Flashback: From a record low of RM2.10 to US$1 in October 1978, the Malaysian Ringgit hit its all time high of RM4.73 to US$1 in January 1998. Prior to the infamous Asian Financial Crisis, the ringgit was trading at about RM2.40 to a US dollar in 1997. Nobody could have predicted the type of economic havoc that was waiting for them, not even then PM Mahathir.

After all, everybody was still partying from the 1993 Super Bull Run. Just like the 1997 Financial Crisis, the 1993 Bull Run was an equally surprise to Malaysians. Nobody had predicted both events – the 1993 Super Bull Run and the 1997 Asian Financial Crisis. But who can blame them when the internet was still an alien, the same way Star Trek spaceship is to us today.

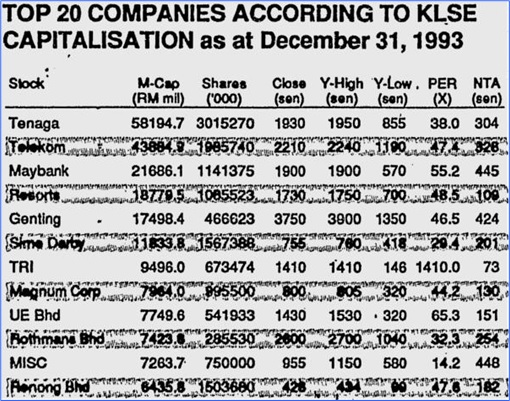

It was called a “Super Bull Run” for a reason. During the peak, there were as many as 130 public listed companies in the then KLSE (Kuala Lumpur Stock Exchange) with market capitalization of above RM1 billion as of Dec 31, 1993. That’s right – it had more than double the 46 billion-ringgit companies registered at the end of 1992, a year before.

It was like a heaven with money drops from the sky every single day. The KLCI (Composite Index) skyrocketed from 631.36 at the end of 1992 to 1,275.32 as of end of 1993. By today’s comparison, you may think that was not much. But with the KLCI at 1,275; TENAGA was traded at RM19.30 a share, TELEKOM – RM22.10 / share, MAYBANK – RM19.00 / share.

RESORTS was at RM17.30 / share, GENTING – RM37.50 / share, PROTON – RM13.00 / share and the list goes on. And what were the prices of these shares today? Even before KLCI’s collapse from 1,800 points to today’s 1,570 points, they were no match compares to the 1993 crazy stock prices, without taking into account stock splits etc.

However, net portfolio investment shrunk RM22 billion, from positive RM10.3 billion in 1996 to negative RM12.9 billion in 1997, leading to a collapse of the stock market. Right under Mahathir’s nose, the economy contracted 14%, with GDP growth plunging from positive 7.7% in 1997 to negative 6.7% in 1998.

The Malaysian stock market dropped dramatically from almost 1,300 in February 1997 to a low of 262 in early September 1998, eighteen months later. The interest rate was raised to double-digit at 11% in an attempt to stop foreign funds outflow. It didn’t work and the stock and property market bubbles burst.

Instead of admitting his administration’s weaknesses, Mahathir bitched about “currency trading as unnecessary, unproductive and immoral; and should be stopped and made illegal” at a Joint World Bank-IMF seminar in Hong Kong on 20 September 1997, but not before calling George Soros a moron and repeatedly said Malaysia’s fundamentals were strong.

Mahathir’s remarks were seen as a desperate man in “denial” who had gone bonkers running amok blaming everyone but himself. On 3 September 1997, Mahathir created a special RM60 billion fund (from EPF, Petronas, Khazanah) for selected Malaysians (cronies) but the money wasn’t enough to bail out all of them.

Today, the same cycle is repeating itself. If you care to check and monitor, Malaysia Bank Negara (Central Bank) had intervened in a huge way last Friday to prop up the ringgit from breaching RM4.10 to US$1, the same way it’s doing it this morning as we speak now. Whether they would eventually run out of bullet in reserve and give up remains to be seen.

Just like Mahathir during 1997, Governor Zeti, Minister in the Prime Ministers Department Wahid Omar and even Prime Minister Najib Razak has been parroting like a broken record that the country’s fundamentals are strong. Today’s scenario is different from the 1997, say Wahid and Najib. Heck, Najib had the cheek to poke fun at Mahathir that the ringgit was worse in 1997.

I really hope that Najib hadn’t said that, seriously. Since he’s still tainted with 1MDB’s RM42 billion debt and RM2.62 billion “donation” money, his remarks would be seen as a desperate man in “denial”. He should watch his mouth because the last time Mahathir did the “blaming and bitching game” in 1997; more foreign funds were seen exiting.

The genius Wahid also justified that in 1997, the country’s reserve was below US$30 billion and borrowings among companies were high. True, Malaysia’s reserve is higher today but its depleting fast to US$96.7 billion as of July 31 from US$100.5 billion just 15-days earlier. And the central bank has burnt US$25 billion defending the ringgit since July 2014.

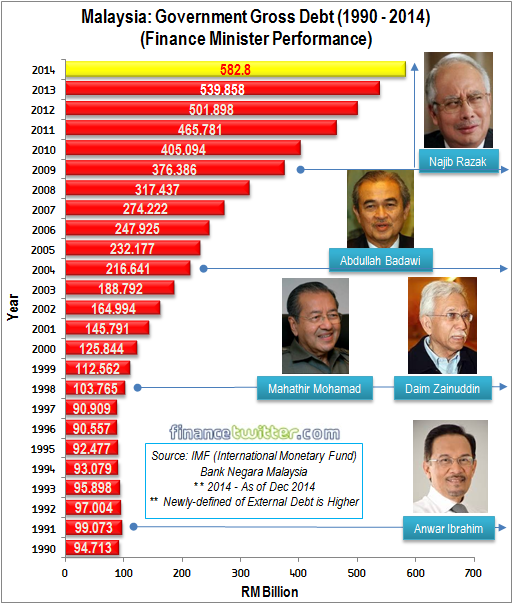

True, the borrowings among companies today are not as high as those during the 1997 crisis. But he conveniently forgets to mention about Malaysia’s household debt. The ratio of household debt to gross domestic product (GDP) rose to 87.9% in 2014, with total debt at “RM940.4 billion”. Most importantly, the ratio of household debt to income is 146%. Did he also deliberately miss out the government external debt, which has tripled to RM740 billion?

Now, do you know why Madam Zeti wasn’t in favour of raising interest rate, even though the ringgit is being slaughtered? Not only would it be an admission that the country is in trouble, but it would immediately send the country into depression. Why? That’s because a raise in interest rate would burst the RM940.4 billion debt bubble, baby.

But for how long can Najib administration resists a rate hike, considering the U.S. Federal Reserve is about to do so next month? The collapse in stock market is only the first step towards a recession. This time, you don’t need George Soros to send ringgit into toilet bowl. External and internal factors would gladly do the favour.

In 1997, the country was under attack only by currency speculators. In 2015, the country is under attack by low crude oil and palm oil prices, China Yuan devaluation and economic slowdown, 1MDB RM42 billion debts, political instability, and Najib’s RM2.62 billion scandals. But these are not the scariest part.

What foreign funds are freaking out is whether Najib administration would do a similar Mahathir in 1997. In case you’ve missed this out, Mahathir regime had imposed a 12-month ban on outflow of external portfolio capital and pegged the ringgit to the US dollar. Sure, Najib can screams till foam at mouth every day about sustainable economic growth, solid fundamentals and whatnot.

His regime can also choose to swear on the Quran that they would never re-peg the local currency and impose any restriction on capital repatriation. But why should the foreign funds believe Najib the son of Razak, who has been caught lying multiple times? After all, a bird in hand is worth two in the Najib’s bush, cheekily speaking (*grin*).

Other Articles That May Interest You …

- SR Strikes Again – Quick Najib, We Love To Hear More Lies

- Thanks, “Taichi Queen” Zeti – Now Everyone Can Do Money Laundering

- Here’s Why China’s Yuan Devaluation Is Such A Big Deal

- The Seven Hundred Million Dollar Man’s Fate Depends On The Ringgit

- A Remaking Of 1997 Asian Financial Crisis By Najib Razak In 2015

- Cleared & Innocent!! Now The World Must Apologise To PM Najib

|

|

August 17th, 2015 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply