Oil has recovered slightly after the black gold hit US$44 a barrel last week – the lowest since August 2016. The sudden plunge on 5th May, however, had momentarily thrown OPEC into disarray and chaos. Saudi energy minister Khalid Al-Falih was forced to calm the market with an early warning that it is almost a done deal that oil production cuts is to be extended.

Not only it’s imminent that the OPEC will extend supply cuts when they and other top producers (such as non-OPEC Russia) meet in Vienna on May 25 later, the Saudi has also openly declared that such extension, if not able to stabilize the oil price to their desired level, could be prolonged to the year 2018. But the market is already sick and tired of Saudi’s babbling.

OPEC’s limited impact on oil prices, since securing a landmark deal to curb oversupply, shows its dwindling influence in the energy market. Infected with denial syndrome, Saudi Arabia, of course, refuses to accept the fact that their rusty “supply control” weapon isn’t working anymore. Even until today, Saudi can’t accept that OPEC has lost its “pricing war”.

Only two things could seriously boost the oil prices – war and deeper cuts. Starting a war in the Middle East is not as easy as lighting up some firecrackers. Unless Saudi is willing to provide funding, Trump administration has no immediate appetite to start a new war. A deeper oil production cut, on the other hand, would cut Saudi’s market share to competitors.

Saudi’s desire oil price level is US$60 a barrel. But its war drums are falling on deaf ears due to the relentless increase in U.S. shale supply. Oversupply concerns continue to cancel out any optimism deal or statement from OPEC. Finally, on Thursday, OPEC went bananas and issued an extraordinary plea – begging the U.S. not to pump so much oil to the market.

In the cartel’s monthly report, CNN revealed that OPEC admits the global markets are still suffering from too much supply. This proves that the grand plan hatched by OPEC and other producers last November – cutting output by almost 1.8 million barrels per day (bpd) during the first half of 2017 – in a bid to tighten the market, hasn’t worked and isn’t going to work.

The report further said there’s one producer in particular to blame – America. After bitching and whining how U.S. shale producers were creating havocs, Saudi, the de facto head of the OPEC oil cartel, is now begging the U.S. to stop pumping so much, arguing with a silly reason that America should do so “for the general prosperity of the world economy.”

Tom Pugh, commodities economist at Capital Economics, said – “I think OPEC are now acutely aware that they don’t have the kind of influence they used to have 10 years ago, and that shale is now the swing producer in the market.” As U.S. oil production continues increasing, thanks to shale drillers, OPEC oil gets edged out of the lucrative American oil market.

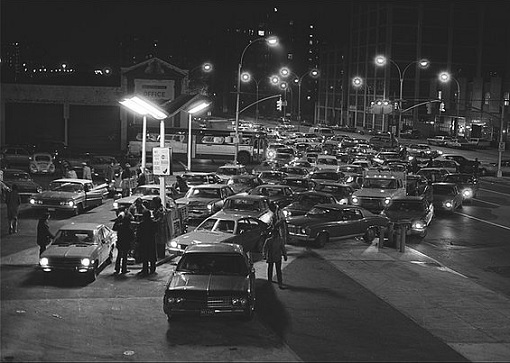

Well, karma is a bitch. On October 1973, OPEC kingpin Saudi Arabia decided to teach the Yankees a lesson for its military support for Israel in a 1973 war with Egypt and Syria. As the U.S.’ thirst for oil skyrocketed in the 1970s, Saudi slapped the nation with an embargo, triggering the infamous 1973 Oil Crisis.

The Arab Oil Embargo of 1973-74 caused long gas station lines, soaring fuel prices and rationing for American drivers. By the end of the embargo in March 1974, the price of oil had risen from US$3 per barrel to nearly US$12 globally. But the shale revolution would transform America into an energy powerhouse.

Meet America, the world’s latest oil exporter starting January, 2016 – after 40 years under the thumbs of the notorious OPEC oil cartel. Suddenly, everything is upside-down in the global oil market. The days where the U.S. can only ask how high when Saudi Arabia told them to jump are gone. Today, the kingdom magic wand losses its shine and doesn’t seem to work.

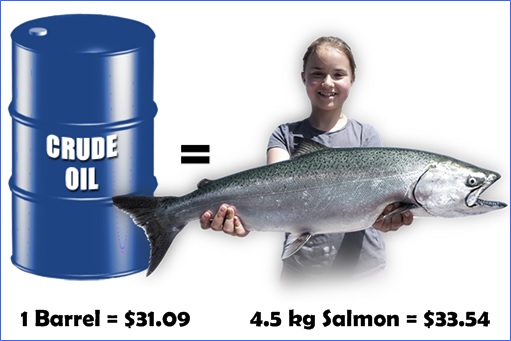

Starting in 2014, Saudi arrogantly pumped relentlessly in order to squeeze higher cost American producers. The strategy pushed prices well below US$30 per barrel and forced many U.S. producers to scale back in 2015 and 2016. The oil was so cheap that you could trade one 4.5-kg salmon fish, 5 pieces of cauliflower or even the “barrel” itself – for a barrel of crude oil.

Did shale producers die? Nope, with infrastructures already in place, they were merely taking a rest while waiting for the right price to spring back to production. But for the OPEC, it was a different story altogether. The government budgets of OPEC members were badly affected. Venezuela is bankrupt with its citizens literally scavenging for food.

Even the least affected OPEC nation – Saudi Arabia – had taken the drastic move of cutting ministers’ salaries by 20% and perks for public sector employees were scaled back, only to make a U-turn after calls for protests in at least four Saudi cities. Spooked by a possibility of a Saudi Spring, the Al Saud monarchy of Saudi Arabia had no choice and restored the perks.

Instead of flushing out shale drillers, OPEC’s strategy backfired spectacularly and forced U.S. producers to become more efficient. Today, these stubborn U.S. drillers can withstand much lower prices than just a few years ago. Analysts at UBS estimate that U.S. producers can now make money as long as prices remain above US$40 per barrel, down from US$65 in early 2014.

America imported about 60% of its oil in 2007, but by 2014, the U.S. only imported 27% of its oil – the lowest level since 1985. U.S. oil production has risen over 10% since mid-2016 to 9.3 million bpd. In 2015, the U.S. surpassed both Saudi Arabia and Russia as the world’s largest and fastest-growing producer of oil. America now has a whopping 527.8-million barrels of stock.

Dr. Jean-Marc Rickli, a risk analyst at the Geneva Centre for Security Policy, said – “Saudi Arabia is under extraordinary pressure both internally and externally.” Although OPEC and Russia committed to production cut last November, in reality, OPEC countries couldn’t cope with low crude prices and have already cheated so that they could balance their national budgets.

From a budget surplus of US$48 billion in 2013, Saudi registered a US$100 billion fiscal deficit in 2015. Humiliated, Saudi was forced to raise money by selling bonds in 2015. By March 2016, U.S. rating agency Moody’s was forced to downgrade Saudi’s banking system from “stable” to “negative”. Standard & Poor’s had lowered the kingdom’s rating to “A-minus” a month earlier.

Sure, Saudi can survive better than other OPEC countries under cheap oil. But if Saudi’s brothers could hardly survive, they would cheat and pump more oil, further weakening Saudi control over the OPEC cartel. King Salman knew his kingdom is trapped. The kingdom can neither pump more oil nor cut production. He hopes Americans would forget about 1973 Oil Embargo and pump less to help the Saudis.

Other Articles That May Interest You …

- BOOM!! – Oil Crashes, Just 2 Bucks Away From $42 A Barrel

- A Saudi Spring – Here’s Why King Salman Returns Perks To Public Sector

- Meet United States – The World’s Latest Oil Exporter – After 40 Years

- 1 Salmon For 1 Barrel Of Oil, Anyone?

- Oil Going $42 – Speculators Give Up, Saudi Doesn’t Know What To Do

- A Month Of Asia Tour – King Salman’s Mission & The Real Reason He’s Here

- Moody’s Downgrades – Saudi Banking System Now “Negative”

- Here’s Why Oil Above $100 Will Never Happen Again, Ever, Forever!!

- The Glory Days Are Over – OPEC Warlord Saudi Has Started Borrowing

- Saudi’s Past Arrogance & Terrorists Funding – Is This Karma?

|

|

May 13th, 2017 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply