zero rates policy, a situation similar to 2008 sub-prime crisis could explode. There would be toxic non-performing loans all over the streets. By then, the Fed could do next to nothing because the rate was already near zero so it can’t be lowered anymore, unless they adopt negative rate policy, which could be even more disastrous.

With the Federal Reserve raising rates for the first time in 9 years, higher borrowing costs might spark a credit crunch in Asia and hurt growth too. Non-banking sectors around the world have borrowings to a whopping US$9.8 trillion, according to the Bank for International Settlements (BIS). Although the dollar has already appreciated, the interest rate hike will strengthen the greenback even further.

Andrew Tilton, chief Asia-Pacific economist at Goldman Sachs, noted that many Asian economies have seen a rapid build-up in debt, especially China, Thailand and Malaysia. It will be more expensive to service U.S. dollar denominated debt when local currencies decline and greenback rises.

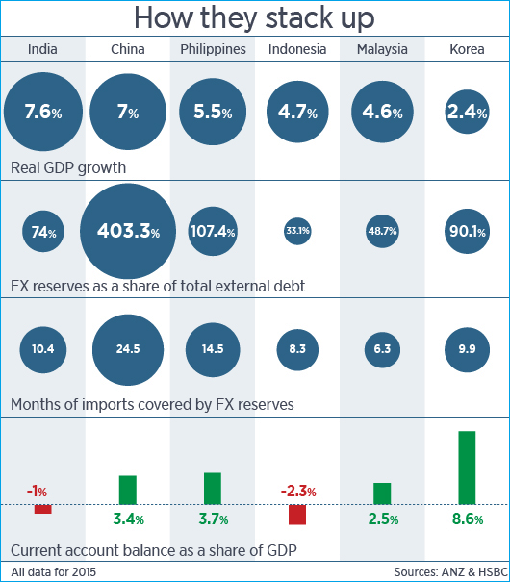

According to a report from the Institute of International Finance (IIF), net capital flows for global emerging markets will be negative in 2015. Still, emerging market countries have different ability to weather the impact of higher interest rates. Indonesia and Malaysia have suffered due to the slump in commodities, hence their currencies have been getting the beatings.

India and the Philippines have done better because they depend more on domestic consumption. Lower crude oil prices also helped the inflation in both countries. China, in its attempt to prevent a hard landing, has been intervening in the currency market such as the yuan devaluation. If situation gets bad for Indonesia and Malaysia with the latest rate hike, then next year could be worse.

Here’s why – the latest 0.25% rate hike will not be the last because the Wall Street expects 3 more hikes next year (2016). And FOMC pretty much confirms that when the Fed sees rates to be around 1.375% at end of 2016. About 60% of respondents polled think the next hike will be in March 2016, and they think the probability of a recession to hit in the year 2016 is 22.9%.

With the rate target moved from 0%-0.25% to 0.25%-0.5%, and major banks wasted no time in increasing their prime rate to 3.5%, you can basically do the Maths when the Fed eventually moves the rates to 1.375%. So, if you have lots of loans such as house mortgage or car loans, not to mention mountains of credit card debts, get ready to be squeezed (*evil grin*).

Other Articles That May Interest You …

- Next Year – 2016 – Will Be A Tough & Volatile Year For Businesses

- Get Ready For A Second Round Of Chinese Yuan Devaluation

- Forget About US$30 Oil Price – It Could Hit US$20 Per Barrel Next Year

- Here’s Why Turkey Could Be Alone In A “Nuclear War” With Russia

- Russian Jet Shot Down – How Putin Brilliantly Turns It To His Advantage

- Paris Attacks – Western Superpowers Playing With Fire They Couldn’t Control

- These 8 Charts Show How China’s Economy Meltdown Spreads To The World

- Flashback Of 1997 & Today’s Financial Crisis – Here’s Why You Should Be Scared

|

|

December 17th, 2015 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply