Ahead of her first debate with Trump on Monday night at Hofstra University in Hempstead, New York, Clinton has proposed to raise taxes on inherited property – up to 65%. That is totally the opposite of what Republican presidential nominee Donald Trump wants to do if he gets to become the next President of the United States.

Donald Trump, a wealthy real estate developer, wants to eliminate the estate tax and advocates steep cuts in business tax rates. In a way, Hillary Clinton is trying to rob from the rich people such as Donald Trump and give the money to the poor – a stunt similar to Robin Hood. That’s a brilliant plan – in theory.

Under Clinton’s new proposal, which she copied from her former rival Senator Bernie Sanders, estates for individuals above US$10 million would pay 50%, estates over US$50 million would pay 55%, and those with assets above US$500 million would get slapped with a 65% tax. She previously had proposed a top “death tax” rate of 45%, a hike from the present 40%.

However, based on Internal Revenue Service’s data, Clinton’s highest rates would apply to very few Americans only. In 2014, for example, there were only 223 estate-tax payers with reported estates valued at US$50 million or more. If her plan gets executed, it would be the highest estate tax since 1981.

Wait a minute, since there were only so few real estate affected by such high taxes, why should the rest of the Americans bother? True, but the fact that there are 145,000 U.S. households worth US$25 million or more means tons of Americans would be affected too. Those with net worth between US$5 million to US$25 million alone are numbering 1.2-million Americans.

With a stroke of a change in the tax proposal, the Clinton campaign estimated it would yield US$260 billion in extra revenue over the next decade, enough to pay for her plans to simplify small-business taxes and expand the child tax credit. In total, that would boost the expected revenue from Clinton’s tax increases to US$1.5 trillion over the next 10 years.

Clinton’s proposal would raise more revenue for the federal government and helps her make the case that she has proposed sufficient tax increases to offset all her proposed spending programs. It is also a genius tactical strategy to win the hearts of Bernie Sanders’ supporters who have deserted Clinton after it was exposed her team had secretly engaged in “character assassination” on Sanders.

In reality, however, Clinton’s Robin Hood plan could be merely a gimmick to hoodwink ignorant American voters. First of all, Hillary needs to get her exotic proposal passed by the Congress, of which the House is controlled by the Republicans. Unless she can convince both House and Senate, which is highly unlikely, Clinton’s plan is DOA (dead on arrival).

Secondly, even if the Democratic Party, under President Hillary Clinton, could control the Congress, not all Democrats, let alone Republicans, like the proposal because it is seen as an unfair confiscation of wealth that punishes family-owned companies. It will stop family-owned businesses – including women and minority-owned businesses – from being passed down to their children and grandchildren.

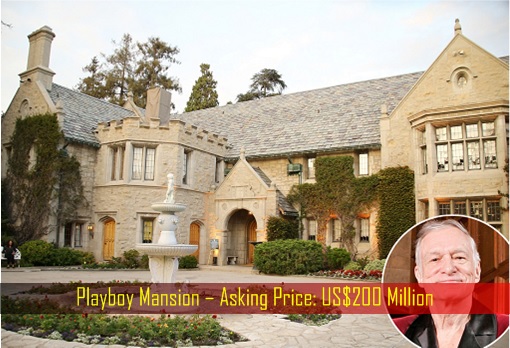

Thirdly, the super rich are too smart to be taxed by Clinton administration. Is there anyone out there who thinks the wealthy Americans are so dumb that they’re like sitting ducks – waiting for the taxmen to come and take their fortune away? Thanks to politicians such as Hillary Clinton herself, there is plenty of colourful tax loopholes specially created for the very rich.

And it’s called “trust”, the same game which Bill and Hillary Clinton play. The Clintons created “residence trusts” in 2010 and shifted ownership of their New York house in Chappaqua into them in 2011. Because such trust prevent any growth in the property’s value from being counted in the couple’s estate, the Clintons save hundreds of thousands of dollars in estate taxes.

Ever wonder why Hillary Clinton once declared on ABC television that she and hubby Bill were “dead broke” and in debt when they left the White House, despite the fact they were worth at least US$110 million? That was because they knew “how to hide” – legally – their assets on the non-taxable side of the balance sheet when they die.

Heck, the Clintons were so creative they actually created two separate trusts to spread risk. Also in 2010, the Clintons created a “life insurance trust” to help defray future estate taxes and to pass on large sums tax-free to heirs – namely Chelsea Clinton. Unless Hillary Clinton is willing to eliminate various trusts in existence, the rich can offer very little on the table for taxation.

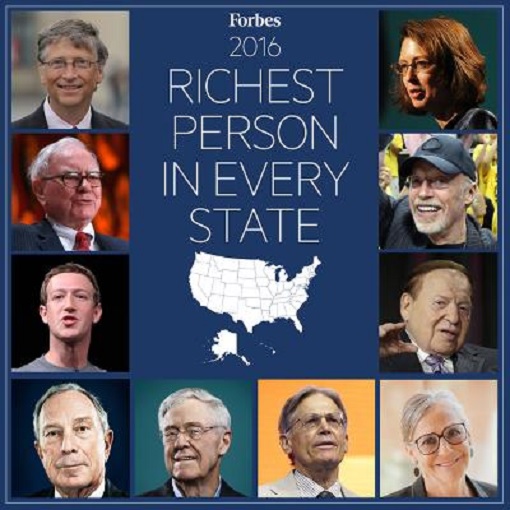

By the way, why aren’t billionaires such as Warren Buffett, Bill Gates, Mark Zuckerberg, Jeff Bezos, Koch family beating their chest in protest of Hillary Clinton’s outrages taxes? They didn’t put too much money in real estates or have either move and hide 99.99% of their wealth into trusts, foundations, and other financial instruments or out of the country.

Besides, how does Clinton plan to differentiate between real estates’ capital gains from inflation? How about farms which have been inherited for generations? Hadn’t the deceased paid taxes on the properties already? How many times do they need to pay taxes? How would the government justify or prove that the affected real estate’s appreciation value is fair to the heirs?

Other Articles That May Interest You …

- Hillary Clinton Goes Down – Mexico Currency Goes Haywire

- Greatest Money Laundering – Najib Did $3.5 Billion, Obama Did $33.6 Billion

- Clinton’s 911 Drama – Collapses, Losses Shoes, Thrown Into Back Seat

- Medically Unfit – Hillary Clinton Could Be Suffering From Parkinson’s / Alzheimer’s

- No Wonder Putin Laughs At America – F.B.I. & A.G. Cover-Up Clinton Scandal

- Here’s Why “President Trump” Wants To “Fire” Janet Yellen In 2018

- Bias!! Federal Reserve Donated To Everyone Except Trump

|

|

September 23rd, 2016 by financetwitter

|

|

|

|

|

|

|

Alternatively ,the super rich will just renounce their US cititzen and migrate if they are taxed until their butts hurt too much.