Have you watched the two films we recommended about a year ago? Flashback – “Inside Job” and “The Wolf of Wall Street”, released in 2010 and 2013 respectively, are two movies you must watch to understand the reality of financial markets. And in case you’ve missed our previous article, go read about “30 Investing Tips & Tricks You Won’t Learn at School“.

Here’s the fact – nobody on the planet Earth knows what the markets will do next – whether it will go up, come down, or go in circle. Fund-managers, analysts, economists, specialists do not care about making money for their clients. Their job is to make clients happy thinking they’ve made profit, on paper, not real cash.

Brokers would then convince their happy clients to continue putting money into the markets, to grow their money, without letting them cashing out. In the process, the brokers would be the real winners laughing all the way to the bank, with real money from commissions. It’s all about enriching themselves first, never about the clients.

In 2009, Moody’s had issued a report titled “Investor fears over Greek government liquidity misplaced”. Amazingly, 6-months later, the country was seeking a bailout. Today, Greece becomes the first “developed country” to default to the IMF. In 2011, S&P’s sovereign debt team miscalculated US debt by as much as US$2 trillion when it downgraded America’s AAA credit rating.

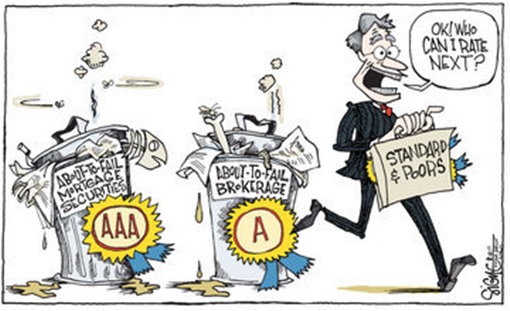

In layman’s terms, the infamous 2008 America subprime crisis started when thousands of US homeowners stopped paying interest on their mortgage. Even bankers and fund-managers lost their shirts. But who can blame them entirely when rating agencies – Moody’s, S&P, Fitch Ratings – all failed to warn them of the risks involved?

Amusingly, in the run-up to the 2008 financial crisis, majority of American mortgage-based debts were rated AAA, when in fact they were junk. In fact, Moody’s, S&P, and Fitch all still rated Enron, Lehman Brothers and AIG as safe investments before they went bust. Here’s the reality – ratings agencies are funded by the very companies they rate (*grin*).

To be rated, you must pay an agency between US$1,500 (£960; RM5,650) and US$2,500,000 (£1.6 million; RM9.4 million) for the privilege, depending on the size of your company. Of course, if yours is a country and need a favourable rating, the price can easily in excess of tens of millions of dollars (*tongue-in-cheek*).

Obviously, Fitch, S&P (Standard & Poor’s), Moody’s are the “Big Three” credit rating agencies in the world. And just like the magnificent “Gartner Magic Quadrant”, published by Gartner Inc., any possible reports or ratings can be tailor-made, hence the conflict of interest, because it gives the agency an incentive to give the companies the rating they want.

These agencies do not go around questioning their clients’ risks, let alone challenge the accuracy of their audited accounts. If somehow dishonest and corrupt accountants sign off on a fictional set of accounts, the rating agencies’ integrity is as good as their clients’ honesty.

There are more than 150 ratings agencies worldwide, but the “Big Three” monopolize about 95% of debt rating globally. The fact that they run debt rating business like a cartel also means they are extremely powerful, so much so that they can easily bring down a company, or even a country’s economy for that matter.

What this means in the world of finance is: they give investors an idea which investments are safest to make. And since they rate “creditworthiness” of companies and currencies, they can practically drive billions of dollars out of a country’s stock market and create panic selling of currencies.

Hence, it’s understandable why Malaysian prime minister Najib Razak was such a jolly happy person yesterday. Fitch Ratings has affirmed Malaysia’s Long-Term foreign currency Issuer Default Rating (IDR) at “A-” and local currency IDR at “A”. The Outlook on the Long-Term IDRs has been revised to “Stable” from “Negative”.

Again, as mentioned above, Fitch Ratings do not care about the “hidden” accounting figures, if any, that a country such as Malaysia might have cooked or creatively presented. Their rating is as good as Najib administration’s honesty. If Malaysian government could make its accounting deficit disappears to 0%, Fitch Ratings will still believe them.

However, Fitch views progress on the Goods and Services Tax (GST) and fuel subsidy reform as the primary contributing factors to the ratings improvement. In other words, without the estimated RM21 billion (US$6.3 billion) in annual saving from fuel subsidy, and an estimated RM22 billion in annual revenue from GST, Malaysia is most likely to go bust, just like Greece today.

In short, the average 30 million Malaysians such as Ahmad, Ah Seng and Arumugam are being forced to pay the extra RM43 billion every year, so that Fitch Ratings is happy and not downgrade the country’s foreign ratings. Strangely, the same rating agency had told Bloomberg in March that Malaysia’s credit rating is “more than 50% likely” to be downgraded.

At a rating of “A-“, the fourth-lowest investment grade, Malaysia was only two steps away from being rated as junk. Andrew Colquhoun, head of Asia Pacific sovereign ratings had hinted that Malaysia would “sit more naturally in the BBB range”. But the emergence of Minister Abdul Wahid Omar from a meeting with Fitch officials behind closed doors 3-months later changes everything.

Not only Fitch Ratings didn’t downgrade Malaysia, it upgrades it to “Stable” from “Negative”. What was transpired behind the closed doors? Did Najib administration send Abdul Wahid Omar to lobby for a better rating, in exchange for “kickbacks”? Remember what we said earlier about fund-managers, analysts, economists’ jobs? They are here to make money, and to do that they are more than happy to make their clients – “HAPPY”.

Other Articles That May Interest You …

- Najib’s “Glokal” Is A Success – Corruption From U.S. To Australia

- Here’re 14 Crazy Facts How Huge (1MDB) RM42 Billion Debt Is

- 30 Investing Tips & Tricks You Won’t Learn At School

- 15 Tax Deductions You Should Know – e-Filing Guidance

- How To Save Money This Year – 15 Exciting Tips

- Credit Card Safety Tips That You May Have Missed

- Debts & Deficits – 21 Currencies That Have Gone Bust

|

|

July 2nd, 2015 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply