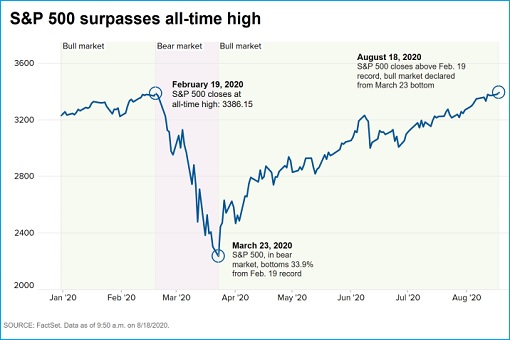

On Tuesday (August 18), the S&P 500 closed at a record 3,389.78 points – higher than the previous record of 3,386.15 recorded on February 19, 2020. The benchmark plunged from the Feb’s all-time high to a low of 2,237.40 on March 23, effectively losing 33.9% thanks to the Coronavirus pandemic. It entered a bear market – defined as a 20% decline in the index from a peak.

Spectacularly, that bear market now becomes the shortest ever in the S&P 500 history. Based on the past 20 bear markets since 1920s, the median age of a bear market is 302 days. But the Coronavirus-triggered bear market lasted only 33 days. More amazingly, not only the bear had ended in record time, the S&P 500 bounced from its March 23 low to enter a bull market on Tuesday.

Using the same definition, a bull market happens after a 20% rise in the stock market index, and it’s only official when the S&P 500 hits a record closing high. The index took 5 months to achieve that. By Tuesday, the dramatic bounce saw the index gain a jaw-dropping 55% from the bear market’s bottom in March. S&P 500 is a vital index because it measures the stock performance of 500 listed companies.

Essentially, the new bull market is already 5-month old (since March 23’s bottom). But does it make sense at all considering that the Covid-19 pandemic is still alive and kicking in the United States, the world’s largest economy since 1871? Should not the stock market reflects the economy? The U.S. has close to 5.5-million Coronavirus cases and more than 170,000 deaths.

Sure, the U.S. and global economies have shown some improvements since the lockdowns were lifted, but they are certainly nowhere close to fully recovered. Even though Americans unemployment claims fell below 1-million for the first time in 21 weeks, claims still remain historically high. At 10.2%, the unemployment is still above the 2008 Great Recession.

Not only the U.S. national debt nears record US$27 trillion, the actual economy is still so screwed up that some sectors like tourism or air travel is struggling. Globally, air travel is down more than 85% from a year ago, according to industry figures. The four largest U.S. airlines lost a combined US$10 billion from April through June and have definitely not recovered.

In fact, Standard & Poor’s admitted this week that the industry’s prospects have gone “from bad to worse,” with global air traffic dropping by up to 70% this year. It was only in May that the same American credit rating agency said a 55% drop in air traffic was a worst-case scenario. S&P analyst Philip Baggaley said – “It’s going to be a slower and more uneven recovery than one might have expected.”

Even though air traffic in the U.S. has recovered after a 95% collapse in April, the recovery stubbornly stalled – down 74% in July and 72% in August. In Europe alone, more than 500 airports have tumbled – down 94% in June. There were only about 4 million passengers registered in Europe airports, compared with 217 million a year earlier.

Besides, if the economy has recovered to the pre-Coronavirus level, why did President Trump approve funding for 7 states (Arizona, Colorado, Iowa, Louisiana, Missouri, New Mexico and Utah), offering US$300 free cash every week – on top of the weekly assistance the states pay for jobless benefits? The second round of aid comes after a US$600-a-week federal subsidy ended in July.

Well, the famous saying in the Wall Street is – “don’t fight the Fed”. You cannot defeat the Federal Reserve because the central bank can print an unlimited amount of money. Yes, the bull market that started as early as March 23 has been supported by trillions of US dollars in stimulus from the U.S. policymakers to recover from the deepest economic downturn since the 1929 Great Depression.

The U.S. Federal Reserve has not only pledged to buy risky corporate debt, but also cut interest rate to near zero and even hinted will keep the jaw-dropping low rate at least until 2022. The goal was to force everyone to put money into stocks, gold, oil and other investments to boost their prices since bank savings and bonds give almost zero interest.

Clearly, the S&P 500 bull run has conveniently ignored the fact that the U.S. economy contracted at a 32.9% annual rate from April to June – the worst ever quarter since 1947. Personal spending, which makes up about two-thirds of GDP (gross domestic product), slumped an annualized 34.6% – a record. The decline was especially horrible in services – travel, tourism, healthcare, restaurants and whatnot.

The money printing and cash pumping into the stock markets by the Federal Reserve have actually pushed up the stock prices of technology companies. That explains why NASDAQ had already hit its all-time high as early as June, before S&P 500’s confirmed bull run. The Big Tech – Apple, Microsoft, Amazon, Facebook and Google – were the stocks that triggered the S&P 500 bull market.

Restaurants, bars, hair salons, beauty shops, tattoo parlours, hotels, small retail shops, and more than 100,000 businesses across the nation have closed permanently since March. Those struggling family restaurants or beauty salons, however, are not listed on the stock market. On the contrary, the five big tech giants are worth a combined US$7.6 trillion – about 23% of the S&P 500′s total value.

While the powerful Fed has helped avoid a 2007-08 style meltdown of the financial system, the reality on the Main Street is totally different from the Wall Street. Of course, the “hope” of a vaccine for the Coronavirus pandemic is one of the best-selling factors contributing to the bull market. They just need to announce promising clinical trials and the stocks go ballistic.

Jim Cramer said – “In a V-shaped recovery, the Dow Jones Industrial Average would be hitting new highs, but this move’s been led by the Nasdaq and the S&P. You don’t need a rocket scientist to figure this out. Just look the stocks that have brought us to these levels – they’re not the recovery plays. In fact, they are the opposite. They are stocks that tend to do well, because of what we call secular considerations.”

A host of Mad Money, Cramer shot down a V-shaped recovery – “The S&P’s new highs are a tale told by an idiot, full of sound and fury, signifying nothing about the hardship of millions of people on food stamps, or the millions about to be fired from service jobs, or the homeless, or the people who are just huddled at home waiting for the vaccine, which currently feels a lot like waiting for Godot.”

Other Articles That May Interest You …

- Russia Reveals “Sputnik V” – But Scientists Condemn The Coronavirus Vaccine As Risky, Dangerous & Could Backfire

- Covid-19 Third Wave – The 3 Deadly Mistakes From Hong Kong That Every Country Should Avoid

- Trump vs. Biden – Here’s How Stock Market Can Accurately Predict Who Will Win The 2020 Presidential Election

- Bad News For Economy – IMF Slashes Growth Again, U.S. Hits Record 45,000 Covid-19 Cases & Jobless Claims Continue

- Lawsuits For Trillions Of Dollars Against China Over Spread Of Coronavirus – Here’s Why It’s A Waste Of Time

- IMF – The “Great Lockdown” Is Set To Triggers The World’s Worst Recession Since The 1929 Great Depression

- 3 Coronavirus Variants Discovered – Surprisingly, “Type-A” Found In Americans, Wuhan’s Type-B And Type-C In Europe

- The World Is Working On 20 Coronavirus Vaccines – But It Could Take Up To 18 Months

- China Appears To Be Winning The Coronavirus War, And Other Countries Are Studying How The Chinese Did It

- Arabs Conspiracy Theories – Coronavirus Is The U.S. & Israel Biological Warfare To Cripple China’s Economy & Reputation

|

|

August 19th, 2020 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply