Deutsche Bank, a 146-year-old bank employing more than 100,000 employees is like JPMorgan Chase to the U.S. and Maybank to Malaysia. As Germany’s biggest lender, the “German Bank”, as Deutsche Bank literally means, is perceived to be too big to fail. But that was exactly what financial experts told everyone including their hamsters about Lehman Brothers in 2008.

Back in 2008, 158-year-old Lehman Brothers failed largely due to panicked hedge funds pulling their money. And when Bloomberg reported 10 hedge funds that do business with the German lender have moved to reduce their financial exposure, the 2008 U.S. subprime crisis flashes and all hell breaks loose.

After several years of fretting about Spanish, Italian and French banks as the eurozone economy crawled onwards; the financial markets shifted and became nervous about the health of the German powerhouse Deutsche Bank. What’s the problem with the German Bank that makes everyone seeing the ghost of Lehman Brothers again?

In January 2016, the Germans’ pride took a beating not due to a cut in their bonus but primarily because Deutsche Bank reported a loss for the fourth quarter and 2015 – its “first full-year loss” since the 2008 financial crisis. The full-year net loss was €6.8 billion, including a fourth-quarter net loss of €2.1 billion.

The huge loss was primarily related to an anticipated settlement tied to mortgage-backed securities. By then, it had eaten up the bank’s €5.2 billion provision for fines and lawsuits. But that wasn’t the worst part. The worst part was when Deutsche Bank €4.6 billion tranche of contingent-convertible bonds – also known as “CoCos” – crashes spectacularly.

CoCos are converted into equity when a bank’s capital level falls below a certain threshold. It is like a piece of “IOU” papers which can be exchanged for cash during crisis. Thanks to the US Department of Justice who slapped the German Bank with a US$14 billion fine last week for mis-selling mortgage-backed securities before the 2008 financial crisis, the bank’s CoCos is losing its values.

The proposed US$14 billion fine is very close to US$16.8 billion of Deutsche Bank’s market capitalization. Deutsche Bank’s stock has slid more than 50% so far this year and the cost of insuring exposure to its debt has risen sharply. Aggressive short-selling, including from Soros Fund Management, is putting more pressure on the German Bank’s stock performance.

Among hedge funds who have withdrawn from Deutsche Bank were Izzy Englander’s US$34 billion Millennium Partners, Chris Rokos’s US$4 billion Rokos Capital Management, and the US$14 billion Capula Investment Management. Although the amount looks negligible compares to more than US$600 billion in customer deposits overall, it’s a signal of client’s tumbling confidence in Deutsche Bank.

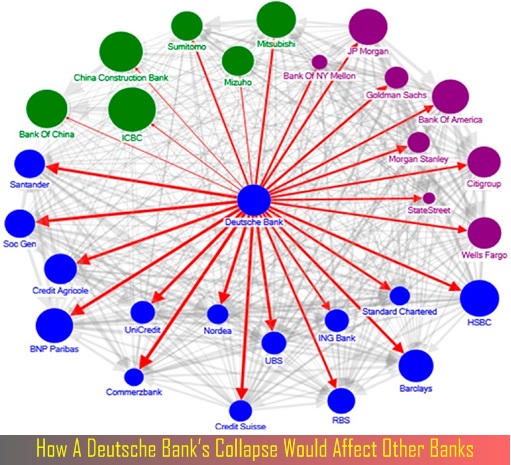

The bank keeps saying it expects to successfully negotiate a lower fine. But even if Deutsche manages to do that, a US$4 billion settlement would still raise questions about the bank’s capital position, as what JP Morgan analyst Kian Abouhossein believes. The IMF hasn’t helped matters, saying that the bank is the greatest contributor to systemic risk in the world’s biggest lenders.

Facing a crisis of confidence, strategists and analysts think the German government will ultimately forced to bailout the country’s largest lender. Generally, Deutsche Bank CEO John Cryan hasn’t said or done anything useful except repeatedly boasting that the bank doesn’t need the government’s help and in “comfortable condition”.

Stefan Müller, the CEO of Frankfurt-based boutique research company DGWA, however, believes Chancellor Angela Merkel had personally forced a panicked John Cryan to do an interview with a German newspaper – Bild – to assure the public that everything is under control. Lehman too, at one time, was too proud to accept rescue capital, until it was too late.

Therefore, regardless whether Deutsche Bank’s final fine is US$4 billion or US$14 billion, the bank needs financial rescue. Angela Merkel had ruled out providing the bank with government assistance. She has for years taken a hard-line stance criticizing taxpayer bailouts of European banks. But such rhetoric is only applicable as long as it doesn’t happen in Merkel’s own backyard.

Struggling to survive politically after double humiliation defeats in Germany’s state elections, does anyone dare betting Merkel will do nothing while watching the Deutsche Bank collapses? Deutsche is not immune. No amount of liquidity could ever be enough if clients or depositors lose faith. Merkel will definitely rescue her bank; if not openly then it would be secretly – most likely through merger.

To not bailout Deutsche is not only political suicidal to Chancellor Merkel but also spells disastrous to the overall European Union financial system. But the present crisis is also seen as an opportunity to make money like how George Soros is shorting Deutsche Bank’s stock. Betting against the Euro currency is also a nice game if one believes the crisis would turn for the worse.

Other Articles That May Interest You …

- After “Double Humiliations”, Now Cocky Merkel Wishes She Could Turn Back Time

- Soros Will Lose All His Money On “Put Options” If Bull Market Continues

- Germany Has Been Importing Junk Migrants – 1.1-Million “Unemployable”

- Market Crash! “Sell Stocks”, “Buy Gold” – Soros Has Profited $90 Million So Far

- Soros – We’re About To See Something That Hasn’t Happened in “80 Years”

- 10 Crazy Facts How The World Has Changed Since The Fed Last Raised Interest Rates

- Bernanke Admits Execs Should Be Jailed, But Never His Fault

- Fitch Ratings – How They Make Money By Making Clients Happy

|

|

September 30th, 2016 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply