Days after the Panama Papers were leaked and shocked the world; people are still arguing and debating why the lack of Americans being named. Preliminary reports indicate that more than 200 people with U.S. addresses are named in the Panama Papers, a pathetic number considering that the leak implicates 214,488 companies involving 11.5 million documents.

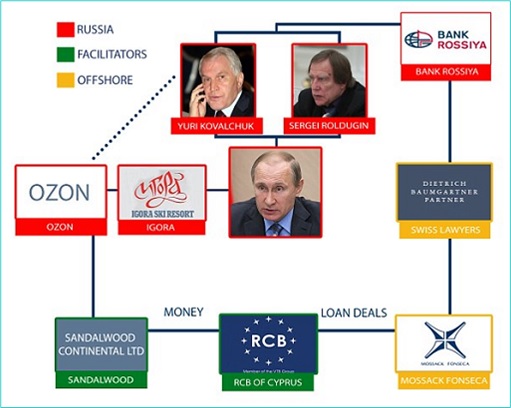

People are suspicious why the leak only focuses on leaders from certain countries, especially Russia, China, Argentina, Pakistan and some Gulf nations whose leaders have recently rubbed shoulders with Russian Vladimir Putin. Although Putin didn’t own a single offshore account, his name was being mentioned the most, for obvious reason.

Many reasons have been offered for the lack of Americans. The most famous one was that Mossack Fonseca wasn’t a favourite law firm among Americans. Others suggest that the U.S. has its own flexible entity structures and corporate tax breaks, while some simply suggest that it’s easier for U.S. citizens to create shell companies in certain states in their own country – America.

Bradley Birkenfeld – an American, a former UBS banker and one of the most significant financial whistleblowers of all time – believes that the hacking and leaking of the Panama City-based firm was the doing of a U.S. intelligence agency – CIA. The purpose was to name and shame direct enemies of the United States, particularly Russia supremo Putin.

What does Russian President Vladimir Putin has to say about his overnight celebrity status? He simply smiled and called the Panama Papers leak as a “provocation” and blamed a U.S. investment bank Goldman Sachs. He didn’t deny about money trail linking his close aides to US$2 billion with offshore firms and banks though.

Putin also questioned the German newspaper who had first gotten the leak – Seuddeutsche Zeitung – and accused it of doing the job on behalf of Goldman Sachs. Of course, there’s the link between whistle-blower ICIJ (International Consortium of Investigative Journalists) and one of its funder Open Society Foundation, owned by billionaire George Soros.

But the best proof that ICIJ has been cherry picking on who to be named and shamed comes from none other than the United States and world’s richest man with net worth of US$77.7 billion – Bill Gates. During an interview in Qatar, Gates said – “I was surprised there were so few Americans.” And why was the billionaire surprised?

That’s because it’s an open secret the Americans have been stashing their wealth outside of United States for as long as one can remember. Exploiting tax loopholes and engaging in large-scale tax avoidance are integral components of the profit-making strategies of many multinational corporations, including Microsoft, Apple, General Motors, Pfizer and Coca-Cola.

US corporations must pay 35% tax on all profits, wherever they are earned around the globe – but only after that money has been “repatriated” back to the US. To avoid paying the US’s 35% statutory rate, companies artificially shift the ownership of assets (such as patents or other intellectual property) to subsidiaries that exist only on paper in tax havens.

For example, a US company might transfer its intellectual property rights to a Cayman Islands subsidiary, even if the underlying technology was developed in the United States. The U.S. subsidiary of the company would then pay royalties to the Caymans subsidiary to use that intellectual property.

That payment would decrease the profit of the U.S. subsidiary, which faces the US tax rate, and boost the profit of the Caymans subsidiary, which faces a low rate. The largest 500 U.S. companies would owe an estimated US$620 billion in U.S. taxes were it not for the more than US$2.1 trillion in offshore cash that most of the firms hold in foreign tax havens.

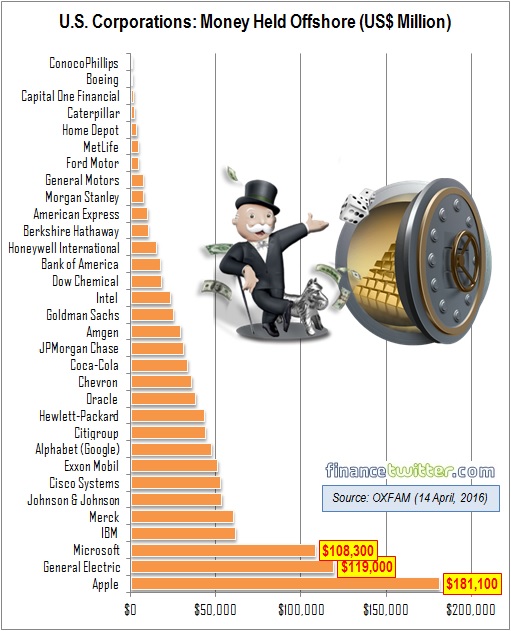

Big corporations and their lobbyists in Washington, DC are quick to decry “double taxation” to justify their attempts to avoid repatriating their foreign profits and any attempts to close tax loopholes. The latest study done by anti-poverty group Oxfam dated 14 April, 2016 accused the 50 biggest U.S. companies of holding about US$1.4 trillion in assets in offshore accounts to avoid paying billions of dollars in U.S. taxes.

According to the study, here’re the reasons why hiding money in offshore accounts are so lucrative to these 50 largest U.S. corporations:

- Paid US$1 trillion in taxes globally, US$412 billion of which was paid to the US federal government;

- Received US$11.2 trillion in support in the form of loans, loan guarantees and bailout assistance from the federal government;

- Made US$4 trillion in profits;

- Reported an average overall effective tax rate of 26.5%, 8.5% lower than the statutory rate of 35%;

- Received US$337 billion in tax “breaks”;

- Currently hold US$1.4 trillion in offshore cash reserves;

- Disclosed 1608 subsidiaries (with possibly thousands more undisclosed) in offshore tax havens;

- Spent US$2.6 billion on lobby expenditures.

Apple is by far the largest holder of offshore money not subject to U.S. taxes, with US$181.1 billion. If those profits were taxed at U.S. rates, the company would pay US$59.2 billion. General Electric and Microsoft hold US$119 billion and US$108.3 billion in offshore cash holdings, respectively, coming in at second and third on the list.

Among other top tax-dodgers are pharmaceutical company Pfizer, which keeps US$74 billion offshore. IBM keeps US$61.4 billion, Goldman Sachs US$24.8 billion and Bank of America US$17.2 billion. Famous household brands – including Walmart, Coca-Cola, American Express, Home Depot and Walt Disney – all keep billions away from U.S. taxes.

The use of tax havens costs the U.S. government about US$111 billion a year in tax dollars. Interestingly, while hoarding their funds in havens, the big 50 companies spent about US$2.6 billion on lobbying between 2008 and 2014, so that Washington does not come out with a new law to force their US$1.4 trillion in offshore cash reserves to be repatriated.

Other Articles That May Interest You …

- 1MDB Parliament Report – Blames Everything & Everyone Except Najib Razak

- How Come “Panama Papers” Haven’t Exposed U.S. Big Guns?

- Panama Papers – The Secrets Of Dirty Money – From King Salman To Lionel Messi

- The WSJ Is Hustling Razak Family – Nazir Could Have Committed Money Laundering

- 1MDB Scandal – An Ali-Baba “Scam” Partnership Goes Bust

- Exposed!! – How HSBC Swiss Bank Helped Hide (Dirty) Money

- Leaked!! – The Ultra Rich And Powerful Chinese Who Stash Money Offshore

- Here’re Tax Havens To Hide Your Black Money & Plunder

- Top 20 Countries With Highest Proportion of Millionaires

|

|

April 15th, 2016 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply