Charles Ponzi was a genius, without realizing it himself. Born in Italy, he became famous in the early 1920s. He promised clients a 50% profit within 45 days, or 100% profit within 90 days, by buying discounted postal reply coupons in other countries and redeeming them at face value in the United States as a form of arbitrage. But in actual fact, Ponzi was paying early investors using the investments of later investors, plain and simple. Ponzi started his own company – Securities Exchange Company – to promote the scheme (which ultimately known as Ponzi scheme) and from Feb 1920 to July 1920, he made impressive millions of dollars. At one time, Ponzi was making a staggering $250,000 a day – that was back in the 1920s, mind you.

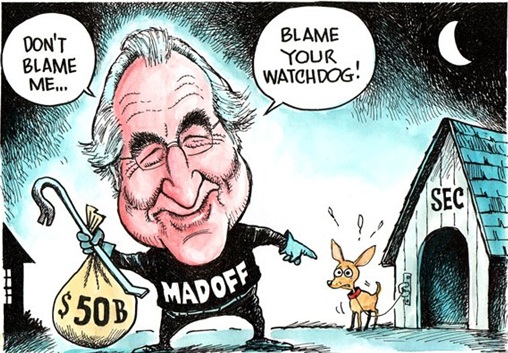

Financial analyst was asked to examine Ponzi’s scheme and it was found that based on Ponzi’s investments, there should be at least 160 million postal reply coupons in circulation. However, there were only about 27,000. It was later found that Ponzi scheme was merely a plan of robbing Piggie to pay Doggie. Charles Ponzi’s surrender to federal authorities brought down 5 banks together with him. His once loyal investors were wiped out, receiving less than 30 cents to a dollar. In total, his investors lost about $20 million in 1920 (about $225 million in 2011 dollars). Using the same scheme 88 years later, Bernie Madoff brought down about $13 billion in investors’ money.

So, was Genneva Malaysia, a company dealing in buying and selling gold products another Ponzi company waiting to collapse? Actually directors of Genneva – Marcus Yee Yuen Seng, Ng Poh Weng and Chin Wai Leong – can use MLM (Multi-level marketing) Pyramid system to do this business. While MLM is more profitable, it’s more cumbersome since the regulatory control is much tighter. Of course you still can get away by appointing UMNO-linked Datuk-Datuk as your company chairman to facilitate license renewal and to close many enforcers’ eyes when irregularities occur.

Genneva brilliantly plays in a grey unregulated area – gold trading. Interestingly, according to the gold exemption order 1986, any Tom, Dick and his pussy cat can hold, borrow, lend, buy, sell or export gold without contravening any laws. In short, it’s easier to move around gold than hold a rally in this country. Genneva was careful not to collect deposits from investors as this action can be seen as crossing into BAFIA’s (Banking and Financial Institutions Act) territory which requires a license from the Central Bank (Bank Negara). Without a need for a license (and renewal) means one less problem in doing business for Genneva.

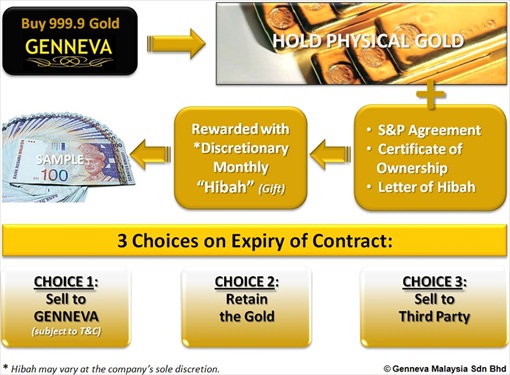

How the Genneva Gold Investment Scheme works is quite simple. You purchase the physical gold which comes with a S&P (Sales ad Purchase Agreement), a Certificate of Ownership and a Letter of Hibah. The juice of the orgasm was in the form of “Hibah” (or monthly gift) – ranging from 1.8% (50g – 95g of gold purchase) to 2.5% (3kg and above of gold purchase) in cash return every month. That’s a whopping 21.6% – 30% annual return rate, mind you. Warren Buffett must be super idiot not to join Genneva, no? In addition, your initial capital is 100% protected because according to die-hard investors, you can sell back your gold to Genneva at the same price you bought initially.

Who could resist such a proposal – it’s like when you buy sofa sets from IKEA, not only you get the sofa but also 30 cups of Starbucks free latte vouchers every month. And if you don’t like the sofa thereafter, its money back guarantee, no question asked. Gosh, IKEA (in this case) must be really stupid. So far, everything seems to be too good to be true. However, according to Genneva website, the company “does not” gives any undertaking or guarantee the repurchase of the gold products sold to its purchaser. Now, what did mom said about there ain’t no such thing as a free lunch. How could there be golden goose hopping around on the street?

First of all, this gold trading is a mega project. Genneva claims to have about 50,000 satisfied clients (or investors) in Malaysia alone. Let’s assume each investor poured in RM100,000 for this once-in-a-lifetime investment – that’s a mind-boggling RM5,000,000,000 (RM5 billion) hot money. Knowing how greedy Malaysians are, the RM100,000 of investment quoted here is a super conservative figure. And here comes the magic. Genneva actually sells its gold to customers at a staggering premium of 20-30 percent. For example, while UOB was selling gold at $74,500 per kilobar, Genneva sells $96,000 per kilobar, on the same date.

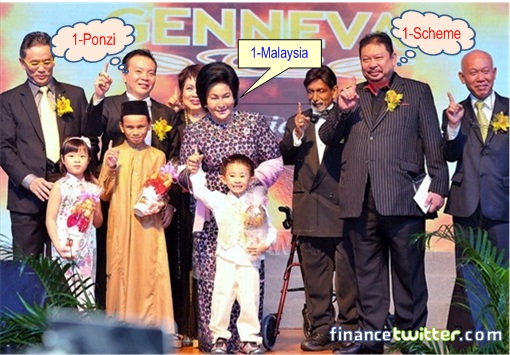

And why wouldn’t Genneva laugh all its way to the bank with RM1 billion to RM1.5 billion in profit (20-30%) from these so-called 50,000 “expert” gold investors (*tongue-in-cheek*). Now, do you understand why I call this scheme a mega project? It’s because everything was designed to be gigantic. If you want to fleece others’ money, do it big and systematically. As the Chinese saying – giant chicken does not eat small feeds (*grin*). Adding spices to instil artificial confidence would be to invite heavyweights such as mighty former premier Mahathir (on behalf of the King) for Genneva products’ launching and Prime Minister’s wife, Rosmah Mansor for its Consultants Appreciation Night 2012. Heck, Genneva even has Tengku Muhaini Sultan Ahmad Shah, the Sultan of Pahang’s daughter, as its chairman.

Do you really need to be a rocket scientist for a scheme that gives you 1.8% – 2.5% of cash when the banker already made 20% – 30% in profit upfront? If you think taking 30 bucks from your pocket and return 2 bucks and 50 cents to you every month is the best invention since sliced bread, then you deserve to be scammed. But there’re many great testimonies – not only they’re still keeping the physical gold, they’re also making 30% annual return rate. Of course they do otherwise this scheme won’t work, would they? You need some testimonies for this musical chair game to continue playing. And due to greed, some investors would sell every inch of cloth increasing their investment, which keep the money rolling.

How do you know the gold you’re hugging every night is as pure as it claims? How do you know it’s not tungsten-filled gold bars? Yes dude, jewelry stores on 47th Street and Fifth Avenue in Manhattan discovered a 10-ounce 999.9 gold bar costing nearly $18,000 turned out to be a counterfeit. The bar was filled with tungsten, which weighs nearly the same as gold but costs just over a dollar an ounce. Heck, the gold bar even had stamp of the reputable Swiss Produits Artistiques Métaux Précieux and a serial number. Apparently the victim, Ibrahim Fadl, a dealer himself bought the gold bars from a merchant who has sold him real gold before (watch video below). Previously such fake gold bars case happened in England but now had spread to New York.

If you challenge Genneva investors with questions, they may put a gun to your head. Besides, who cares as long as they continue receiving their Hibah. To the investors, Hibah was the main juice of orgasm but to Genneva, Hibah may be their biggest bait. Frankly, the whole system works as long as the gold price doesn’t crash, people continues to buy gold bars, Genneva continues to generate positive income from their billions of dollars of profit elsewhere, no power struggle within the company and whatnot. For every single Ringgit of your hard-earned money, Genneva can pay you the Hibah for 10-months and still make profit – with not a single cent coming out from the company’s own pocket. It’s your original money that they’re rolling and playing, as simple as that.

Genneva also knows all the 50,000 “happy” investors will not redeem their gold at the same time. If they do, the company will simply go bust simply because they don’t have RM5 billion (based on example above) to take back all the gold bullions (*grin*). With billions of dollars war chest, Genneva was like a mini bank. Perhaps it then uses the money trading Call / Put Option in equities, currency or even gold itself. Worst still, the ultimate objective could be to clean dirty money obtained by illicit means – money laundering. Now, that would be really interesting. What – just because Mahathir launched the company’s products, the company can’t possibly involve in money laundering?

If you do not already know, money laundering is an extreme lucrative business whereby the operator charges 60% or more – meaning for every dollar of your dirty money, you’ll get 40 cents of “clean money” in return. The operator takes the remaining 60 cents due to obvious reason – cost of dynamo detergent, washing machine, electricity and whatnot (*tongue-in-cheek*). When even Casino King, Stanley Ho, used his casinos for money laundering, who are you to say Genneva is not another money laundering vehicle, since the company is not regulated by anyone?

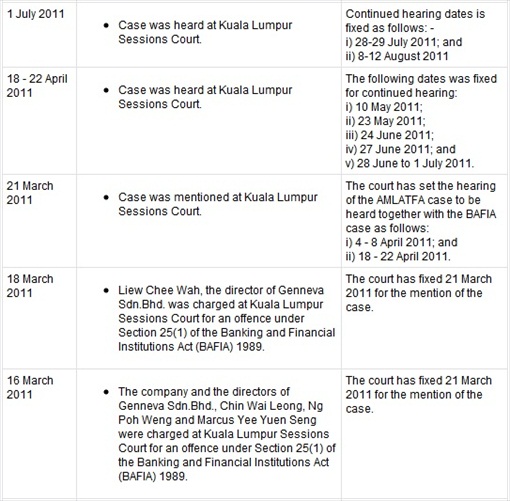

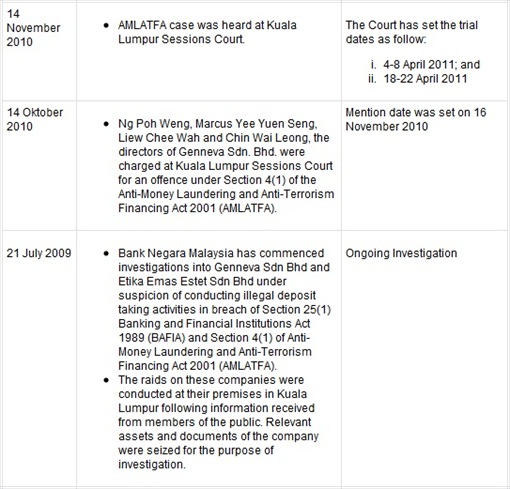

Back in Oct 2010, the directors of Genneva Sdn Bhd – Ng Poh Weng, 60, face 263 charges involving RM185mil while Marcus Yee Yuen Seng, 58, faces 234 charges amounting to RM153mil and Chin Wai Leong, 34, face 210 charges involving RM212mil. Earlier in July 2009, Bank Negara (Central Bank) had frozen their personal and company bank accounts and their asset of gold bars. Later, Genneva Pte Ltd, also a gold trading company in Singapore, with the same directors from Malaysia’s Genneva, lost a lawsuit from one of its investors claiming $190,000 with a second writ of summons for a total sum of $86,000 in the pipeline. If everyone was enjoying 21.6% – 30% annual return with option to sell back the gold bars to Genneva, why would investors sue the company?

Another burning question – if the company’s account and asset were seized and frozen since 2009, how can the directors and company allowed to operate until the latest raid early this month, more than 3-years later? Was Bank Negara sleeping on the job? Were there too many (greedy) hands in the cookie jar, hence the power struggle (or rather money struggle), considering the gigantic amount of money in the coffer (if there’s any left). Or was it purely SOP (standard operating procedure) by any ponzi scheme operator to call it the day by asking the authorities to raid the company itself so that they can stop paying investors, knowing very well nobody would go to jail?

There’re people who made good money from Genneva gold trading scheme but not everybody made it to the finish line. But now that the company is raided, what’s next? Maybe Mahathir can help by declaring Genneva is an honest company that is incapable of cheating the people, the same way he told the High Court that he believed Ling Liong Sik was not capable of cheating the government since Ling is an honest person. As usual, early bird catches the worm and as for the latecomers – remember to join the party early next time, will ya?

Other Articles That May Interest You …

- MLM, a Pyramid Scheme? To Join or Not to Join?

- SwissCash Scam – SC a Little Too Slow & Too Late

- Internet Investment’s Get-Rich-Scheme You Should Avoid

|

|

October 11th, 2012 by financetwitter

|

|

|

|

|

|

|

Comments

Golden rule for investment:-

High gain high risk;

Low gain low risk;

No gain no risk.

If some con-sultants offer you an investment with high gain low risk; you should be very very very careful about the investment.

If the con-sultants offers you an investment with high gain no risk (as with GMSB), you should immediately run away.

Dear all. Sad but it would not generate too much problem

To the directors Fantastic smart ppl even used Tun and Rosmah which allow them to pull crowds and avoid regulators sniffing until it comes down

For marketing and PR. The hiba is payable as long as gold price keep appreciating but then again music has stopped and there will be blood on the street. Sad

To all those who made negative comments without the backing of facts, may I know if you guys philosphers with your empty rhetorics and foolish statements, making a fool out of yourselves on each & every blogs?

Do yourself a favor, study history and look at the bigger picture of thngs. Best if closed minds also come with closed mouths. Agree?

Whoever is writing this article is trying to fool others to believe this …first of all, the pic shown here comes from other companies …. cause GENNEVA has their name engraved onto the Gold … not the one in the pictures shown in this article …

hello peter pui,

the picture of the gold bar in this article was referring to the fake gold exposed in the Fifth Avenue in Manhattan …

nice try peter, but try harder to defend the indefensible, will ya …

good luck in your gold bullion adventure … hope you didn’t burn …

cheers …

I won’t be surprised if those gold bars are filled with tungsten after all who in their sane mind would want to cut open a nicely sealed in plastic casing and then dissect the gold bar, definitely not me …..

I would like to hear from a Genneva investor who has actually confirmed it’s authenticity by taking their gold bar and opening it up like the pictures in this article to ensure it’s not tungsten underneath and end up like the fake ones exposed in New York.

Quoting one investor that wrote in to the Star who claimed himself to be an entrepreneur and business consultant for over 18 years and has had the chance to study and formulate hundreds of business plans and financial models for various global brand multinational corporations (MNCs), SMEs as well as governments all over the world who praised the business model of Genneva as truly revolutionary, innovative and true to its spirit – a blue-ocean business strategy; like the same principles that our current Malaysian Government wants us to practise and build on.

All I can say is Wow !! I am truly impressed. If investigation by the authorities proof that Genneva is a scam and can fool such a qualified individual, what chance do ordinary folks like us have against such smart and unscrupulous crooks? We should be greatful to the Government and Bank Negara for stepping in to protect the public from these people ever waiting to fleece us of our hard earned money.

Bernie Madoff would be so shameful if he comes to know Genneva Malaysia pulls off such a Ponzi scheme and still gets the investors ?/buyers/idiots? to come to the defense of GM.

Sadly, so many VVIP have associated themselves with the Scheme to enhance the credibility of this Scheme. Wonder the payment for such ‘apperances’.

Is Life Insurance or Health Insurance a Ponzi Scheme Scam?

Is Life Insurance a Ponzi Scheme Scam?

Whenever there is something that people earn money from online, I don’t care if it is an MLM, an advertising program like Genneva Malaysia Sdn. Bhd, even a straight commission program like Amway or a marketing platform like Monavie, THERE WILL ALWAYS BE THOSE THAT CALL IT A SCAM. This annoys me, not just because I don’t believe them to be scams, but also because there are things in every day life that actually DO look like scams, but we don’t call them that because, most of us really like them. I will call it “Selective Scam Labeling”. Now, in another post I crushed the “it is too good to be true” lie, and I want this post to deal another blow to that myth.

I have to be careful, though. The last person who wrote on this subject actually REFUSED to put his name on the article because of “fear of reprisal”. Wow. This is a touchy subject. See, most people who mock online business opportunities as scams are highly involved (and believe everyone should be highly involved) in something that looks more like a Ponzi Scheme than Genneva Malaysia Sdn. Bhd. EVER did and EVER will.

Is Life Insurance a Ponzi Scheme Scam?

(To simplify the argument I will be focusing on Life insurance more than Health Insurance, though both are similar at their root.)

To even ask this question is nearly a crime. Most workplaces in the Malaysia actually provide Life Insurance, or at least make it more affordable. And…you know what……It sounds too good to be true. GASP! Did I just say that?

Few ringgits a week……..RM50,000 when you die, whenever you die! Hmmmm. But it can’t be a Ponzi Scheme Scam! Because, the people who call EVERYTHING a Ponzi Scheme Scam have Life Insurance. Let’s look at what makes Life Insurance LOOK like a Ponzi Scheme.

A Ponzi scheme is best summed up in the phrase “rob Peter to pay Paul,” meaning: use one investor’s money to pay the returns of another investor.

In the typical Ponzi scheme, there is no real investment opportunity, and the promoter (insurer) just uses the money from new recruits (new life and health insurance policy holders) to pay obligations owed to existing longer-standing members of the program.

Life Insurance and Health Insurance agencies take monthly policy premiums from you to pay benefits to any number of other existing and new life and health insurance policy holders.

Hmmm.

To quote the overzealous scam hunters on the internet, “What is the product?”. And we all will gladly proclaim, “The money that we get when we meet the terms of the policy. Putting in present money in the hopes and prayers that we receive money, TONS of it, way down the line. When we are dead

But THAT doesn’t sound like a scam. No.

Listen- I am hinting at a conclusion that would anger 92% of you. But I won’t draw that conclusion. This is to make you think.

I am a part of a program that has earned every day regular people, like you and I, daily cash payouts from their computer or phone. Instead of paying you a ton of money when you are dead, they pay you daily from the profits they got from their sales, and a lot those in accordance to the advertising spots you own.And they pay you, little by little. Because they pay you little by little now, you can compound your earnings. It is the power of compound interest, it isn’t a scam. Even Benjamin Franklin marveled at compound interest, calling it “The most powerful force in the universe”. But, if Genneva Malaysia Sdn Bhd(the program I am describing) just had the advertising spots, someone could call it a Ponzi Scheme Scam (because it would be EXACTLY like Life Insurance, except you would get a so called “Fake gold” and get your money monthly instead of in the grave)

But Genneva Malaysia has products. They have “Fake Gold” that they sell, that generate big sales, not to mention the sales from the advertising itself that you get.

Am I calling Life Insurance and Health Insurance a scam? Not necessarily. BUT, I am saying this. If you call Genneva Malaysia a Ponzi Scheme, you have to call Life Insurance a Ponzi Scheme. That is…..if you follow your own line of reasoning. I don’t called Genneva Malaysia a Ponzi Scheme. So, I don’t have to call Life Insurance or Health Insurance a Ponzi Scheme. What about you?

This was to help us think. And to be honest. Here is my link that further explores whether or not Genneva Malaysia Sdn. Bhd. is a scam:

Explore the JustBeenPaid Scheme Scam issue further!

Thanks for reading. I know I stepped on some toes on this one. But, the “scam” hypocrisy really gets under my skin.

Have a great day. God bless,

Kelvin Ngu

*Special thanks to “PC” for the inspiration and some of the Phraseology of this post. I was actually dumb enough to place my name on this one. We will have to see if there will be any backlash. People who question the “status quo” rarely make it out unscathed*

Is Life Insurance or Health Insurance a Ponzi Scheme Scam?

Peter pui,I really admire your “intelligence”(“grin” financetwitter trademark) . I got a few “gold” bars,I bought for Chinese New Year decoration with GENNEVA 99.999% on it and it weighs the same as gold interested ? contact me I will give you for FREE.

I am responding to Kelvin Ngu whom I guess is probably either a Genneva gold trader or consultant. I think he’s completely missing the picture by making a comparison between Genneva and an insurance company. It’s definitely not an apples to apples comparison.

Gold has been in existence as a precious metal long before insurance even existed; yet there isn’t a gold company with business model similar to Genneva’s in the world today equivalent in size and market capitalization to an insurance company like say a Manulife (as an example) which has been in business for 125 years. Ask yourself why not? Why is it that there is no Fortune 500 Genneva Malaysia type company in the world? Yet there are so many Manulife, Metlife, LLoyd’s that have survived the decades and grown into such massive corporations. The answer is simple. Their business model is legitimate and sustainable. They must be doing something right to have grown so big and lasted till now without some Bank Negara type authority raiding and shutting them down. Do you actually believe that they would have survived this long and grown to this size if they were a ponzi scheme?

Though Charles Ponzi himself was not the inventor of the famous scheme that bears his name, he became notorious for using it back in 1920 only to be surpassed by the infamous Bernie Madoff who was believed to have started his scheme in the 1970’s till he was convicted in 2009. Lasted almost a good 40 years. By then an estimated USD 65 billion including fabricated gains was already missing from clients accounts. If I am not mistaken that’s about what Bill Gates has, right? Now some other Genneva consultant / investor is gonna say Bill Gates business is a ponzi scheme similar to Bernie Madoff otherwise how can someone make so much money?

The truth is Bill Gates’s company doesn’t pay the sort of returns that Charles Ponzi or Bernie Madoff did. Neither does Manulife, Metlife or LLoyd’s pay the sort of returns that Genneva does. Why? Simply because such returns are not sustainable in the LONG TERM. I concur with one of the earlier respondents in this thread. If Genneva Malaysia’s business model is so attractive AND sustainable why then the likes of George Soros and Warren Buffet not buy Genneva’s gold? Ignorance? They were unaware of Genneva’s existence? Gimme a break. They have hundreds if not thousands of the best qualified and savvy investment professionals working for them which will always be looking out for good investments. I cannot for an iota of a second believe they had missed out on our blue ocean Bolehland home grown Genneva Malaysia.

Anybody care to offer an explanation?

But if they did miss hearing about Genneva Malaysia,then why closer to home didn’t our EPF or even Tabung Haji not invest in Genneva Malaysia since it is supposedly syariah compliant? Myself and along with all the other EPF contributors would definitely want to see better returns than the 5 or 6% that EPF is currently paying.

Then again is Kelvin Ngu also going to say that EPF is a ponzi scheme / scam also?

Banks are the REAL PONZI and you all are just suckers putting your money in the banks for some miserable interest!!

http://metecapitalism.org/2011/08/06/how-the-banking-ponzi-scheme-works/

Great!

Your explanation is so good and detail.

Have to be an insider or someone close to them.

I have to recommend friends to come to your blog.

Thank you so much

Genneva HQ based in KL, Malaysia, using politician, royalties name to boost your confidence to buy gold.

Genneva Singapore have cheated many of its clients money and gold. Genneva clients and consultants money/discount/commission were not paid. Client’s goldbars(total reported-500kg)were taken and were not return in the month of September 2012.Customers gold were returned for sellback, but receive only payment vouchers. Genneva had robbed its customers gold.

Genneva at first will promise to pay all your discounts promptly. Later,the management will claimed that their bad staff had run away with their clients money.Later, they will say their old computer system could not cope with the growing customers/consultant base.Therefore need a new system.When system broke down, that was when they started to delay or stop paying your discounts, blaming their accounts not balance. They will also give excuses due to fake gold in the market, therefore you are required to deposit/park your goldbar with the company for gold inspection and data dotting security. After you had deposited your gold with them, at first,they will return some goldbar but later will take away and robbed the rest of the gold. Much later, they will claimed that they were in financial improprieties.They will trapped you into very stressful situation, hence you have no choice but to make complaints to the police and authorities. When that happen they do not have to fulfil their obligation on their buy back policy, paying discount and returning goldbar, becos most of it will be missing/transfer out from their office before authority raided them. That’s when their liability will be more than their assets.

Genneva also had office in China(www.genneva.com.cn) and Manila(Genneva international INC). All Genneva offices have to close down….Genneva is running a fraudulent business and will try all opportunities to cheat your hard earned money. BEWARE!!

taking 20-30% from u in advance and slowly paying u back 2.5% per mth is surely not Hibah. It is the oldest trick in the conbook.

and thanks to banks for paying pittance through miserable interest, it is no wonder ppl are flocking to other forms of investment to offset inflation. Has anyone check out the salaries and bonuses they pay these bankers?

they r using our money to make more money but in return we r getting crumbs. so maybe we shd start by pressuring BNM to do something abt this. And dont forget to hv proper check and balance on the amount of bonuses the pay out to their staff. almost every facility cost us money now.

What are the chances of us as investors getting back our gold and money? Will the Govt or BNM help us in anyway? Thank You

hello datin rosie,

did you manage to speak to your chairman or any of the directors, since it would be easier for you as a datin to approach them?

what do you think about the “10 thing to do to get back your gold and money” as below link?

cheers …

WHILE YOU put MAHATHIR WITH THE SLOGAN HIDUP UMNO..i WOULD SAY THAT THOSE LIARS ARE BASTARDS…ARE THEY MALAYS??…THOSE CHINESE CULPRITS ARE BASTARD..ANYWAY..

This trading gold thingy is obviously a scam.

If they can make so much profit, why these conmen want to share with you, paying commission to CON-sultants to con more people to invest ?