Christmas is around the corner. You probably have bought most of your Christmas’s gifts. In case you have not, this weekend could be your last chance to swipe your credit cards like crazy. It’s hard not to use credit cards nowadays, especially with the escalating cost of living. Consumers, particularly youngsters tend to have this habit of spending future earnings. That’s fine as long as you can pay 100% of total amount owed each month to avoid late payment fees. Banks hate such customers because they can’t earn a single penny from them, although they earn enough from the shops that you swipe your cards with.

There’re thousands smart consumers who use credit cards but pay promptly every single penny stated in the monthly statement before the due date. At the same time, there’re millions rich-chap-wannabe who only pay minimum payment simply because their debts snowball to a critical level. Next year (2014) could be a bad year to this second group of heavy spenders. Country such as Malaysia could see a turbulent year due to multiple hikes’ impact in toll charges, fuel charges, electricity rate, assessment rate, transportation, healthcare, gas and whatnot.

When economy gets worse, scams flourish. You can bet your last penny scams such as scratch-and-win, Nigerian “Black Money”, Casanova sweet-talk Malaysian women or even another similar “Genneva Gold” could strike again. This may sound too boring but credit card spending is perhaps the easiest way to lose your money, if you do not care about some safety tips. If you think R&N office (that’s Rosmah and Najib office) is a scary place, wait till you hear about internet.

[ 1 ] Use Credit Card, Not Debit Card

You read that correctly. In spite of what you heard about credit card schemes and how bad this monster is, credit cards are safer than debit cards. You may have heard horror stories about how Maybank, the largest lender in Malaysia, refused to accept any liability due to their credit cards fraud many years ago. But those were during their infancy and they’re much better now. Nowadays, most credit cards come with consumer protections against fraud.

On the other hand, debit cards do not usually enjoy similar privilege. Depending on when you report your losses, you could lose a mountain of your money. While credit cards involve spending “bank’s” money, debit cards mean taking money out from your already funded bank account. The best way is still to pay by cash but when the amount is huge, the best way is still to use credit cards. As long as you’re able to pay the balance in full within the billiing period, you’re winning this credit card game over the banks (*grin*).

[ 2 ] Don’t Shop in Public

You may think it’s not cool at all for not conducting online transactions in public places such as Starbucks. But it’s definitely not cool to lose your money due to hacking. Hackers could install keylogger to record your keystrokes hence stealing your usernames, passwords, credit card numbers, personal information and whatnot because, guess what, you’re using the public WiFi. It’s even worse if you perform such transactions in cyber cafes. Most cyber cafes computers are infected with keylogger software. I would rather believe that Rosmah is a virgin than to trust cyber cafes’ computer.

If you insist on performing online transactions in public places, use your own network – your own smartphone’s 3G network. Make sure nobody is sneaking behind your back when you do online shopping. If you don’t mind being called paranoid, conduct online transaction with your back facing walls without any camera watching over you.

[ 3 ] Always Check for the Super “S”

Don’t enter your password, credit card number or anything that is personal into an “unsecured” website. That’s when you have to give yourself a kick and check if the page’s address starts with “http://” rather than “http://”. The extra “s” could save your life and potential millions of dollars (*tongue-in-cheek*). This extra “s” means the site uses an encryption system so that the communication between you and the server is secured by way of scrambling (those gibberish codes) the whole transaction.

Also, make sure that your browser displays the “secure lock” or “padlock” – either in right-bottom corner or in front of your page’s URL itself (just before your http://). It pays to spend couple of seconds on these minor indicators before you start keying password or credit card information.

[ 4 ] Install and Keep your Anti-Virus and Firewall Updated

Ten years ago, every computer needs anti-virus. Now, every computer must have antivirus and firewall. There’re quite a number of free anti-virus and firewall which could provide you with great protection. You should not download “cracked” anti-virus or firewall simply because you do not know if it’s actually Trojan horse. Install software from their original website – you can easily google for permanent activation-code after the trial period ended. Netizens are nice people who like to share (*grin*).

Most anti-virus or firewall software provides comprehensive products. Normally they provide both anti-virus and firewall in their package. Don’t use only one brand for both protections. Use two brands to do the job – one brand to guard your computer against virus while another brand to prevent intrusion. It’s like putting a BMW engine into a Mercedes car and send it to Chow Ah Beng workshop for repair. Give them hard time even if they want to do damage to your computer, get the juice?

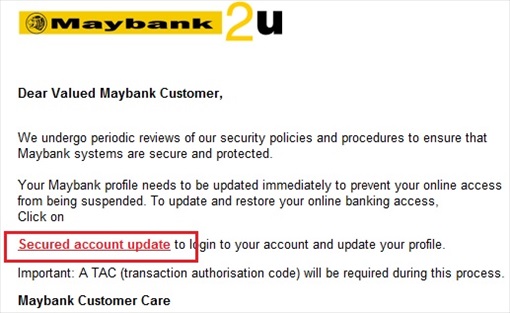

[ 5 ] Do Not Reveal Info, Email or Phone Call

Gone were the days where emails were (randomly) sent to consumers, pretending to be from banks. Strangely, these emails start itself with “Dear Valued Customer” but yet there were thousands of idiots who actually responded as if it was from Justin Bieber. How could you respond to emails, which are supposedly from banks, when the sender does not even know your name in the first place? Some of these emails even came from a bank that you do not have any account with. Even if they correctly address your name, banks “do not” send emails asking for personal information or verification. Delete such emails. Do not click any hyperlink within such emails.

Now, the modus operandi gets bolder. They recruit “girls” to call and persuade you to give away your credit cards’ information. To add sweeteners, these sexy voices would tell you that you have actually win some prizes. The funny part – these girls talk with unbelievable heavy “China’s accent”. If that still doesn’t give away that it was a scam, then you deserve to be scammed.

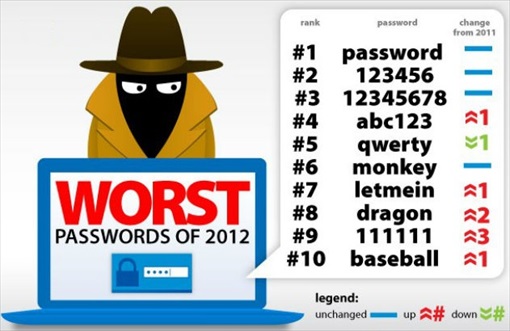

[ 6 ] “abc123” or “123456” is Not A Good Password

Your ATM card’s default pin is perhaps “123456”. Your online transaction default password could be “abc123”. But how many users actually change it immediately? Even when people change the default pin or password, how many new passwords belong to a “strong password” category? Using your date-of-birth, car’s plate number, Social Security or Identification Number or driving license are bad choices. Heck, even words from dictionary are not recommended. PIN for cash advances should not be written on the credit card or keep it together with it.

Besides making your password as long as possible, it should also consists of uppercase, lowercase and special character such as “@”, “%”, “$”, “&” and whatnot. And do we have to tell you to use different password for multiple accounts? The logic here is to prevent your intruders from stealing “everything” when one of your accounts is breached. It’s better to lose one account than ten accounts due to same password.

[ 7 ] Dedicate Only 1 Credit Card for Online Shopping

If online shopping cannot be avoided, dedicate only one credit card specifically for online transactions. Add additional protection by limiting this credit card’s spending limit. It doesn’t matter if the credit limit is $1,000 or merely $500. The game here is to limit your risk of loss. It’s easier to prove to your bank that you’ve never use other cards for online transaction based on your past history.

[ 8 ] Trust Your Instinct

You can usually trust reputable websites such as Amazon.com, Bestbuy.com, Dell.com or eBay.com. Lesser-known website should be avoided with all cost. Watch out for tricky yet funny brands such as KFG, NKIE, Adidos, SQNY, McDnoald’s, Fuma or Apple Stoer. Such creative mis-spelled brand names could happen to websites as well. Phishing emails is a popular method that links you to an infected website. Sometimes, your instinct will tell you that a website is suspicious. Trust your instinct.

Most of the time, it’s more secure to google the website that you wish to visit. This could help you avoid clicking to a fraudulent link. Above are just some of the tips to safeguard your credit cards. There’re more tips but if you can keep yourself to the above tips, chances are high that you won’t lose more money than you already have.

Other Articles That May Interest You …

- Budget 2014: Sugar & GST – Newly Found Cash Cows

- Fuel Prices Hike – Can You Blame PM Najib Alone?

- Budget 2013 – What the Govt Doesn’t Want You to Know

- How to Get Back Your Genneva Gold and Money – 10 Things To Do

- Here’re Tax Havens To Hide Your Black Money & Plunder

- Despite Being Hacked, Malaysian Govt Shows Arrogance

|

|

December 20th, 2013 by financetwitter

|

|

|

|

|

|

|

Good advice thanks!

Years ago I made the mistake of booking direct with a cheap hotel. They EMAILED me my own visa card number which I had faxed to them to me to verify they had the correct number. The card didn’t last long before someone cloned it and started buying gold in Dubai. (true story) Luckily the bank protected me.