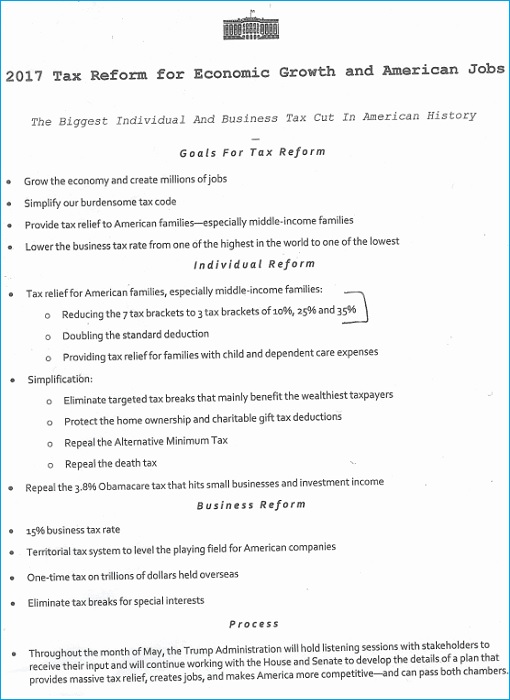

What do you really expect from a page of less than 200-words tax overhaul proposal? That’s what President Trump revealed on Wednesday but the financial markets aren’t impressed. Perhaps he knew his new tax plan is too good to be true that very few believe it could be implemented. Or he realizes the ambitious plan would need more rounds of brainstorming with the Congress.

Donald Trump’s proposal will see the “biggest” tax cut” in U.S. history – slashing corporate tax rate to 15% from 35%. That would make the U.S. a cheaper country than Singapore (17%) and Hong Kong (16.5%) – the #3 and #4 world’s top financial centres – to do business. How much would that reduce the federal revenue? The 1-page proposal didn’t tell.

The Committee for a Responsible Federal Budget said the plan would probably lead to a loss in government revenue by roughly US$5.5 trillion over 10 years. That’s US$550 billion of revenue lost every year. Trump assumes the tax cut would automatically and immediately grow the economy – creating more jobs and producing trillions of dollars in new revenue.

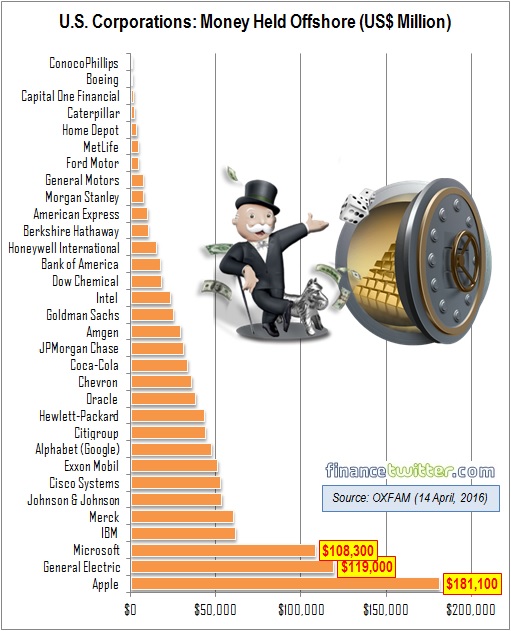

The goodies for the corporations didn’t stop there. The White House also proposed a “one-time tax” on the trillions of dollars held by corporations overseas. What is the tax rate, speculated earlier to be 10% versus 35% now? Again, the 1-page proposal didn’t tell. Treasury Secretary Steven Mnuchin said the rate for that tax has yet to be determined.

But even if the tax rate is 10% for the super rich corporations to bring back their US$2.5 trillion cash from overseas, there’s nothing to shout about. The plan isn’t new. In 2004, a whopping 9,700 companies were eligible to take part in a tax holiday approved by the Congress that would bring the overseas cash back at a rate of only 5.25%.

The Bush administration thought the program, part of “American Jobs Creation Act”, would grow the American economy in the forms of investment and job creation. Instead of using the repatriation money for hiring and capital purchases, companies dumped the cash into share buybacks and dividends – rewarding their shareholders.

To rub salt into the wound, not only the US$312 billion cash brought home didn’t go into investment or job creation, the greedy corporations had chosen to slash jobs. Between 2005 and 2006 – Pfizer, which repatriated US$37 billion, slashed 10,000 jobs while Merck, which brought back US$15.9 billion, cut 7,000 jobs. HP fired 14,500 staffs after repatriating US$14.5 billion.

Unless Trump administration makes it clear that the money repatriated must be used for investment and job creation, most of the money would go into repairing balance sheets and rewarding shareholders, as demonstrated by 91% of the US$312 billion cash brought home back in 2004 by big guns such as Pfizer, Merck, Hewlett-Packard, IBM and Johnson & Johnson.

However, if Trump administration put a condition on how the cash can be used, those corporations might find little reason to bring back their trillions of dollars of cash from overseas. As a businessman himself, it’s safe to bet that the U.S. president will not tie any strings to what is done with the repatriated cash. He could only hope the money would be used to create jobs.

As for individuals, Trump plans to cut the number of income tax brackets from seven to three, with a top rate of 35% (from presently 39.6%) and lower rates of 25% and 10%. But which income ranges will fall under those brackets? The 1-page proposal didn’t tell. However, the deduction for married couples would rise from US $12,600 to US$24,000.

With the exceptions of “homeownership”, “charitable giving” and “retirement savings”, all other tax benefits will be terminated under Trump’s new tax plan. What this means is those popular tax benefits such as home mortgage interest and taxes paid to state and local governments normally used to cut overall tax bills will no longer be available.

The “alternative minimum tax (A.M.T.)” was designed to make it harder for very rich individuals to game the tax system and pay less tax. Treasury Secretary Steven T. Mnuchin called it a “complicated” additional system of taxation so the AMT will be killed. Although 4-million taxpayers are subject to this tax, there’s a good reason why President Trump wants to get rid of AMT.

Based on Trump’s 2005 tax return where he paid US$38.5 million in federal taxes that year, Trump would have paid only US$7.5 million without AMT. Essentially, his effective tax rate on US$153 million in income (Donald Trump’s 2005 tax return) would plunge to less than 5%. If his plan goes through, it would benefit Trump and his children’s business tremendously.

The “Inheritance Tax”, also known as the “death tax”, would be scrapped too. Although Trump administration said that the tax was a burden on farmers and small businesses, the repeal of this tax will see 145,000 U.S. households worth US$25 million or more being spared from taxes, not to mention 1.2-million rich Americans with net worth of between US$5 million and US$25 million.

Sure, the tax plan seems to benefit most U.S. households. But obviously it will provide the biggest windfall to the wealthy, including Trump and his family members. Still, the burning question is, could a page of proposal (or rather guidelines) consisting of less than 200-words gets through the Congress, considering it would definitely burn a huge hole in the federal debt?

Other Articles That May Interest You …

- Here’s How Trump Brilliantly Kills His Enemies With ObamaCare

- Trump’s Red Herring – Paid $36.5 Million In Taxes, Earned $153 Million

- Trump The Invincible – Dow Hits 20,000 As Stock Market Gains US$2 Trillion Wealth

- Beijing Sends Jack Ma To Befriends Donald Trump, Offering 1-Million Jobs

- BREXIT 2.0!! – Here’re 12 Major Reasons Trump Wins Presidency, Against All Odds

- Hillary Clinton Declares WAR On The Rich – “65% Tax” – But Here’s Why It Won’t Work

- 10 Business Philosophy Billionaire Trump Disagreed With Billionaire Buffett

- Few Americans In Panama Papers – Top 50 U.S. Companies Hide US$1.4 Trillion

- Trump’s “Zero” Tax For 75 Million Americans Might Win Him The Presidency

|

|

April 27th, 2017 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply