You thought it only get mentioned in James Bond films, where the super bad guys promised to destroy the world (they always do, don’t they?) unless the US or UK government pay them hundreds of millions or even billions of dollars to some offshore Swiss banks. It made you think how come the bad people could easily get away with Swiss accounts, and why the powerful US or UK government couldn’t give a call to the Swiss authorities and forfeit the ill-gotten money.

Now, the mystery is solved. The secret is revealed about how bad people hide their money in Swiss banks. And they don’t have to lift a finger, because the Swiss banks were “happily” helping their clients – good and evil – stashed their money. In 2007, an IT expert, Hervé Falciani, hacked into HSBC database, resulting in 30,000 accounts holding about US$120 billion (£78 billion; RM427 billion) of assets being compromised.

The leaked HSBC files, covering the period 2005-2007, the biggest banking leak in history, reveal the full scale of malpractice at HSBC Swiss subsidiary. Apparently, HSBC, headquartered in Britain, acquired a Swiss bank in 1999. Amazingly, the HSBC’s Swiss private banking arm had not been integrated (or rather deliberately not integrated) into parent company, HSBC Group, until 2011.

What this means is between 1999 to 2011, the HSBC Swiss subsidiary was given the liberty to run its business without proper compliance or standards according to the UK banking regulations. During the “tainted” period, HSBC was headed by Stephen Green – now Lord Green – who served as the then group chairman until 2010 when he left to become a trade minister in the House of Lords for David Cameron’s new government.

Although tax authorities around the world have had confidential access to the leaked files since 2010, the true nature of the Swiss bank’s misconduct has never been made public until now. The HSBC files are being published in an international collaboration including the French daily Le Monde in Paris, the Washington-based International Consortium of Investigative Journalists, BBC Panorama and the Guardian.

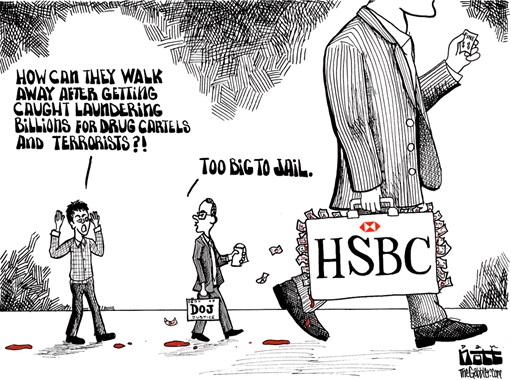

The hacker, Hervé Falciani, fled to France with police on his trail for breaching Switzerland secrecy laws. But upon detention in France, the French authorities refused to extradite him because the valuable data could identify thousands of French tax evaders. The scandal has led multiple arrests in Greece, Spain, Argentina, Belgium and the US. Amazingly, the UK government has taken zero action against HSBC.

Tax authorities in France, Italy, Spain and Germany have already used Falciani’s leaked data to pursue billions of euros in lost taxes and have so far collected a total of €250 million (£212.1 million, US$327 million). Currently, whistleblower Hervé Falciani lives in Spain where Swiss authorities have failed to extradite him. He is also helping the Spanish in their efforts to crack down on tax fraud.

HSBC was so keen to protect its clients, that it used codenames when contacting its clients who hid the mind-boggling US$120 billion. However, not all HSBC’s Swiss private bank customers are public figures and many are not dishonest. For example, a Finnish teacher set out to hide money from her husband. One British banker admitted that he hid £5 million in his Swiss account merely in order to conceal from colleagues the size of his bonus.

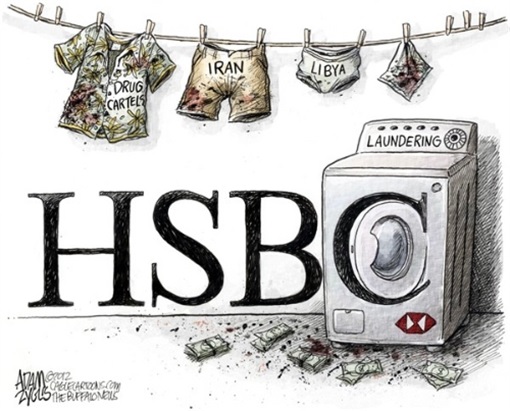

But it was estimated that less than 20% of HSBC Swiss secret clients are innocent. Evidence exists that some may have been smuggling drugs, handling bribes, committing fraud, helping to finance terrorists, or looting their own countries. The documents also show HSBC Swiss “happily” providing banking services to relatives of dictators, people implicated in African corruption scandals, arms industry figures and others.

The British government may close one-eye over its own HSBC scandal, but the giant banking corporation is already facing criminal investigations and charges in France, Belgium, the US and Argentina as a result of the leak of the files. Perhaps the British government thought HSBC didn’t commit such a big crime in tax avoidance and tax evasion services. But what about helping drug and arm dealers and dictators hid ill-gotten money?

So, the next time you watch the bad guys in crime trillers blackmailing money to the tune of millions or even billions, remember that they couldn’t do it alone. There’re always banks helping them to siphon their dirty money after their crimes. And you can safely bet that HSBC Swiss was one of them.

Other Articles That May Interest You …

- This Country Is So Badly Hit By Oil Prices That Having Sex Is Impossible

- Sweet Revenge – Scammer Jover Chew Closes Business At Sim Lim Square

- Jack Ma Kept Talking “Trust” – Did He Try To Signal He Won’t Scam Your Money?

- How To Save Money This Year – 15 Exciting Tips

- Here’re Tax Havens To Hide Your Black Money & Plunder

- Genneva Gold – Another Collapsing Ponzi Scam?

|

|

February 9th, 2015 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply