For the first time in 40 years, a ship loaded with U.S. crude oil set sail for foreign shores Thursday. The mission: to sell the black gold to an international trading company Vitol Group, a Dutch oil-trading powerhouse. The Bahamian oil tanker – Theo T – departed from the Port of Corpus Christi, about 160 miles north of the Texas border with Mexico.

NuStar Energy and ConocoPhillips overtook Enterprise Products Partners LP, which said it expected to load the first oil export cargo in Houston during the first week of January, as the first companies to sell American light crude oil internationally. The oil was pumped from the Eagle Ford Shale of South Texas at NuStar’s North Beach Terminal at Port Corpus Christi.

The U.S. exported oil as early as 1913, and Japan was one of its biggest buyers in the 1930s. However, during World War II, President Franklin D. Roosevelt enacted an oil embargo that cut off shipments to Japan in 1940, contributing to the bombing of Pearl Harbour. Thereafter America’s economy expanded and needed more oil so much so that the country became a major importer of crude in the 1950s.

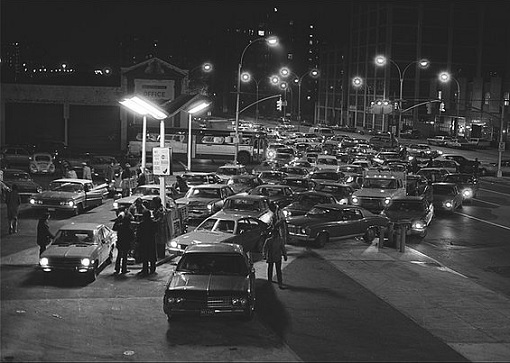

Oil imports into the U.S. nearly quintupled during the 1970s but thanks to its military support for Israel in its 1973 war with Egypt and Syria, Arab oil producers, led by OPEC kingpin Saudi Arabia retaliated and imposed an embargo against the United States on October 1973, triggering the infamous 1973 Oil Crisis.

The Arab Oil Embargo of 1973-74 caused long gas station lines, soaring fuel prices and rationing for American drivers. By the end of the embargo in March 1974, the price of oil had risen from US$3 per barrel to nearly US$12 globally. Interestingly, U.S.’ ally back then, the Shah of Iran – Mohammad Reza Pahlavi – had kept on producing and exporting to America.

As a result of the Arab Oil Embargo, the U.S. imposed price controls and rationing as well as export ban in 1975. But the shale revolution would transform America into an energy powerhouse. In fact, the U.S. was the only major oil-producing country in the world that bans the export of crude until President Barack Obama signed legislation lifting the ban about 2- weeks ago.

The U.S. shale industry – mining oil from sedimentary rocks – employs two million people, about 25% of the jobs created since the 2008 financial crisis. Shale firms invest about US$100 billion a year, or about 7% of United States’ total annual capital investment. U.S. crude oil inventories have grown from 350 million barrels in 2014 to more than 480 million barrels last year (2015).

Everything is upside down in the U.S. oil industry. A previously idled 60-mile pipeline from Pettus to Corpus Christi has been “re-activated”. Two other pipelines that previously transported imported oil from the Port of Corpus Christi have been “reversed” to make the export of Texas crude possible.

It was reported that San Antonio’s NuStar Logistics, which controls the pipeline network is also constructing new docks in Corpus Christi in anticipation of expanded exports of Eagle Ford crude. Once completed NuStar will be able to load 90,000 barrels of Texas crude per hour. But really, what will be the impact of U.S. as the latest kid on the block selling crude oil?

U.S. crude oil exporters have all the reasons to laugh as this means they can sell and compete with the Arabs for customers overseas for the first time. Technically, this is not the first time they’re selling oil outside of U.S. though, because through special arrangements and under unique circumstances, they have been selling to Canada and Mexico before the lifting.

But it would be bad news for US refiners that have enjoyed fat profit margins by processing relatively cheap US crude into petrol and diesel sold at global prices. Still, economically, it would add jobs and boost investment in the U.S. oil industry. The timing of the ban lifting could be a coincidence but it would deliver blows to OPEC, making them even less significant in influencing global prices.

Most importantly, with America emerges as the latest oil exporter, it would act as price stabilizer enhancing global energy security. Should Saudi-led OPEC suddenly cut their production, for example, it would not send price soaring unnecessary. Does that mean the low oil price is here to stay? Absolutely, but it will take some time for the American oil to take its effect globally.

Other Articles That May Interest You …

- Here’s Why Oil Above $100 Will Never Happen Again, Ever, Forever!!

- Forget About US$30 Oil Price – It Could Hit US$20 Per Barrel Next Year

- The Glory Days Are Over – OPEC Warlord Saudi Has Started Borrowing

- Stop Worrying About Oil Prices – Only “Allah” Knows It

- This Country Is So Badly Hit By Oil Prices That Having Sex Is Impossible

- Are You Ready For Crazy Oil Prices At US$30 A Barrel?

- Reason Why Oil-Rich Kingdoms Scare Of Uprising

|

|

January 4th, 2016 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply